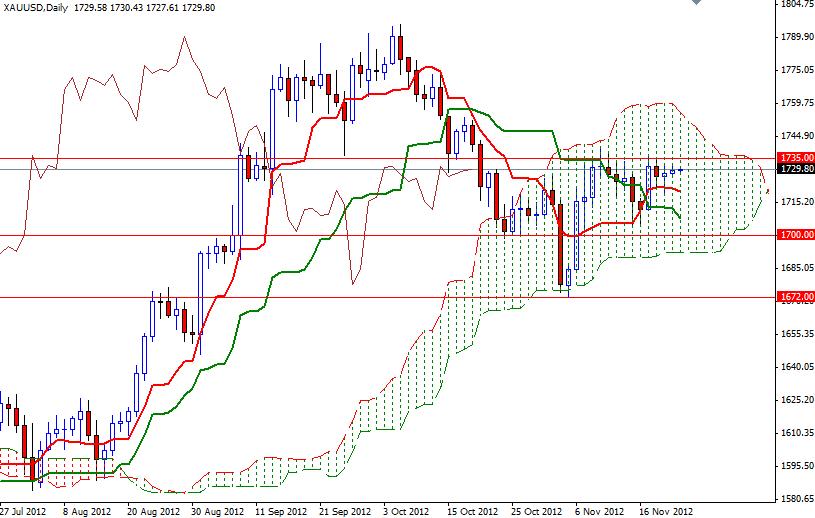

XAU/USD (gold vs. the greenback) closed higher than opening after PMI data from the China and Europe came out better than forecasts. However, the pair remained in range between 1732.40 and 1727.95 as the U.S. markets were closed for the Thanksgiving holiday. Today there is a similar situation during the Asian session due to a Japan holiday. For the last couple of months, underlying demand for gold is being held up by the intensified worries over the global economy. Several central banks around the world continue to purchase gold and these purchases are providing a significant amount of support to gold. But with the overall attitude in the markets, I believe that this tight range will contain the market in the short-term. The XAU/USD has been trading in an increasingly tighter range for the last four days, and as a result it will soon reach a point where it will simply have to break one way or the other. I think it makes more sense to wait until we break out of this tight market. If the pair breaks and holds above 1735 the most likely target will be 1750. If that is the case, there will be additional resistance at 1739 and 1743. A daily close below the 1717 level would shift momentum to the bears’ favor. Support to the downside can be found at 1726 and 1720.60.

Gold Price Analysis - Nov. 23, 2012

By Alp Kocak

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo.

Subscribe

Sign up to get the latest market updates and free signals directly to your inbox. Please enter a valid email address

By Alp Kocak

Alp Kocak has been trading Forex since 2003. He writes technical analysis based on Japanese candlesticks and Ichimoku Kinko Hyo. - Labels

- Gold