Emerging market shares hit their lowest point in over three weeks on Monday, as investor concerns about a possible trade war kept traders concerned that emerging markets could be among the hardest hit by U.S President Donald Trump’s tariff threats, specifically against European carmakers. In his continued attempt to pressure European governments, President Trump tweeted “If the E.U. wants to further increase their already massive tariffs and barriers on U.S. companies doing business there, we will simply apply a Tax on their Cars which freely pour into the U.S.,” Trump tweeted. “They make it impossible for our cars (and more) to sell there. Big trade imbalance!”

Emerging market shares hit their lowest point in over three weeks on Monday, as investor concerns about a possible trade war kept traders concerned that emerging markets could be among the hardest hit by U.S President Donald Trump’s tariff threats, specifically against European carmakers. In his continued attempt to pressure European governments, President Trump tweeted “If the E.U. wants to further increase their already massive tariffs and barriers on U.S. companies doing business there, we will simply apply a Tax on their Cars which freely pour into the U.S.,” Trump tweeted. “They make it impossible for our cars (and more) to sell there. Big trade imbalance!”

Among the countries that could be impacted by this specific tariff are Hungary, the Czech Republic, Romania and Poland, all of which rely heavily on the auto manufacturing industry. German car companies have already been hit even before the policies were implemented, with shares of BMW and Daimler plummeting in early Monday trade. BMW was trading down 1.2 percent around noon in Europe while Daimler shares slumped 0.5 percent, even as European shares were broadly higher. Approximately 6 million cars were exported from Europe in 2016, and over 1 million of them were imported to the United States, making the country the largest importer of European automobiles. A threat to this industry could ostensibly put Germany, the leading automobile exporter worldwide, and many other European countries, at risk. Still, Germany’s carmakers replied that their companies and other European automobile manufacturers are critical investors in the U.S. economy, and that they are responsible for employing over 100,000 workers.

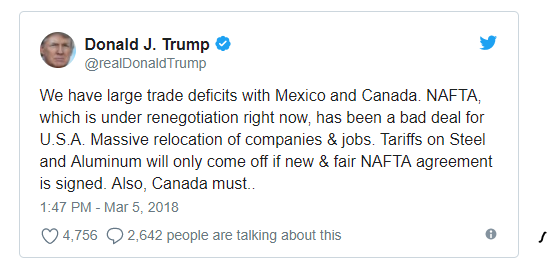

Mexico is also poised to be among the hardest hit, though Trump tweeted early in the East Coast morning that his plans for Canada and Mexico may be halted if he is satisfied with the new NAFTA agreement that is set to be confirmed later today.