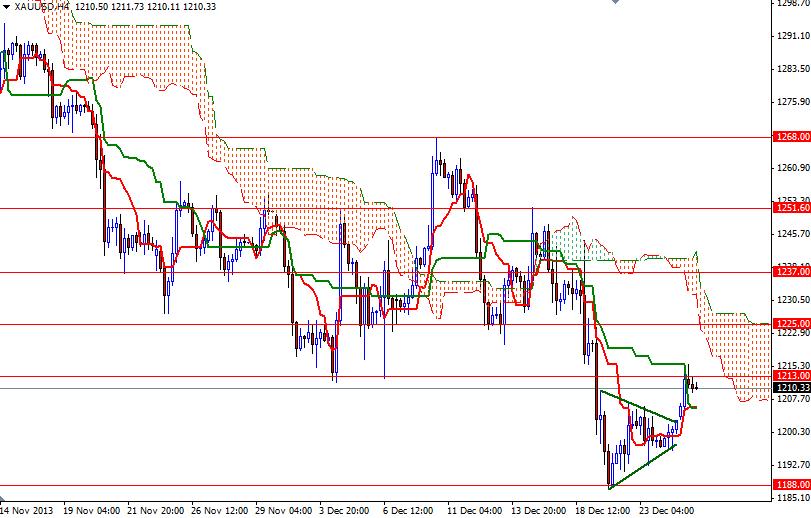

Gold prices settled higher yesterday but failed to hold above the 1213 resistance level. The XAU/USD pair has declined approximately 28% since the beginning of the year and is set to post its first annual decline in thirteen years. The bears have been dominant since prices touched the 1795.75 level in October 2012 as the market conditions (both fundamentally and technically) gave investors few reasons to hold safe-haven investments, including gold.

Inflation is no longer a serious threat and the equity markets are performing well; as a result investors see a reduced need for disaster insurance. Also, last week's strong gross domestic product data reinforced expectations that the U.S. Federal Reserve will reduce its asset purchases in $10 billion increments over the next meetings. Although the weekly and daily charts suggest to me that the path of least resistance is to the south, I don't think we will ever see the levels last seen 5-6 years ago because the average cost of gold production is much higher than those days. Because of that, I think the 1000 - 1160 area will be attracting some serious buyers such as central banks. From a short-term perspective, the key level to the upside will be at 1213.

Closing above this level might give the bulls some extra fuel they need to test the 1225 and 1237 levels. If prices break and manage to hold above the 1237 resistance level, we could see the XAU/USD pair extending its gains and climbing towards the upper band of the descending channel. However, the bears may want to take advantage of light volume and try to push the market around further. If that is the case, expect to see support at 1200, 1188 and 1180.