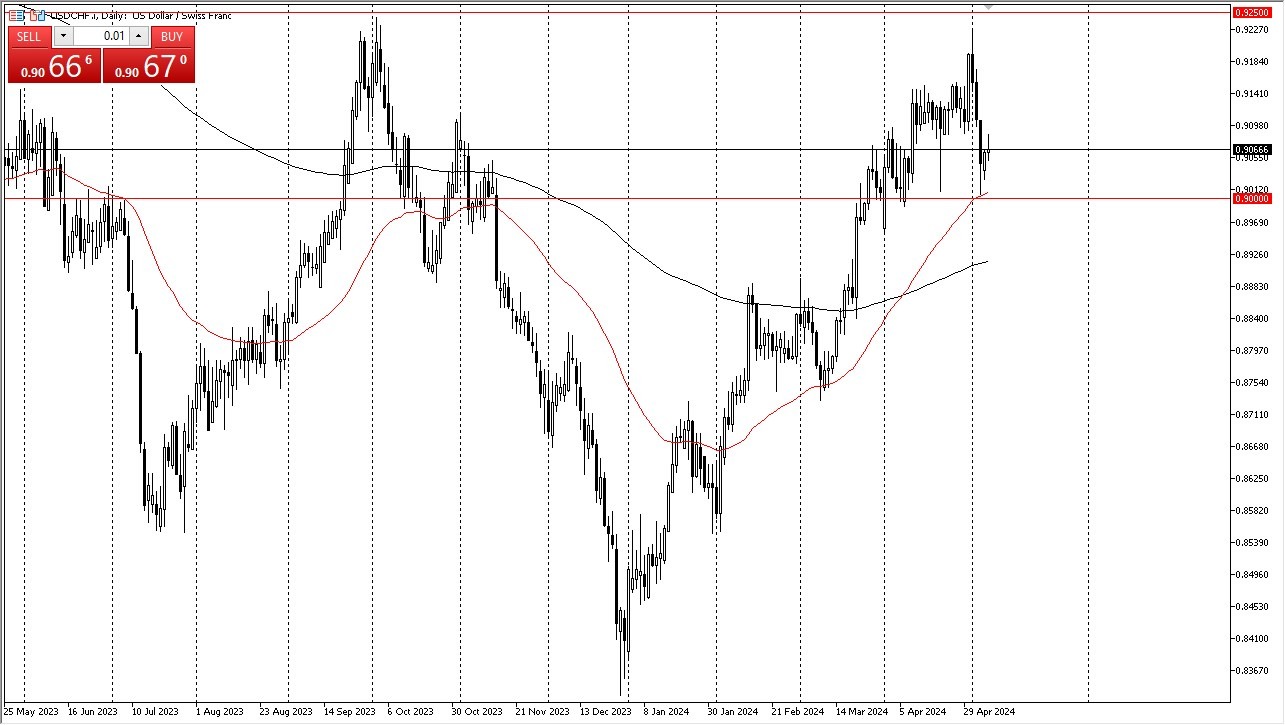

- The US dollar initially rallied against the Swiss franc during the trading session on Tuesday but has since given back some of the strength.

- That being said, it’s not necessarily a negative sign, it’s just a sign that there is a lot of downward pressure that we have to work through that appeared over the last couple of days.

- Quite frankly, it’s worth noting that we are at the top of a major bottoming pattern that goes back several months.

The 0.90 level is an area that I will be paying close attention to due to the fact that the area is not only a large, round, psychologically significant figure, but it is also where we currently have the 50-Day EMA residing. All of that ties together quite nicely for support, and we did in fact see the US dollar bounce from that level during the Friday selloff with this being the case, I think you have a situation in the market will continue to be very noisy, but I still favor the dollar overall.

Interest Rate Differential

The interest rate difference between the US dollar and Swiss franc remains huge, as the Swiss National Bank recently cut rates. The market will continue to pay you at the end of the day, and therefore I think you have a situation where sooner or later we could break out. If we do get that break out, I suspect that the US dollar could be more or less a “buy-and-hold” type of situation, and that breakout would occur near the 0.9250 level, an area that has been massive resistance multiple times. In the short term, it would not surprise me at all to see this market try to get to that level, as it is a bit of a magnet for price, and the 0.90 level underneath has been so supportive.

Interest rate differential continue to be a major factor for the Forex markets, and as long as the Federal Reserve remains as tight as it is, and of course the Swiss are likely to cut rates sooner rather than later, it does make a lot of sense that the Swiss franc continues to struggle against other currencies, not just the US dollar.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.