The WTI Crude Oil markets had a positive session on Friday as the nonfarm payroll numbers came out showing that the Americans added 195,000 jobs to the economy in June. Needless to say this is a much stronger number than what was expected. Because of this, there is an anticipation of stronger demand for oil, and as a result oil prices could rise even as the dollar did.

On top of that, we saw more violence in Egypt as the political crisis continues. There is a certain amount of fear that the Suez Canal will be closed, but quite frankly I think that's one of the most ridiculous scenarios out there. After all, the Egyptian military is very well aware of the fact that they would not exist without financial aid from the Americans, and as a result have a certain amount of loyalty to Washington. Besides that, the Egyptian economy has only one thing working for them at the moment: the revenue collected from the Suez Canal. Tourism is absolutely decimated in Egypt now, and as a result it's hard for me to believe that the military will allow the one working part of the economy to fall apart for no apparent reason.

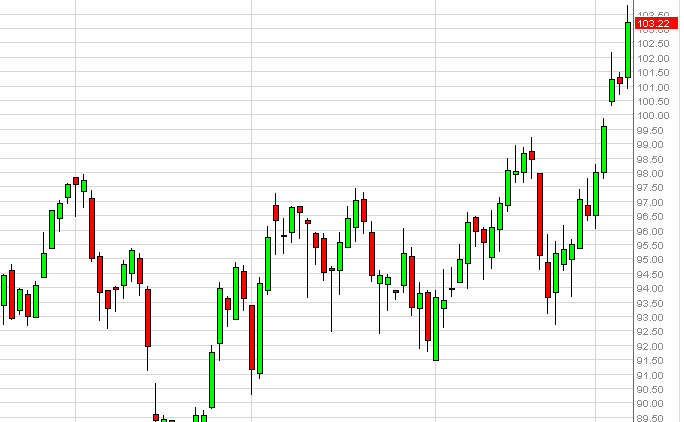

This looks a bit overdone as far as I'm concerned

As far as I'm concerned, this market looks a bit overdone and ridiculous as far as I can tell. After all, this parabolic move is a bit overdone, and the fact that we are now trading at $103.22 a barrel also is a bit overdone. With the parabolic move like this, there is often a very violent and swift correction, which is the play I am waiting for. I do not see the resistive candle yet, but I have a hard time believing that this market will move above the $105.00 level without some type of serious problem. This would be counter to economic growth as well, and $105.00 a barrel without a doubt would slow down the US economy, which would take away one of the positive factors for this market. On top of that, as I said above, the canal is not going to be closed, and as soon as the markets accepts that fact - look out below.