InstaForex Editor’s Verdict

InstaForex EU is part of the InstaForex brand that was established in 2007 and is home to over 7,000,000 traders. The group as a whole represents a leader in the retail sector and InstaForex EU caters specifically to EU based traders. InstaForex EU aims to provide first-class trading services and to become the broker of choice for all EU based traders. This broker claims to be an ECN broker offering over 200 assets across five asset classes. Over thirty analysts are employed, offering research to clients, and this broker was awarded over 30 industry awards since 2009.

Overview

One critical difference between this broker and its competition is that one standard lot equals 10,000 currency units, and not 100,000 as remains the norm across the industry. A respectable fact at InstaForex remains the percentage of accounts operating at a loss, at 62.89% it ranks at the low end in this category and marks a noteworthy accomplishment.

Headquarters | Cyprus |

|---|---|

Regulators | CySEC |

Tier 1 Regulator(s)? | |

Owned by Public Company? | |

Year Established | 2007 |

Execution Type(s) | ECN/STP |

Minimum Deposit | $1 |

Trading Platform(s) | MetaTrader 4 |

Average Trading Cost EUR/USD | 3.0 pips ($30.00) |

Average Trading Cost GBP/USD | 3.0 pips ($30.00) |

Average Trading Cost WTI Crude Oil | $0.00 |

Average Trading Cost Gold | $0.80 |

Average Trading Cost Bitcoin | $0.25 |

Islamic Account | |

Signals | |

US Persons Accepted? | |

Managed Accounts |

Technology plays a critical role at InstaForex and as a group, 9 different data centers are installed to ensure ongoing and uninterrupted trading service; further supported by 25 other servers located around the globe. This ensures proper order flow and connectivity. The MT4 trading platform is the only one offered which surprised us during this InstaForex EU review as the broker claims to be an ECN broker and the cTrader platform remains dominant in that sector. This broker is recognized for the vast sponsorships of professional sports in a statement to the general success of InstaForex. Plenty of auxiliary services are provided by this broker and the sum of this effort is a sound trading environment, but spreads remain elevated which represents the most significant drawback when considering InstaForex EU as an ideal broker.

Regulation and Security

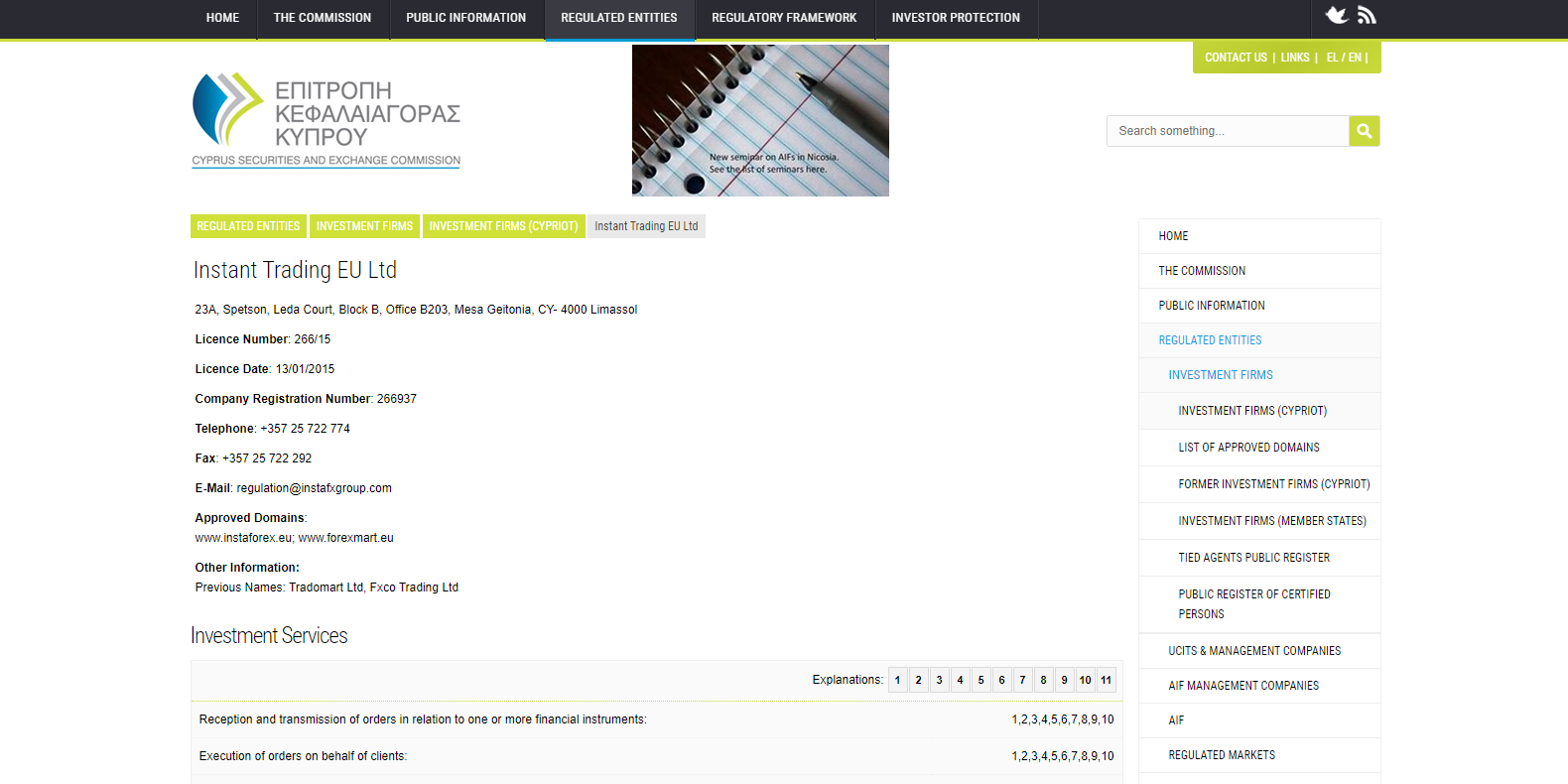

Instant Trading EU LTD, the owner, and operator of InstaForex EU is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 266/15. The license was granted on January 13th, 2015. Cross-border regulation across all EU member countries applies as Cyprus is inside the EU. As an EU regulated broker, InstaForex EU is fully compliant with the Markets in Financial Instruments Directive 2014/65/EU or MiFID II as well as the EU’s 4th Anti-Money Laundering Directive.

As mandated by EU regulation, InstaForex EU participates in the Investor Compensation Fund (CIF). In the event of default, accounts are covered up to a maximum of €20,000. This is sufficient to cover most if not all retail accounts. All deposits are held in segregated bank accounts according to regulatory guidelines for the protection of clients. All required documents and disclosures are listed on their website. From a regulatory perspective, InstaForex EU ticks all the boxes.

Fees

Average Trading Cost EUR/USD | 3.0 pips ($30.00) |

|---|---|

Average Trading Cost GBP/USD | 3.0 pips ($30.00) |

Average Trading Cost WTI Crude Oil | $0.00 |

Average Trading Cost Gold | $0.80 |

Average Trading Cost Bitcoin | $0.25 |

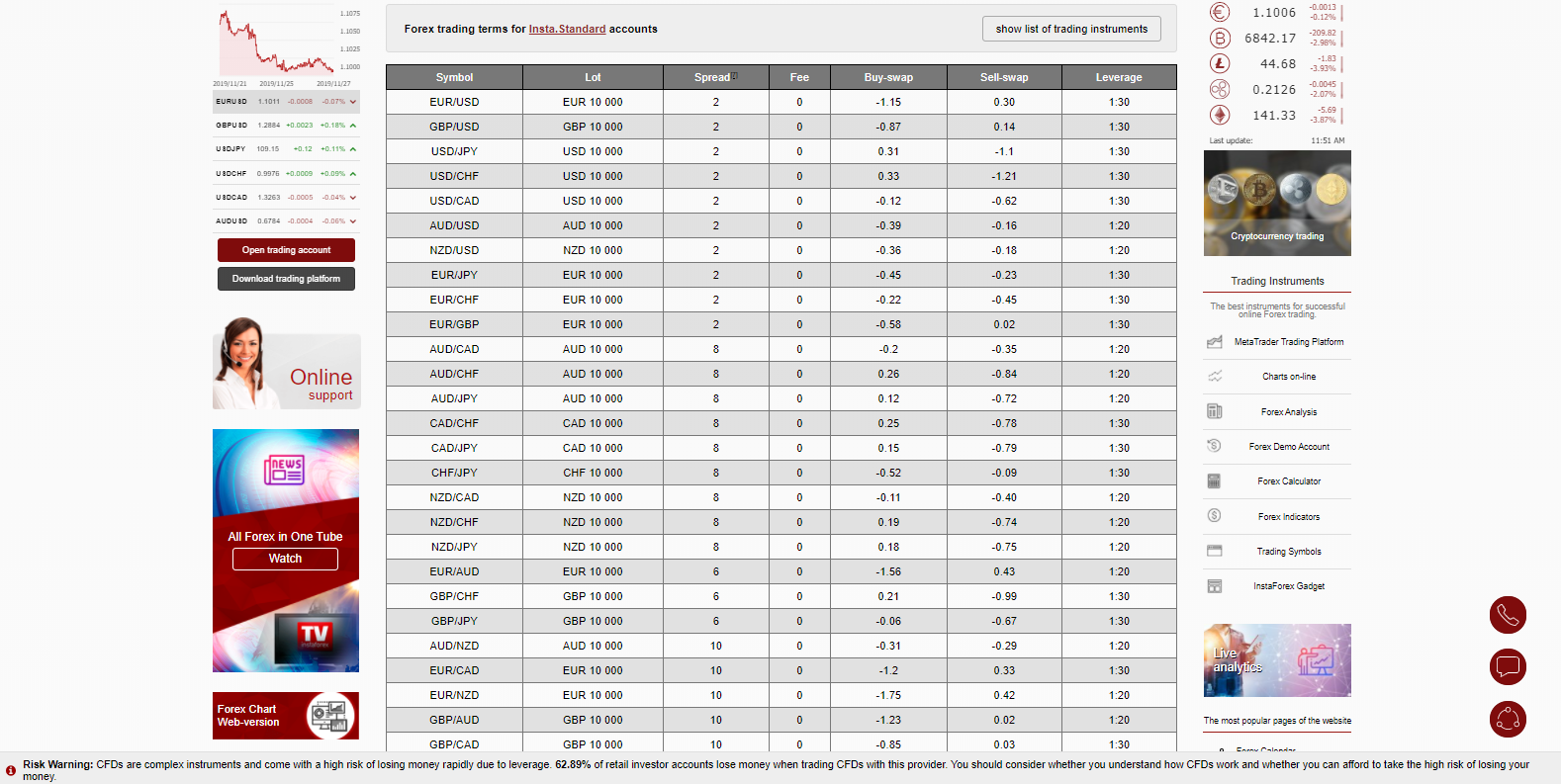

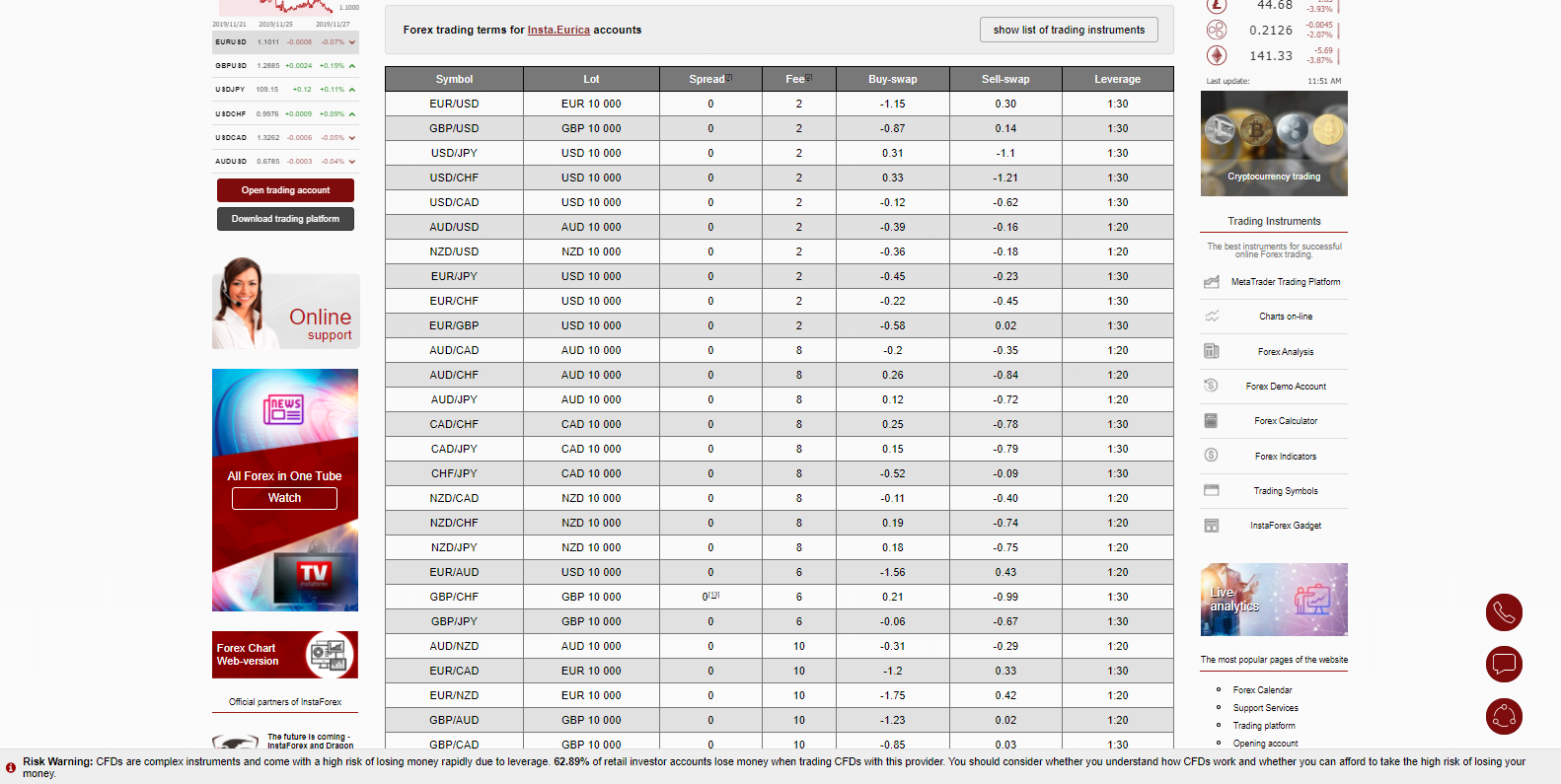

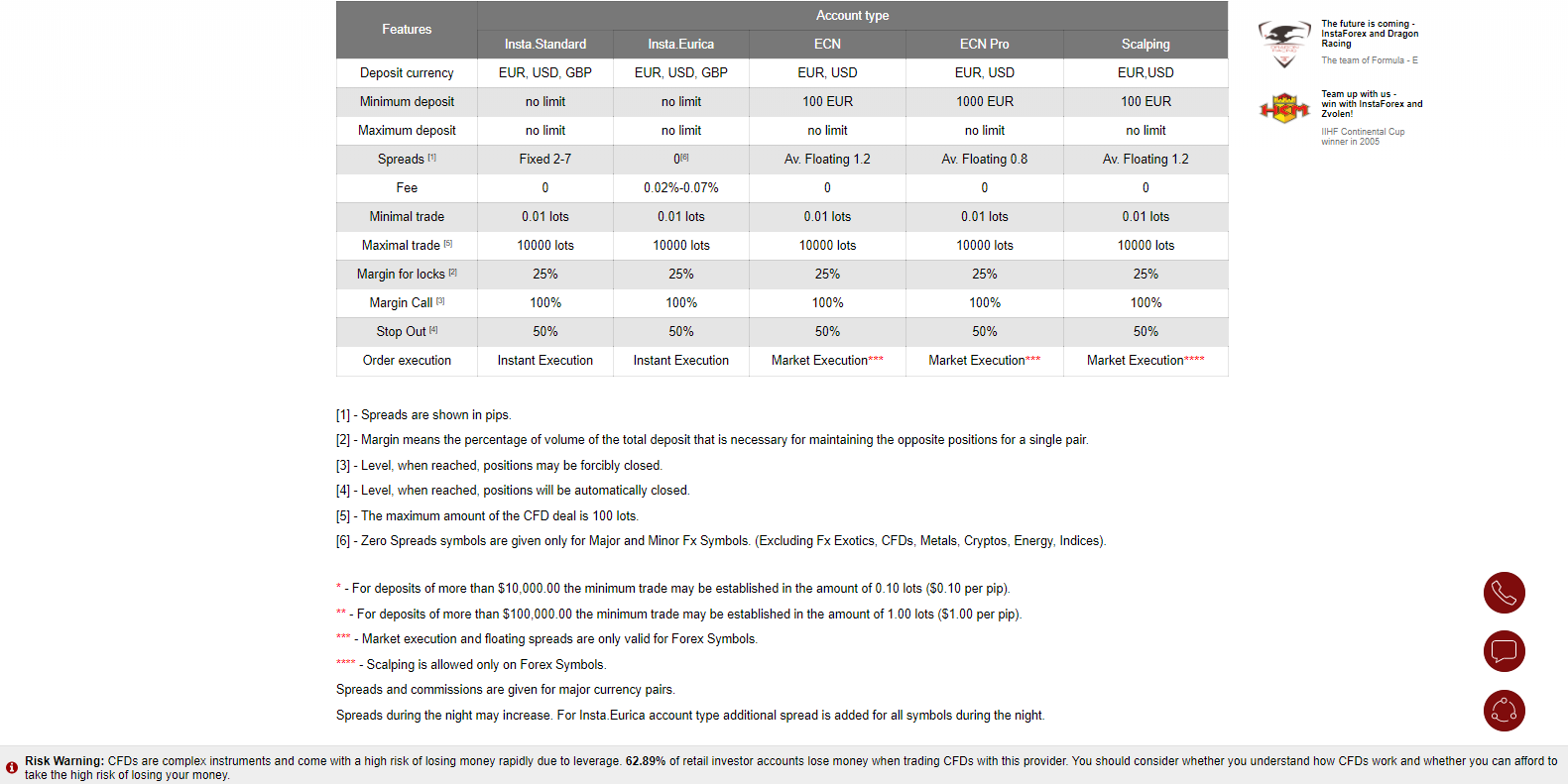

InstaForex derives the majority of its income from spreads which remain elevated by all comparisons. The average spread in the ECN Pro account starts from 0.8 pips while the Insta.Standard account comes with fixed spreads between 2.0 and 7.0 pips, other accounts are listed as 1.2 pips. A 0.1% commission applies to equity CFDs as well as on cryptocurrencies. While the commission structure is acceptable, the spreads in all account types, except the Insta.Eurica account, are not very competitive.

Swap rates on overnight positions apply, and InstaForex EU is transparent about positive as well as negative spreads.

What Can I Trade

InstaForex EU, as the name suggests, is primarily a Forex broker and this is evident in the outstanding asset selection when it comes to currencies. Over 100 available currency pairs allow pure Forex traders to properly diversify their portfolios. Over 88 CFDs on US stocks comprise the bulk of non-forex assets while commodities are limited to gold, silver, crude oil, and natural gas. Seven indices CFDs and five cryptocurrencies complete the asset selection at InstaForex EU.

When it comes to the Forex market, InstaForex EU may offer the most comprehensive list to traders and deserves consideration for this offering. A pleasant addition we discovered during this InstaForex EU review is the small cryptocurrency selection that deserves to be upgraded to include more assets; this would compliment the extensive selection of currency-related assets. Regrettably, the commodity selection lacks in choice and most Forex traders use commodities for hedging purposes. We would hope that one day the broker will offer more hard and soft commodities to help traders diversify.

The currency selection at InstaForex EU is extremely comprehensive, as you can see here:

Spreads in the Insta.Eurica account are reduced to zero, and though a commission applies, this account type presents the most competitive trading environment offered.

The ECN, ECN Pro, and Scalping accounts are free of commissions and have an average floating spread between 0.8 pips and 1.2 pips. CFD trading carries a 0.10% fee except for gold and silver.

Account Types

Five account types are available at InstaForex EU, but trading conditions appear out-of-order. The Insta.Standard account involves a fixed spread between 2.0 pips and 7.0 pips, trading costs are too high in this account type. No minimum deposit is required for this account. The ECN and the Scalping account carry an average floating spread of 1.2 pips and remain commission-free, but a minimum deposit of $100 applies. While the minimum deposits remain extremely low, neither of those three account types creates a great trading environment.

The exception remains the Insta.Eurica account, marketed as ideal for new traders and offered as an option for professional traders. The spread of 0.0 pips on major and minor currency pairs with a low commission between 0.02% to 0.07% of the deal value produces the best trading account available. It remains the sole option offering an extremely competitive trading environment and no minimum deposit is required.

The ECN Pro account contains average spreads noted as 0.8 pips, and there is no commission charged. This counters the traditional ECN model where raw spreads are offered for a commission. In the case of InstaForex EU, the Insta.Eurica account resembles a true ECN account structure. Broadly speaking, the implementation of trading conditions is surprisingly confusing if compared to what the industry standard resembles. InstaForex EU additionally changed the standard lot classification as 1.0 lot resembles only 10,000 units and not 100,000 units as with other brokerages. The maximum leverage for all traders is capped at 1:30 as stipulated by its regulator. Islamic accounts are available on request.

The Insta.Eurica account creates the most competitive trading environment offered by InstaForex EU, followed by the ECN Pro account.

Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

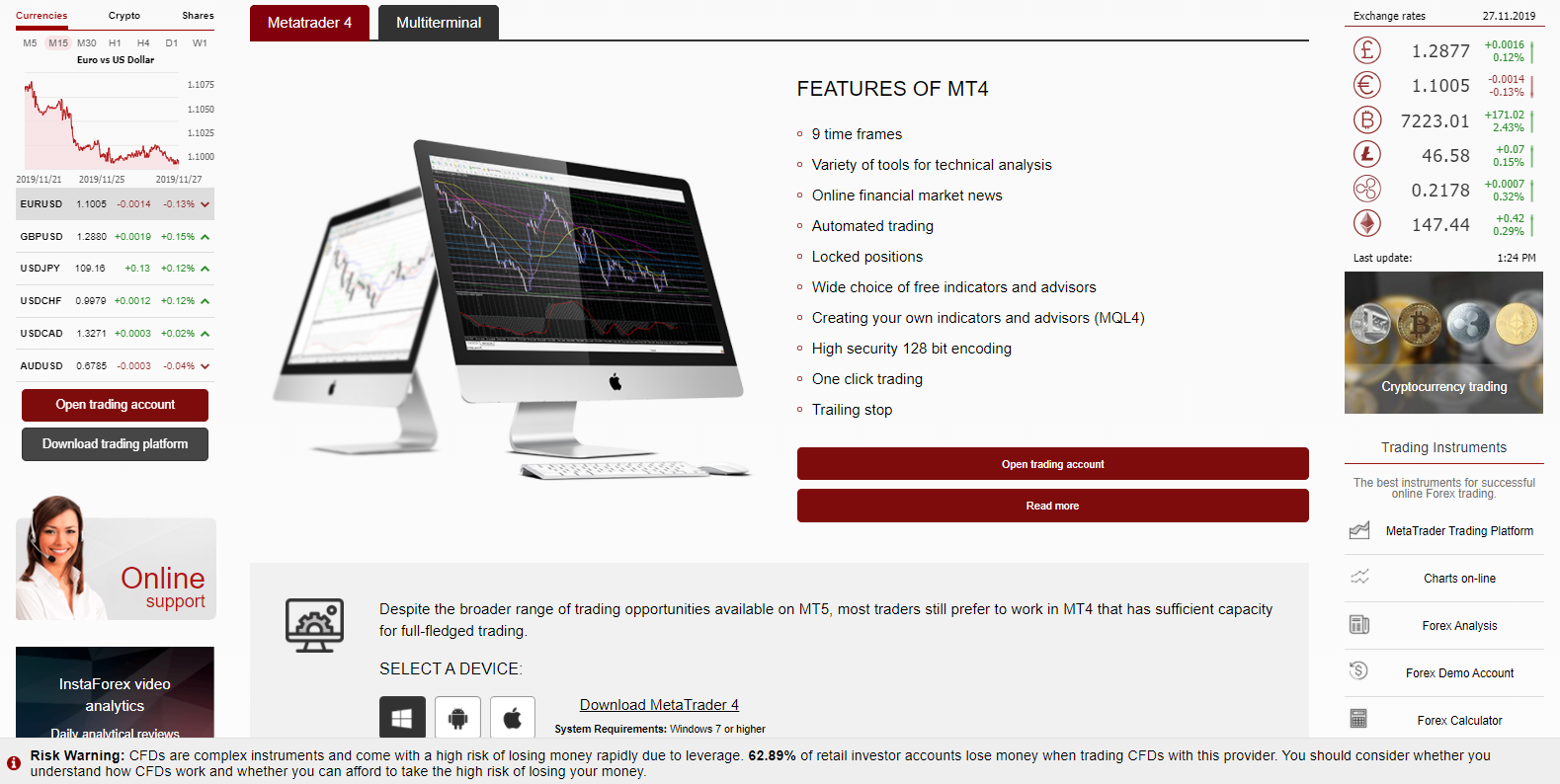

The only trading platform available to traders is the MT4 trading platform, including the multi-terminal ideal for account managers who operate multiple accounts at once. The MT4 platform is available across all devices, but InstaForex EU doesn’t provide any of the required third-party plugins necessary to turn the out-of-the-box platform into an outstanding product. It does offer its Superior Forex Desk plugin which enhances the trading experience, but more is required to offer a truly outstanding product. Given the successful operation of this brokerage, it would be appreciated if InstaForex EU undertakes the additional step and provides critical third-party tools to its traders.

Hundreds of millions of dollars have been invested into the MT4 infrastructure to develop automated trading solutions, the prime feature of this trading platform, and one of the most significant reasons behind its popularity. A back-testing capability further assists traders in creating market-beating trading strategies, but to unlock the maximum potential of the MT4 trading account a further investment on the part of the broker is required. A web trader branded WebIFX is listed, but no details are provided about it. It remains unclear if this is a version of the MT4 web trader or an in-house developed trading platform.

Unique Features

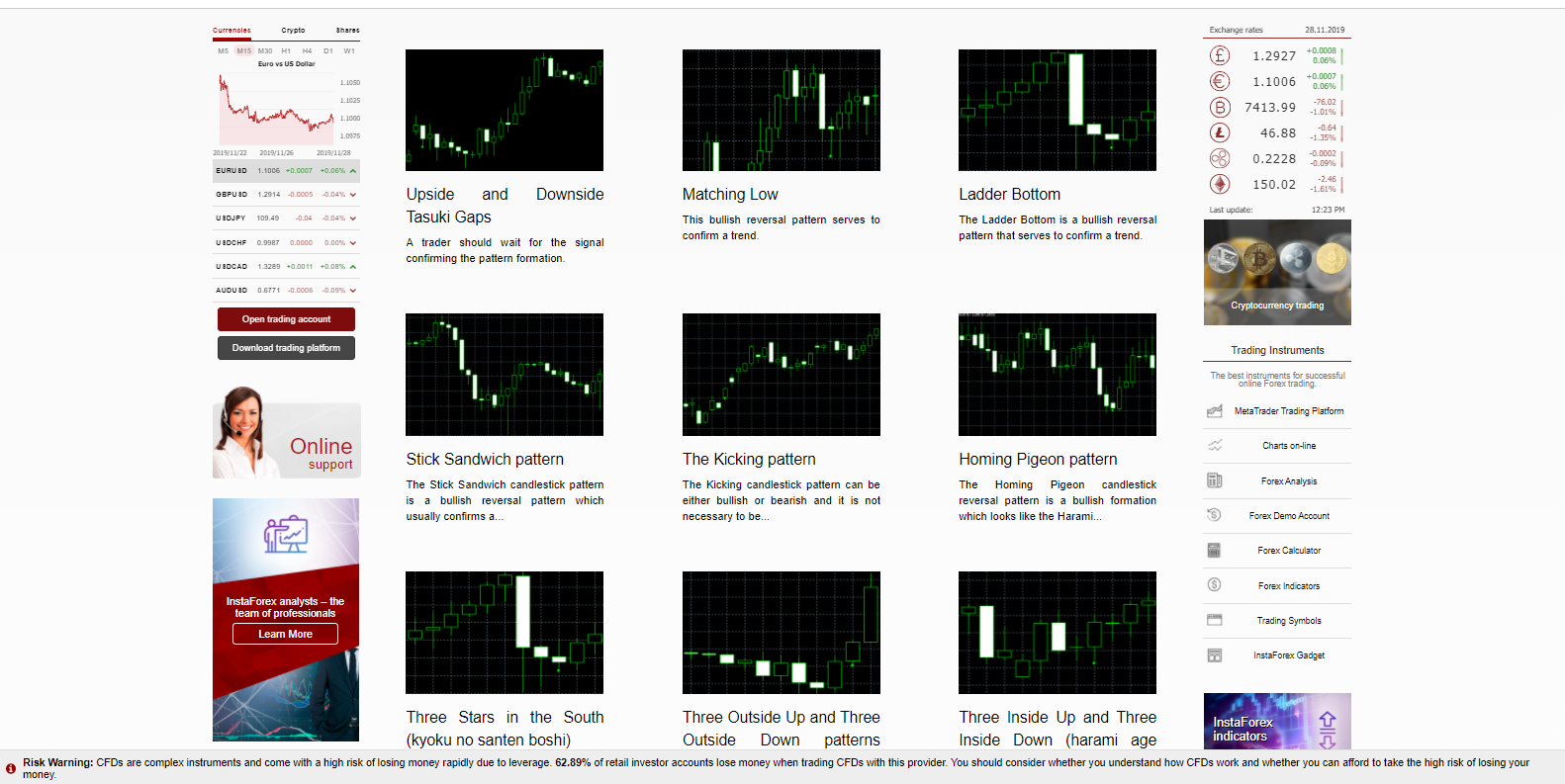

Three unique features stood out for us during this InstaForex EU review. The InstaForex toolbar grants access to streaming quotes and other aspects of the InstaForex website at a glance. How and if clients use this toolbar remains unknown, but an effort has been made to provide clients something unique. Where this broker doesn’t offer clients third-party plugins for the MT4 trading platform, it offers its selection regarding candlestick pattern recognition. 18 plugins are available, but they could have all been wrapped into a single plugin as all cater to candlesticks and trading opportunities as a result of them. Requiring 18 downloads illustrates a brilliant idea with less than stellar execution.

Social trading in the retail sector is growing in popularity and InstaForex EU supports this via its ForexCopy system. This offers a sound system for traders who lack the resources required to manage a portfolio properly, and the minimum investment starts at just $10. Traders who offer their strategies have access to the entire pool of over 7,000,000 traders and growing while collecting a commission if their strategy is successful. Retail traders who provide a stable trading strategy but lack the required capital can boost their revenue stream through the ForexCopy system.

A look at the InstaForex toolbar:

18 MT4 plugins are available at InstaForex:

Research and Education

Research & education are both provided in-house and InstaForex EU is home to over 30 analysts covering the markets, which is quite impressive. The analytics department at InstaForex is broken down into the following six categories: Popular Analytics, InstaForex TV, Pattern Graphix, Forex Forecast, Economic Calendar, and Forex news. Education is provided through an online course, video tutorials, and written content. This represents a solid mix for new traders to get introduced to the basics of trading.

Research

Over 30 analysts provide research to traders, but not all analyses are created equal. Some analysts provide a sound presentation of their reasoning with a proper chart while others are less organized. Traders interested in following InstaForex EU analysts should invest the proper time and identify the quality analysts at this brokerage while neglecting the rest. Navigating through the research is simple, and results can be filtered by analysts making it convenient for traders to employ.

InstaForex TV is a helpful service offering by InstaForex EU and traders may want to tune in to the quick segments. Within this service, the Trader’s Desk where viewers determine the covered content. InstaForex EU scans the comments submitted to them and monitors the MT5 forums, then creates the content and published it on the Trader’s Desk. This section marks the most innovative approach by InstaForex EU and is executed impressively.

A look at InstaForex TV:

Education

New traders should take advantage of the forex course offered by InstaForex EU. According to this broker, the course was designed by its specialists together with retail traders and the end-product should be a solid starting point to get introduced to the basics. One significant feature is that after the course is completed, all material is downloaded so that traders can retrieve it as required.

Complementing the course is a video library addressing key topics regarding the Forex market and completing the key educational section are numerous articles composed. The quality of the content is good and new traders are provided with the necessary tools to establish a deep foundation before placing their first trade. The broker’s Forex humor section offers a pleasant break from trading and always good for a laugh.

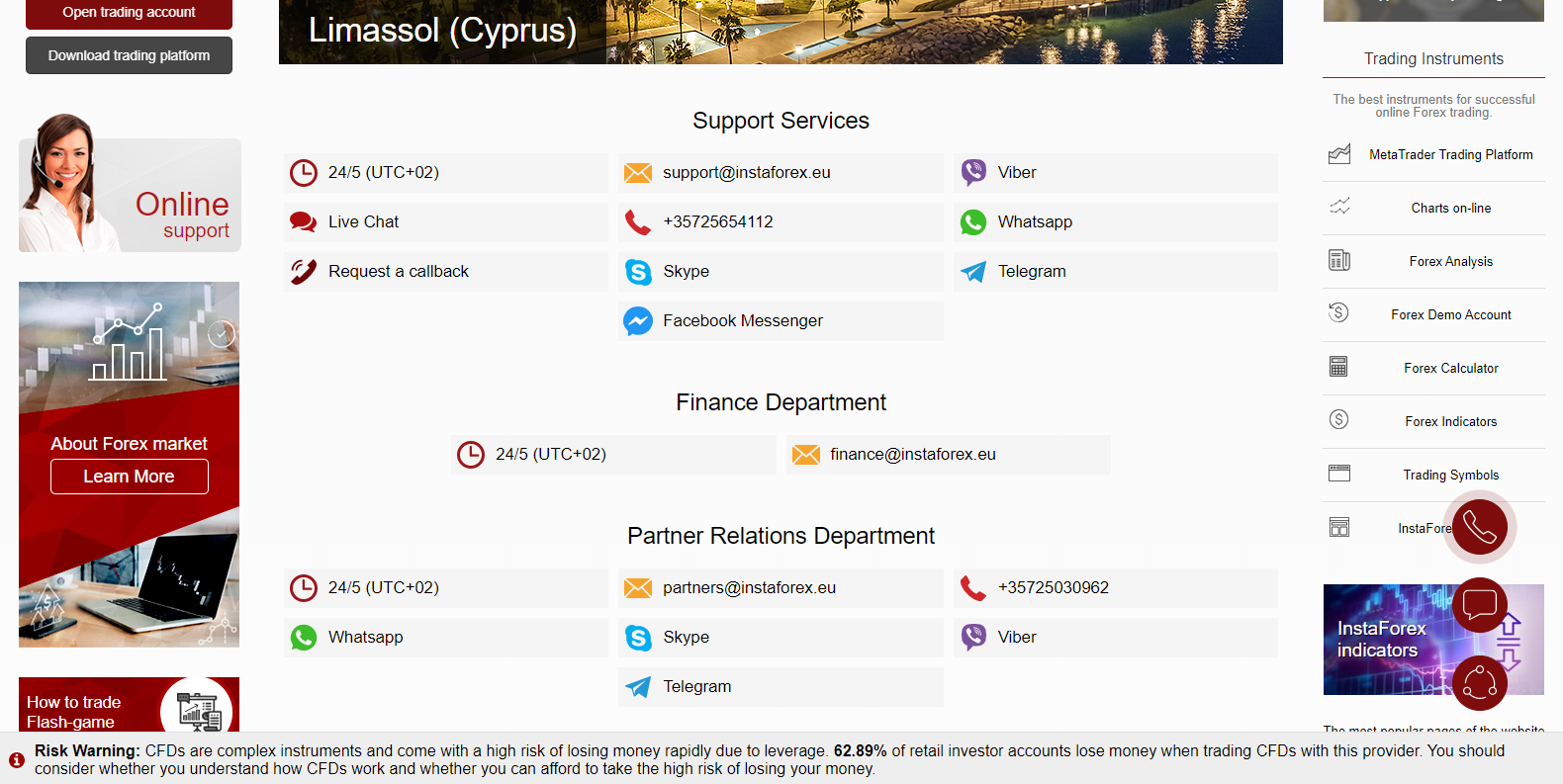

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | 24/5 |

Website Languages |       |

Customer support is available 24/5 and clients are served either from the principal office in Cyprus or from the representative office in Slovakia. Support is available via e-mail, phone and a callback option, live chat, Skype, Facebook Messenger, Viber, WhatsApp, and Telegram. The outstanding choices established for traders to interact with this broker display that customer service is extremely important.

Bonuses and Promotions

No bonuses or promotions were offered to traders at the time of our InstaForex EU review due to regulatory restrictions in Europe.

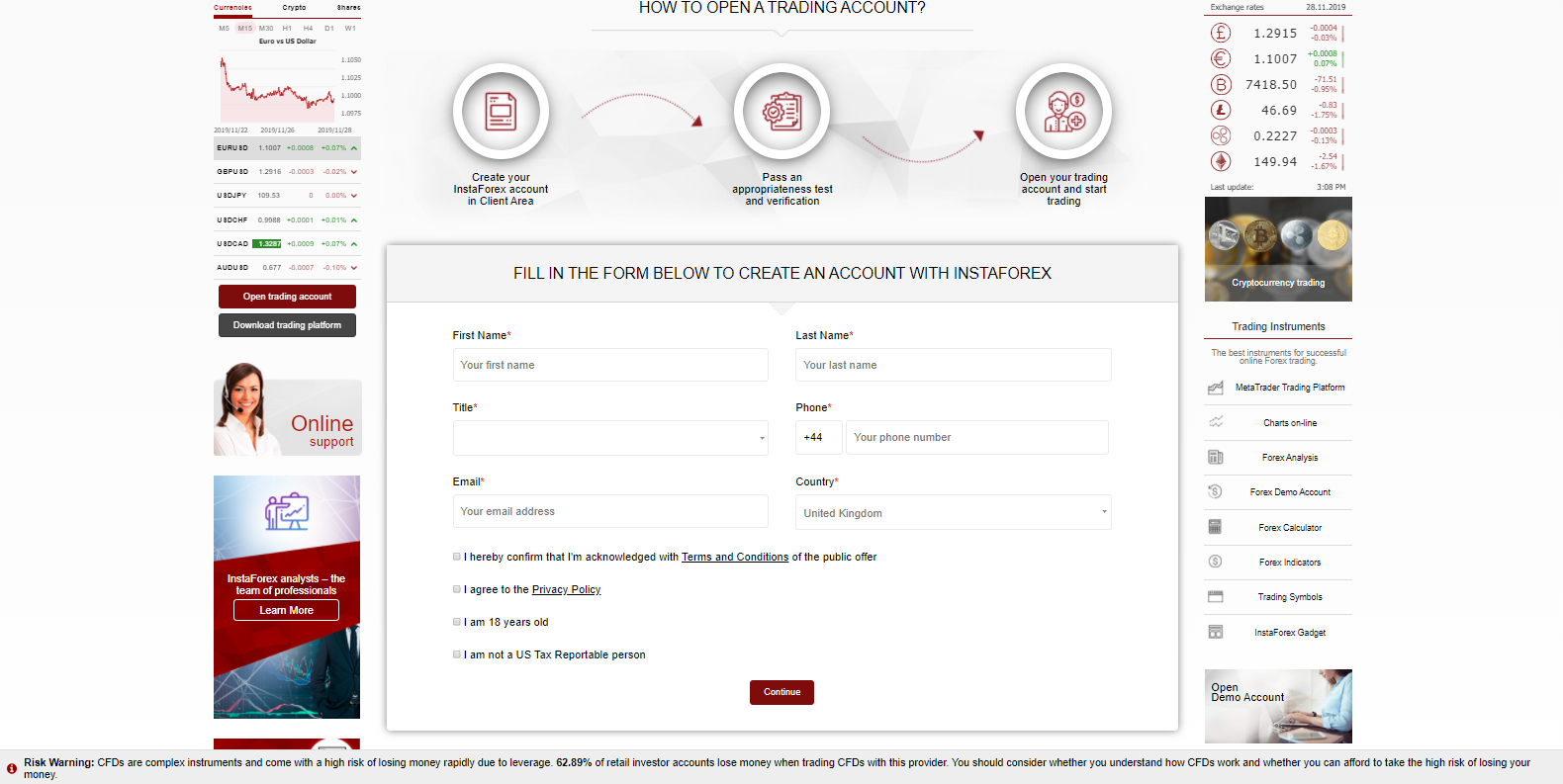

Opening an Account

Opening an account can be accomplished through a straightforward online application that grants new traders access to their client cabinet. To satisfy AML/KYC requirements from its regulator, a copy of the client’s ID and proof of residency is required. This represents the standard operating procedure in today’s brokerage industry and new clients should feel secure when submitting their documents to InstaForex EU; this broker is well-regulated and transparent about its operations as evident with the documents provided and updated on their website.

Deposits and Withdrawals

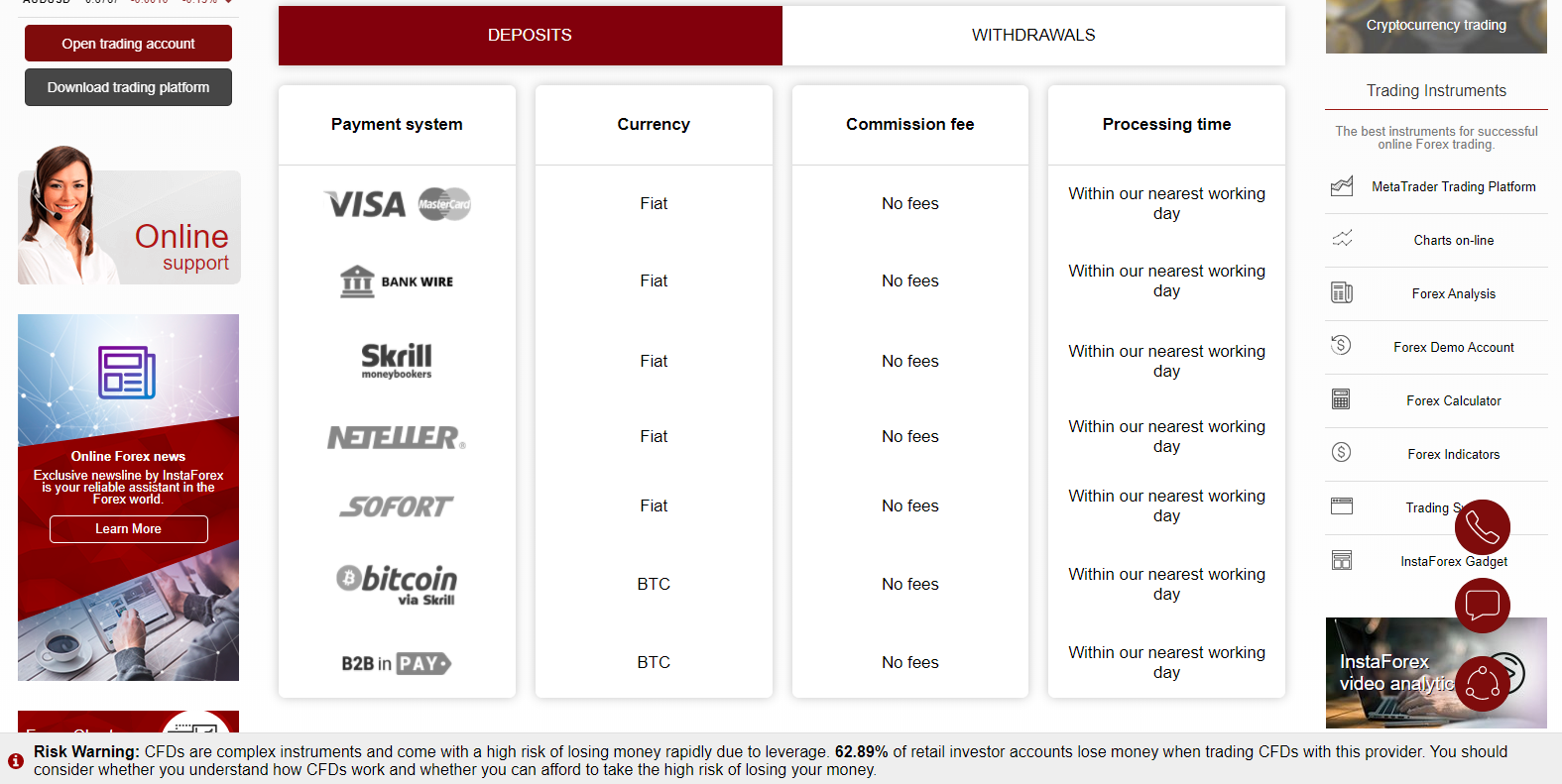

InstaForex EU offers its clients the most commercial payment methods including bank wire, credit/debit card payments, Skrill, Neteller, Sofort and Bitcoin. The inclusion of Bitcoin as a payment option shows that this broker is keeping up with transformations in the remittance market and represents a genuine service. No deposit fees are charged which represents the standard across the brokerage sector, but processing times are noted as the nearest business day. Withdrawal fees apply universally, but range depending on the method deployed and the processing time is once again noted as the nearest business day.

Withdrawals incur a fee ranging from a minimum of 1% for Bitcoin and Skrill withdrawals, €1 for Neteller, 1.8% + €0.05 for credit cards, and a minimum of €5 for bank wires and Sofort.

Summary

InstaForex EU is part of the InstaForex group of companies and received its CySEC license in 2015, after being operational since 2007. With over 7,000,000 traders as a group, this brokerage has established a leadership position in the retail sector of the forex market. InstaForex has received numerous awards for its quality, security, innovative approach, and a wide selection of services and offers. This broker is fully compliant with its regulator and transparent about its services.

Pure Forex traders will enjoy the asset selection with over 100 currency pairs offered, while other assets are represented more scarcely. Traders who seek proper cross-asset diversification will conclude that the overall selection is limited. The trading conditions in the Insta.Eurica account with 0 spreads, and commissions ranging between 0.02% and 0.07% offers the most competitive trading environment. Traders should be aware that 1.0 standard lot equals just 10,000 currency units and not 100,000 units that represent the norm.

From a financial perspective, this broker appears to be quite stable, as evidenced by its sponsorship of professional sports teams; InstaForex has also partnered with Czech Airlines and branded one of its Airbus A319 as the InstaForex Airplane. This project is intended to express the ambitions of InstaForex and to reflect that InstaForex is a broker that is here to stay.

Technology is noted on several occasions and while genuine projects are present, the execution is flawed and requires a drastic overhaul. The research department is home to over 30 analysts but lacks a uniformed approach. Periodically, the impression created is one of a group of amateur retail traders exchanging ideas on a web forum, rather than a professional team catering to clients. Management needs to ensure that sound ideas are implemented properly to have the desired effect.

At InstaForex EU, the proper ingredients are present to create a considerably better brokerage than what has been accomplished to date. The untapped potential and poorly executed projects present an unfortunate draw on the overall brokerage. Retail traders may continue to flock to InstaForex as a group due to some solid basics, but sophisticated traders are unlikely to consider this their prime broker. The Insta.Eurica account, an outstanding selection of currency pairs, and the potential of this broker make it a solid third choice for a well-diversified broker strategy and deserves to be followed for subsequent developments that may elevate it.

FAQs

Where is InstaForex EU based?

InstaForex EU is headquartered in Limassol, Cyprus.

How does InstaForex EU make money?

InstaForex EU collects its fees from spreads and commissions on over 200 assets.

How can I deposit into an InstaForex EU account?

Traders have the choice of bank wires, credit/debit cards, Skrill, Neteller, Sofort, and Bitcoin.

What is the minimum lot size at InstaForex EU?

The minimum trading size is listed as 0.01 lots.

When do a margin call and a stop-out take place at InstaForex EU?

InstaForex EU initiates a margin call at a 100% equity-margin ratio and a stop-out at a 25% equity-margin ratio.

Is InstaForex EU regulated?

Instant Trading EU LTD, the owner, and operator of InstaForex EU is licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 266/15. The license was granted on January 13th,2015.

What is the maximum leverage offered by InstaForex EU?

The maximum leverage is 1:30.

How do I open an account with InstaForex EU?

InstaForex EU has an online application form which is the standard operating procedure.

Does InstaForex EU offer the MetaTrader Trading Platform?

Yes, InstaForex EU offers the MT4 trading platform.