The XAU/USD pair continued to climb on Thursday after the bulls managed to break through the 1293 resistance level. During yesterday's session the pair pulled backed to the 1287/6 support level but weaker-than-expected economic data out of the United States helped gold to recover initial losses and close just above the 1300 level. The Commerce Department reported that retail sales fell 0.4% in January and data from the Labor Department showed that jobless claims increased by 8K to 339K.

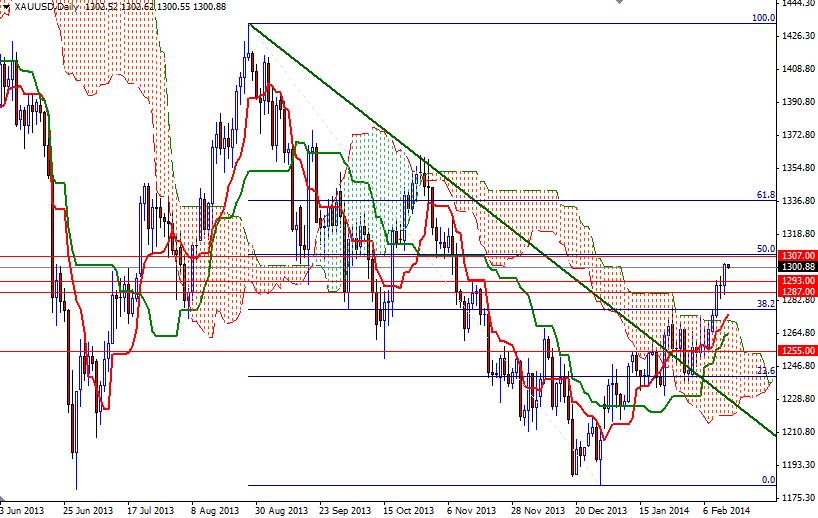

As I mentioned in previous analysis, the pattern on the daily chart suggests that the pair will resume its bullish sentiment as long as the pair continues to trade above the Ichimoku cloud on the daily time frame. Although I have been bullish since the market breached the 1268 resistance level, I will be watching the reaction around the 1307 level which happens to be the 50% retracement level.

Since this area caused the XAU/USD pair to reverse in the past, witnessing a retracement at this point would not seem to be so surprising. If that is the case, expect to see support at 1295/3, 1287/6. Breaking below 1286 means the market will probably head back to the 1278 support level. However, a sustained break above the 1307 would prolong the bullish momentum and clear the path towards 1346. On its way up, the first important challenge will be waiting the bulls at 1320. Today sees release of important economic reports from the United States such as industrial production and University of Michigan consumer sentiment (preliminary reading), so expect volatility.