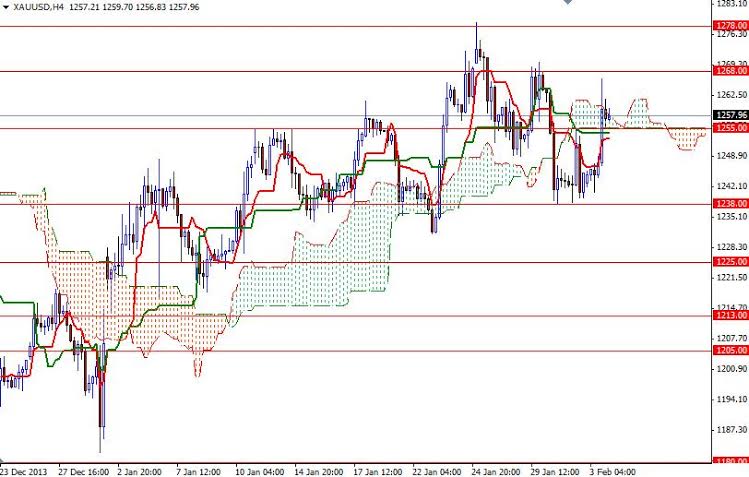

The XAU/USD pair (Gold vs. the American dollar) scored a gain of 1.17% on Monday as the American dollar lost strength after the manufacturing activity data out of the world largest economy disappointed the market. The latest report released from the Institute for Supply Management showed the manufacturing index fell to 51.3 from 56.5 the prior month. The pair traded as high as $1266.19 an ounce before pulling back to the 1257 level. Although the precious metal scored a monthly gain on the back of sharp corrections in equities markets, the market is still struggling to get above the 1268 level.

For the last nine sessions, including today, gold prices have been trapped between the Fibonacci 23.6 and 38.2 levels (based on the bearish run from 1433.70 to 1182.35) and this consolidation might continue as investors want to see the outcome of major central banks' meetings.

From a technical point of view, the bulls will have to hold prices above the 1255/2 zone unless they don’t want to lose the advantage they have. If this support remains intact, it is possible that prices will continue its bullish tendencies and try to push through the resistance level at 1268. Beyond 1268, expect to see resistance at 1274.48 and 1278. Closing above this area would suggest that the market is going to tackle 1293 and 1307 next. If the bears take the reins and drag the XAU/USD pair below 1252, support can be found at 1246.60 and 1238. Once below that, the bears will be aiming for 1230 and 1225. In the meantime, I will continue monitoring the major stock markets and USD/JPY pair.