Stop losses should only be moved either after a defined period of time has elapsed, or after the trade has moved in the trader’s favor by a relatively large amount, compared to the risk of the trade. Other methods of judgement tend to produce poor results.

The question of whether you should move a stop, and if so, when you should move it, depends also upon your style of trading, i.e. your tolerance for losses and your profit targets.

The Statistical Reality of Trade Entries

If you look at all your trade entries, or a lot of entries generated by a strategy, you will find that in most cases, the price comes back to the entry level, even after a relatively considerable period of time has elapsed. Even when a technical development has occurred that indicates that the price is not going to come back there, for example carving out a higher swing low or lower swing high, it is still likely to return and hit your newly breaking-even stop loss.

To give an example, I examined a trend trading strategy that has recently produced excellent results. The stop loss is one day’s average range, so it is adjusted for volatility. I looked at all the really good entries: the ones that produced winning reward to risk ratios of at least 5 to 1. The result was that it was only safe in about half of these cases to move the stop loss to break even once 48 hours had elapsed. Of course, this was a longer-term trading strategy. However it goes to show you that while it may be true that many of the very best trades go into profit right away, this is not usually statistically common enough to build a winning strategy upon.

Top Forex Brokers

Common Approaches to Adjusting Stop Losses

Defined Time Period

One approach that can work is to wait for a defined length of time, one that should have given your trade enough time realistically to “breathe”. Once this time has elapsed, if your trade is showing a loss, exit immediately; if a profit, move the stop loss to break even. If you apply this method consistently, you could save in early exits from bad trades what you miss in any early exits from trades that turn out to be good trades after all.

Floating Profit Equals Certain Amount

You could apply the maxim “don’t let a winner turn into a loser” by moving the stop to break even once it has performed well enough to be out of the “orbit” of the entry level. You will probably be best served by waiting for the trade to be in profit by at least 3 times the amount of the stop loss before doing this.

Trailing Stop Loss

This can work, but a trailing stop loss should only be applied when the trade is in profit by at least 3 times the stop loss, and the size of the trail should be based upon volatility

Technical Stop Loss Adjustment

A very common approach, which usually involves waiting for any of the following to occur:

A failed retest of the entry point

A significant higher high or lower low that “confirms” the entry

A successful breakout in the direction of the trade

A failed breakout against the direction of the trade

These can work sometimes, but will not usually work often enough, especially in intraday trading.

Fixed Pip Amount of Profit

Here the stop loss is moved to break even after some fixed amount of floating profit has been achieved. This is a bad idea except where the price is much closer to the take profit point than the entry point.

Using Moving Averages and Other Technical Indicators

Using a technical indicator to move a stop loss is an intelligent and dynamic strategy. Remember, the choice of where to place a stop-loss should be at a point where the trade is proven to be wrong. For example, if I am in a long trade, I may place a stop-loss below a significant support level or a bullish reversal pattern.

However, before the price hits the stop-loss, there may be clues or signals that the trade is reversing against me or that it’s simply time to start protecting my profits.

That means I don’t necessarily have to wait to take a full loss to exit the trade.

Using a Single Moving Average

A moving average is a trend-following indicator. When the price crosses a moving average, it confirms momentum in a certain direction.

- If I am in a long trade, I can move the stop-loss if the price crosses below the moving average because the price is becoming more bearish.

- If I am in a short trade, I can move the stop-loss if the price crosses above the moving average because the price is becoming more bullish.

I can use this signal to exit a trade completely instead of moving the stop-loss. If I do this, I normally wait for the price to close below or above a moving average, not simply to cross that indicator. This helps reduce the risk of premature and false signals. The disadvantage of waiting for a close above or below a moving average is that it produces a later signal than if I had exited the trade immediately when the price crossed the moving average.

Using two Moving Averages

A way to further help reduce false signals is to use two moving averages on the chart:

- A fast MA has a shorter period, and a slow MA has a longer period, e.g., if I have a 9-period MA and 18-period MA, the fast MA is the 9-MA, and the slow MA is the 18-MA.

- When the fast MA crosses the slow MA from below, it’s a bullish signal.

- When the fast MA crosses the slow MA from above, it’s a bearish signal.

Let us look at an example.

The above example shows two instances when the 9 EMA (the fast EMA) crosses the 18 EMA (slow EMA). If I am in a short trade, I can use this signal to move the stop-loss to breakeven as it tells me the price is picking up new bearish momentum and that I have room to protect some of my trade.

Using Other Technical Indicators

Plenty of other technical indicators can also help identify an early reversal in price and suggest that maybe it’s time to move the stop-loss.

Two very popular indicators are the MACD and RSI.

- I can move my stop-loss when the RSI either goes to oversold or overbought.

- I can move my stop-loss when the MACD histogram changes colour from green to red or vice versa.

Both these scenarios indicate a possible change in momentum, and I can act accordingly.

When T1 is Hit

Many traders use multiple profit targets to scale out of a trade. This is a great way to bank some profits but remain in a trade if there’s potential for more money.

When the price hits the first target or T1, I can move my stop-loss to help protect my overall profits if the trade reverses against me.

There are two typical areas to move the stop-loss to when the price hits T1:

- Move the stop-loss to halfway between the original stop-loss and entry.

- Move the stop-loss to breakeven.

Impulse – Correction—Impulse Wave Pattern

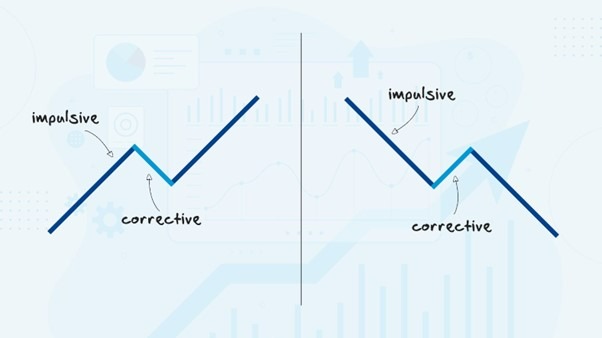

In Elliott Wave and trend theory, prices move in waves. This is one of the easiest things to spot when looking at a chart. Look at any big trend—the price does not move from Point A to Point B in a straight line—instead, it wiggles or waves as it moves through the trend.

Each wave segment is divided into ‘Impulsive’ and ‘Corrective.’

When the price is moving in the direction of the trend, it’s the impulsive part of the wave. When the price is moving against the trend, it’s the corrective part of the wave.

Impulsive moves generally have longer candlesticks with the majority in one colour (for example, bullish green candles if it’s an impulsive wave in an uptrend). Corrective moves generally have a mix of bullish and bearish candles, usually with shorter lengths.

How do I use impulsive and corrective waves in my stop loss?

- If I know I am in an impulsive wave, I can move my stop-loss to breakeven to help protect more of my profits as the price picks up more momentum in my direction.

- I can exit the trade or move my stop loss if I see a new impulsive wave forming against the direction of my trade, i.e., to help protect against taking a full loss.

When Should You Not Move a Stop Loss to Breakeven?

Price Too Close to Entry Level

A common mistake traders make is moving the stop loss close to the entry level when the price is very nearby. This is done out of fear of losing. It’s essential to give the price room to breathe as it moves above before establishing direction. Remember, trading is messy and not an exact science.

Price Hasn’t Done Anything Significant Yet

Traders move stop-losses when the price has barely budged out of emotional reasons. Maybe they are unsure of the trade or afraid to take a loss, so they move the stop-loss, hoping to get out earlier. Or it could be out of impatience and the feeling that they must always be doing something. Either way, these are not strategic reasons to move a stop loss.

To help prevent these mistakes, have written rules about when to move stop-losses.

How To Move Stop Loss to Breakeven in MT4

MT4 makes it easy to move the stop-loss or take partial profits.

Step 1. Click on the Trade tab in the Terminal window. Go to “View > Terminal” or press Control + T to bring up the Terminal window. This is where to find a list of all your trades, including their entry prices, position sizes, stop losses, and profit targets.

Step 2. Right-click the trade you want to modify and select the “Modify or Delete Order” option.

Step 3. Adjust the Stop Loss to the new level. You can also take partial profits in this dialogue box—enter a market order for the volume you want to exit. For example, if I am in a long trade for 1 standard lot and want to take exit half my trade, I will place a sell market order for 0.5 lots.

Step 4. To complete the stop-loss adjustment, click the Modify button. A dialogue box will appear that confirms the new stop-loss level. If I am taking partial profits, I click “Sell by market” or “Buy by market.”

Conclusion

Moving a stop loss to break even is the same as taking profit. If it is too early to take profit, there is no point in moving a stop loss to break even. Except in cases of very skilled traders, it is hard to be profitable if you are aiming for an average reward to risk ratio less than 3 to 1, so it is probably a bad idea to be moving stop losses to break even any sooner than that.

Every currency pair or cross has an average daily range of volatility. If your stop loss level is within half of that amount, it will probably be hit within the next day or two. Consider whether that gives it enough time to reach the kind of profit target you are looking for.

Do not be in a hurry to adjust a stop loss.