LegacyFX Editor’s Verdict

LegacyFX is an intriguing broker as it only offers the MT5 trading platform with a promise of no swap rates on leveraged overnight positions. Retail traders with portfolios below $25,000 must accept higher spreads, but the absence of fees on overnight positions piqued my interest. I reviewed LegacyFX to conclude if the swap-free offer creates a competitive advantage. How does LegacyFX compare to the elite brokers in the Forex industry? Read this full LegacyFX review to find out.

Overview

LegacyFX Overview - Swap-free trading from the MT5 trading platform

Cyprus VFSC 2012 Market Maker $500 MetaTrader 5 1.6 pips 1.5 pips $0.13 $0.63 $505

I appreciate that LegacyFX offers traders the very useful Autochartist plugin, though a minimum requirement of $1,000 is necessary (still, some brokers charge an even higher minimum). While it remains within a reasonable range, traders must deposit $3,000 for access to stock trading. This makes LegacyFX more expensive to get started with, but the lack of swap rates makes it a broker worth considering for traders who can afford the required minimum deposit.

LegacyFX Main Features

Retail Loss Rate | Undisclosed |

|---|---|

Regulation | Yes |

Minimum Raw Spreads | Not applicable |

Minimum Standard Spreads | 0.5 pips |

Minimum Commission for Forex | Commission-free |

Commission for CFDs | 0.45% |

Commission Rebates | No |

Minimum Deposit | $500 |

Demo Account | Yes |

Managed Account | Yes |

Islamic Account | Yes |

Inactivity Fee | No |

Deposit Fee | No |

Withdrawal Fee | Third-party |

Funding Methods | 7 |

Regulation and Security

Trading with a regulated broker will limit the potential for fraud and malpractice. I always recommend traders check for regulation and verify it with the regulator by checking the provided license with their database. LegacyFX presents clients with one regulated entity.

Country of the Regulator | Name of the Regulator | Regulatory License Number |

|---|---|---|

Vanuatu | Vanuatu Financial Services Commission | VFSC License Number 14579 |

LegacyFX has a clean regulatory track record.

Client deposits remain segregated from corporate funds at LegacyFX, and traders get negative balance protection, which I believe is an absolute necessity for leveraged trading. Regrettably, there is no investor compensation fund, for example, via the Hong-Kong-based Financial Commission, the primary authority for brokers regulated in smaller jurisdictions. Another option would be a third-party insurance policy, which LegacyFX does not provide. It should be said, however, that many of today's top brokers don't provide these assurances, but it is a nice-to-have for brokers that offer it.

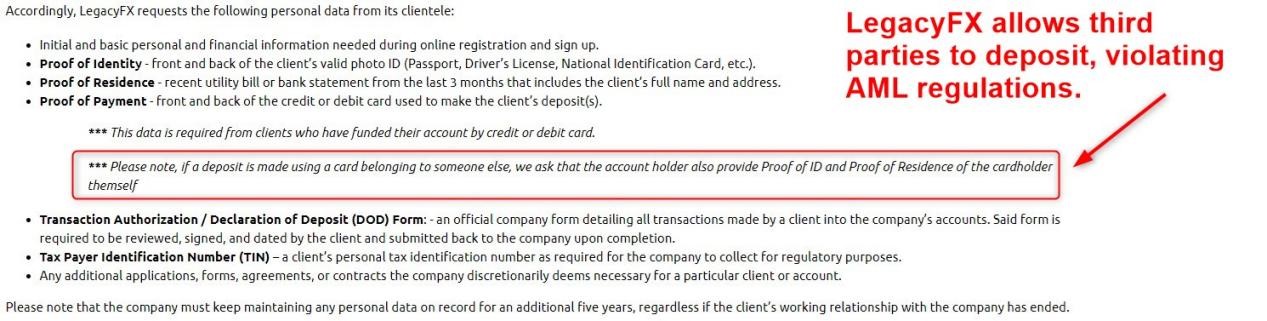

LegacyFX requires proof of payment for deposits made via credit/debit card and allows third parties to make such deposits, which is a divergence from accepted AML stipulations. Traders must also sign a Transaction Authorization / Declaration of Deposit (DOD) Form, countering the AML violation. Traders must also submit their Tax Payer Identification Number (TIN), which other offshore brokers do not require.

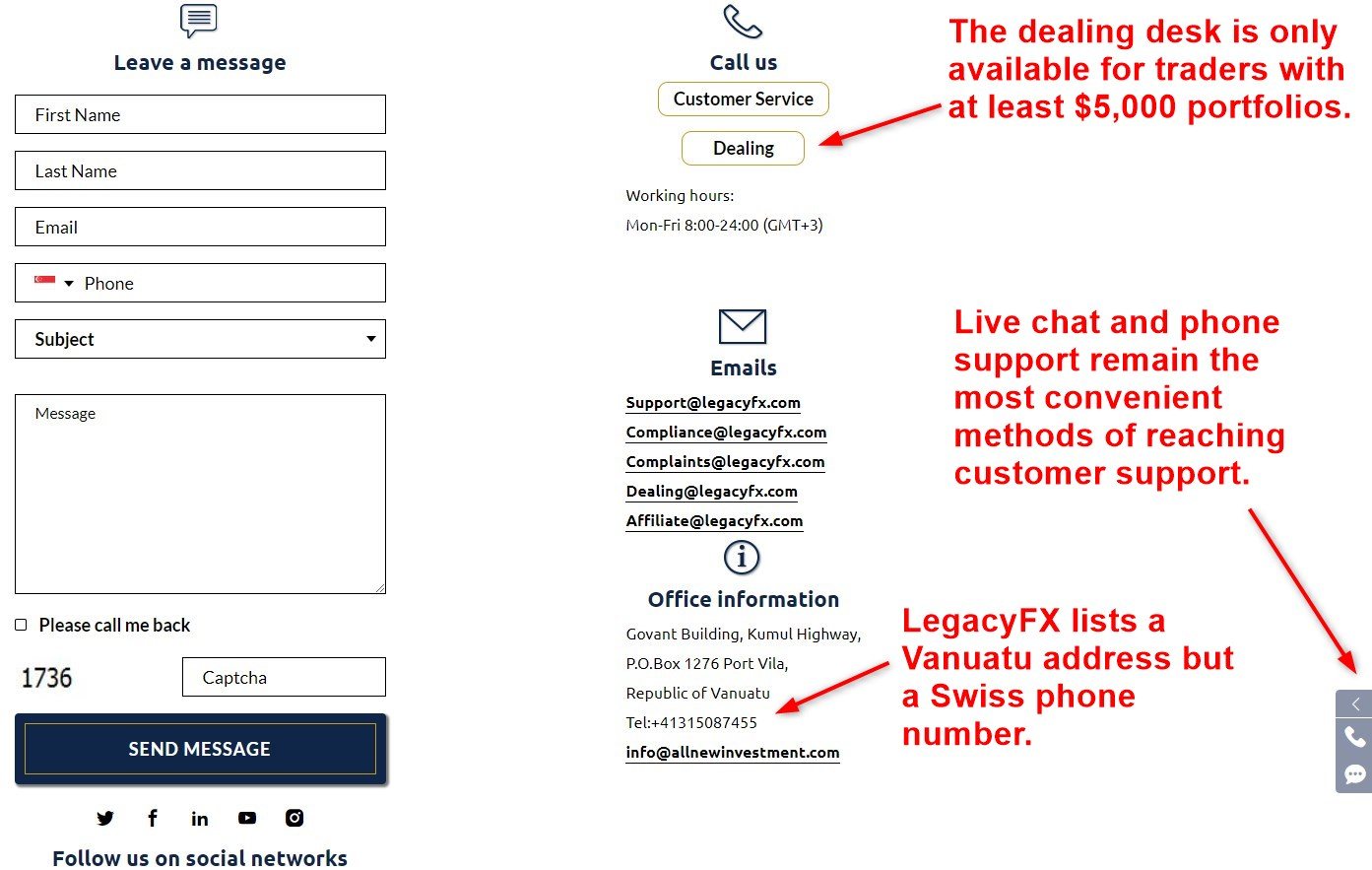

The contact information for LegacyFX is a testament to the broker's internationality. The company's listed phone number is in Switzerland. The messenger app WhatsApp shows a UK-based landline, available via the WhatsApp business app.

Fees

Average Trading Cost EUR/USD | 1.6 pips |

|---|---|

Average Trading Cost GBP/USD | 1.5 pips |

Average Trading Cost WTI Crude Oil | $0.13 |

Average Trading Cost Gold | $0.63 |

Average Trading Cost Bitcoin | $505 |

When it comes to trading fees, things get a bit complicated at LegacyFX. The spreads on all assets, and the commissions for equity CFDs, are very high, making LegacyFX an expensive broker for scalpers and short-term traders unless they have a minimum of $25,000 to deposit.

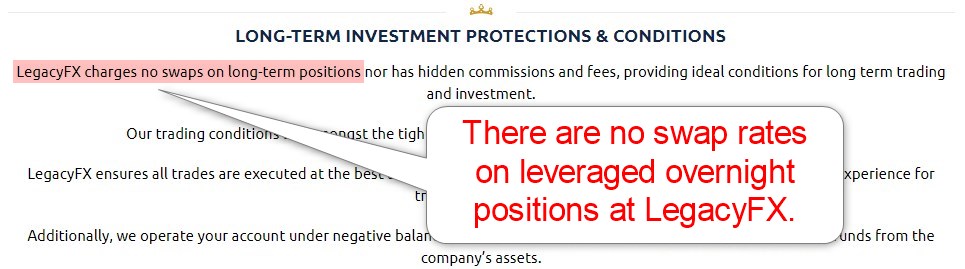

That being said, I have to outline how the absence of swap rates makes LegacyFX an ideal broker for leveraged traders who hold positions for more than a week, where trading costs drop to the best industry-wide.

LegacyFX offers traders a choice between variable spreads and fixed spreads, but I cannot recommend the latter, as trading costs remain excessive even without swap rates.

Spread (Variable) | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

1.5 pips (Standard) | $0.00 | $15.00 |

0.9 pips (Gold) | $0.00 | $9.00 |

0.5 pips (Premium) | $0.00 | $5.00 |

Spread (Fixed) | Commission per Round Lot | Cost per 1.0 Standard Lot |

|---|---|---|

3.6 pips (Standard) | $0.00 | $36.00 |

3.0 pips (Gold) | $0.00 | $30.00 |

2.4 pips (Premium) | $0.00 | $24.00 |

Equity traders should also consider the absence of swap rates and the positive impact on trading profits. Since equity traders generally keep positions open for longer than Forex or commodity traders, I highly recommend traders ignore the 0.45% commission at LegacyFX and account for the lack of financing costs. It can add up to hundreds or thousands in saved trading costs.

Here is a screenshot of the LegacyFX MT4 Premium trading account during the London-New York overlap session, the most liquid one, where traders usually get the lowest spreads.

.jpg)

I did not find an inactivity fee at LegacyFX for international clients, but it exists from its CySEC-regulated entity, where access remains restricted to EU traders. Overall, Legacy actively discourages scalping and short-term trading. It does maintain one of the best trading conditions for traders who intend to hold positions for more than one week.

What Can I Trade

LegacyFX only lists 41 currency pairs and eight cryptocurrency pairs, which is certainly enough for new and intermediate traders, especially in conjunction with the other assets it offers. The broker also offers 19 commodity CFDs and 11 index CFDs. The bulk of assets consist of 246 equity CFDs listed in nine countries, complemented by 13 ETFs.

Asset List and Leverage Overview

Commodities | |

|---|---|

Crude Oil | |

Gold | |

Metals | |

Equity Indices | |

Stocks | |

Stocks (non-CFDs) | |

ETFs | |

Futures | |

Synthetics |

LegacyFX Leverage

LegacyFX offers retail traders maximum leverage of 1:200, which I find competitive for active traders, increasing flexibility and profitability. Negative balance protection exists, and there are no swap rates, making it an ideal trading environment for long-term traders.

LegacyFX Trading Hours (GMT+3)

Asset Class | From | To |

|---|---|---|

Cryptocurrencies | Saturday 00:00 | Friday 23:00 |

Forex | Monday 00:01 | Friday 23:00 |

Commodities | Monday 01:05 | Friday 23:00 |

European CFDs | Monday 10:02 | Friday 18:29 |

US CFDs | Monday 16:32 | Friday 22:59 |

Please note that equity and index CFDs do not trade continuously but open and close each day at the above specified times.

I recommend the following step for MT5 traders to access trading hours:

1. Right-click on the desired symbol in the Market Watch window and select Specification.

2. Scroll down until you see Sessions.

Account Types

I find the seven account types at LegacyFX unnecessarily complex. Equity trading, which I find the best offer at LegacyFX, requires a minimum deposit of $3,000, while access to the direct dealing desk is available from $5,000. It makes LegacyFX ideal for equity traders with more substantial portfolios.

LegacyFX also provides account managers with PAMM accounts, enabling a complete portfolio management solution. This allows smaller account management firms and skilled traders to build their asset management business with control over parameters.

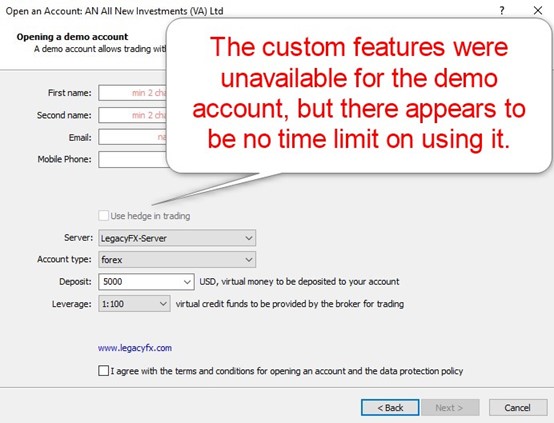

LegacyFX Demo Account

I did not find a time restriction on the LegacyFX demo account, available directly from the MT5 trading terminal. The customization options were disabled on the demo account, which was a bit disappointing.

.jpg)

Trading Platforms

LegacyFX provides traders with the MT5 trading platform and is a rare broker skipping the benefits and infrastructure of MT4. The platform is available as a desktop client, lightweight mobile version, and mobile app. Beginner traders without existing MT4 solutions will not miss MT4, and I like that LegacyFX offers the Autochartist plugin for deposits above $1,000. MT5 has a built-in copy trading service and full support for algorithmic trading but notably trails MT4 in both categories.

Overview of Trading Platforms

MT4 | |

|---|---|

MT5 | |

cTrader | |

Proprietary Platform | |

Automated Trading | |

DOM? | |

Guaranteed Stop Loss | |

Scalping | |

Hedging | |

One-Click Trading | |

OCO Orders | |

Interest on Margin |

Unique Features

For me, the unique feature at LegacyFX is the absence of swap rates on leveraged overnight positions, especially for equity traders. It lowers trading costs significantly and has a notable positive impact on profits. I want to stress that the benefit kicks in for traders who keep positions open for more than a week. Otherwise, the high spreads and commissions make LegacyFX an expensive broker for scalpers and short-term traders.

Research and Education

LegacyFX offers services from third-party provider Autochartist, features data and analytics from TradingView, and complements it with a live trading signals page. All of these services are excellent additions that are offered by some other brokers, but are largely missing in the offerings of newer or less-developed brokers. It represents a well-balanced collection of trading ideas, but traders should test their accuracy before blindly copying the recommendations. Overall, I can confidently rank the available research at LegacyFX as quality service.

Beginner traders get numerous educational tools, and LegacyFX claims to lead in knowledge. They offer what feels like endless video content. Most remain ultra-short, just enough to introduce the topic without providing really deep insights. Eleven ebooks are also available, following the same principle as the video content.

LegacyFX's website says that they offer webinars, but I found them difficult to find on the site.

Customer Support

Customer Support Methods |   |

|---|---|

Support Hours | M-F, 0800 - 2400 |

Website Languages |      |

Customer support is available Monday through Friday between 0800 and 2400 (GMT+3). LegacyFX provides its registered office address in Vanuatu, an official phone number in Switzerland, a messenger with a UK landline, e-mail addresses, a web form, and live chat. An FAQ section answers some questions, and I recommend live chat or phone support as the most convenient contact method if traders require assistance.

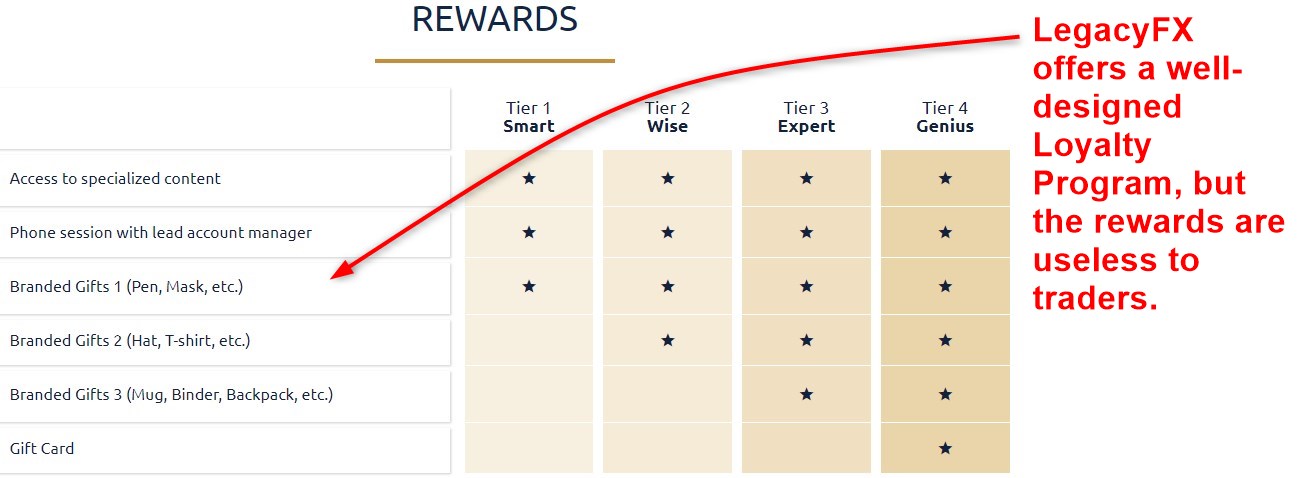

Bonuses and Promotions

LegacyFX does not offer deposit bonuses but maintains a Loyalty Program for affiliates. The structure is a mix of minimum equity, executed trades, and referred traders, an intelligent concept I like, but the rewards remain unattractive. The highest of the four tiers grants a gift card with an unspecified amount. LegacyFX does not provide benefits traders can use but branded merchandise and additional content.

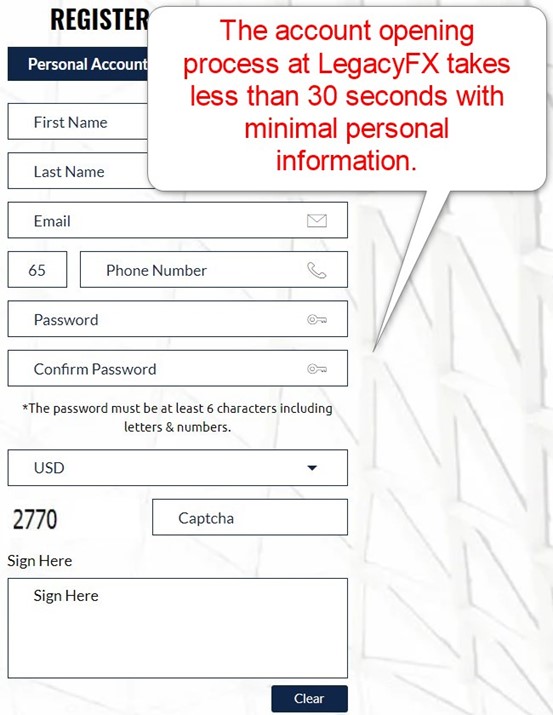

Opening an Account

The account opening process at LegacyFX is both short and straightforward, and I appreciated the hassle-free process. Traders can complete the application in less than 30 seconds by submitting their name, e-mail, phone number, desired password, and account base currency. It also includes a signature box, which I found interesting.

Account verification remains mandatory, and most traders satisfy it by sending a copy of their ID and one proof of residency document. LegacyFX also asks for Taxpayer Identification Number (TIN), breaking with the procedure available at other offshore brokers.

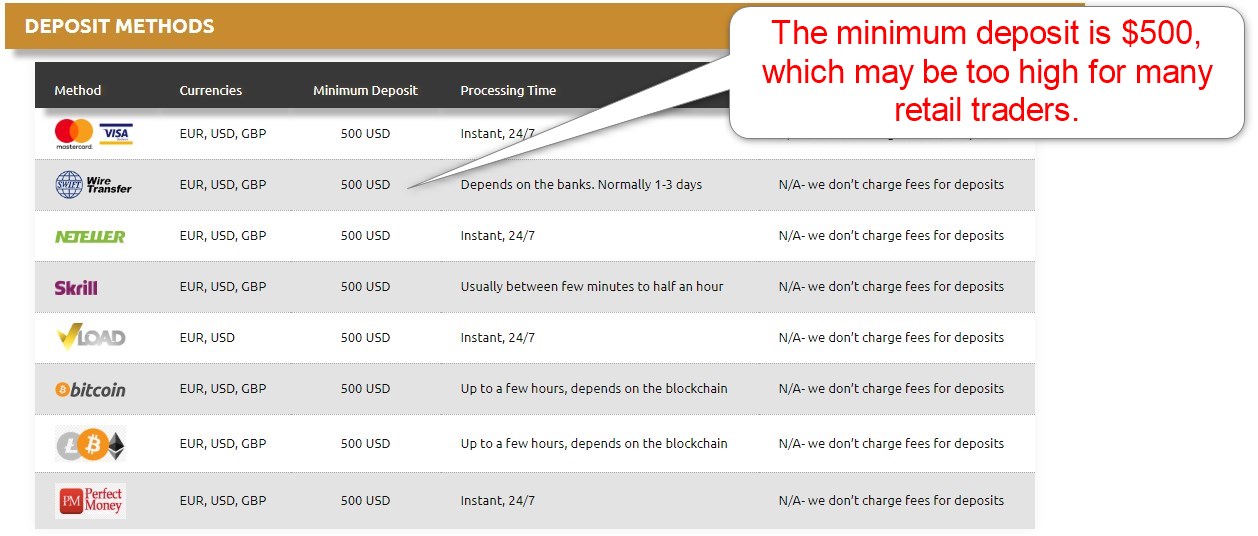

Minimum Deposit

The minimum deposit LegacyFX is $500. This is more than brokers that require only $100, but in reality, I find that it's not realistic to trade with only $100, so by requiring a higher minimum deposit, LegacyFX is actually setting its traders up for greater success, in a way. Equity trading requires $3,000, and access to the dealing desk is available from $5,000.

Payment Methods

LegacyFX offers bank wires, credit/debit cards, Neteller, Skrill, VLoad, cryptocurrencies, and Perfect Money.

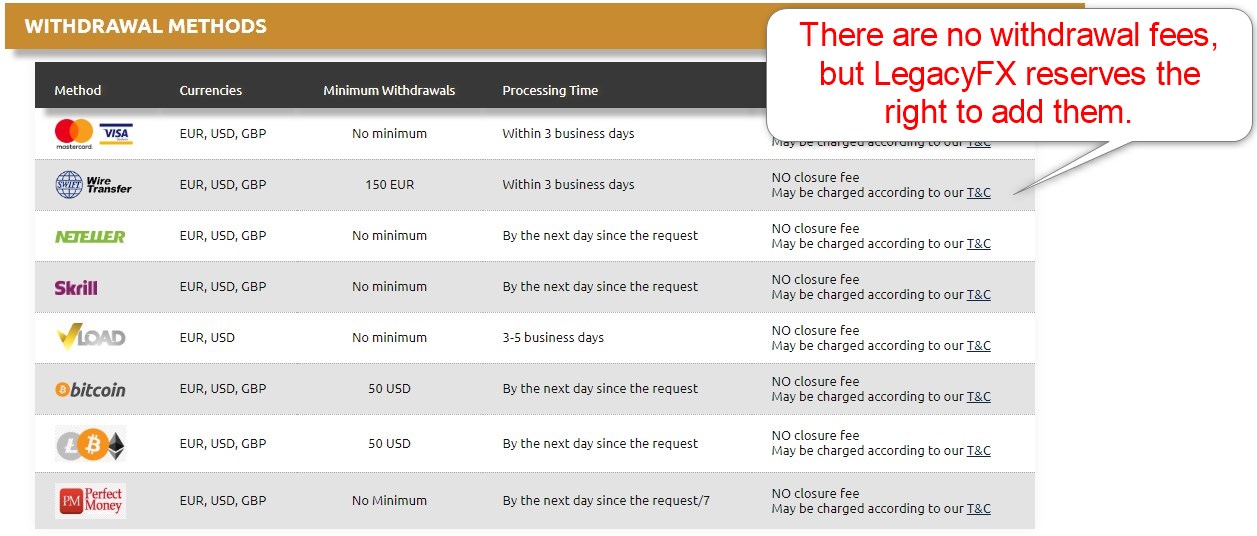

Deposits and Withdrawals

I find the third-party deposits available at LegacyFX confusing, as it violates globally accepted AML stipulations. LegacyFX attempts to counter it with a Transaction Authorization / Declaration of Deposit (DOD) Form, which all traders must sign. No deposit and withdrawal fees exist, but LegacyFX reserves the right to add them. Traders may also face third-party processor costs, which can be applied at any brokers that use third-party payment options.

The Bottom Line

I like the trading experience at LegacyFX as this broker does not charge swap rates on leveraged overnight positions. I prefer more client protection in the form of a compensation fund, but overall, LegacyFX presents a secure trading environment. The asset selection remains average, and while spreads and commissions are high, the lack of swap rates results in a competitively priced broker for traders who maintain positions for more than five trading days.

The Autochartist plugin is available for MT5, and LegacyFX presents a comprehensive research service, which I rate highly. While beginner traders have access to a quantity of educational content, the quality lacks notable. I believe LegacyFX is best for equity traders with deposits exceeding $5,000, which is the minimum required to unlock all beneficial services at LegacyFX. Otherwise, the minimum deposit is $500.

FAQs

Is LegacyFX a good broker?

Legacy is an excellent choice for traders who keep positions open for more than one week, as this broker does not levy swap rates.

Is LegacyFX real?

LegacyFX is a broker catering to international traders as a duly registered and regulated broker from Vanuatu.

Is LegacyFX regulated by the FCA?

LegacyFX operates an EU-based subsidiary with regulation from the CySEC and the FCA. Legacy limits access based on geographic location.

Is LegacyFX legit in South Africa?

LegacyFX does not have a physical presence in South Africa, which is not a requirement to accept traders from South Africa. Therefore, it remains a legit choice for South African traders.