Gold prices fell 3% for the week but managed to hold just above the bottom of the Ichimoku cloud on the daily time frame. During Friday's session, the XAU/USD pair initially fell to a 6-week low of 1285.68 before recovering to 1292.67. The XAU/USD pair has seen quite a sell-off recently as the market conditions (both technically and fundamentally) have been working against the precious metal.

It appears that market participants are fixated on the Federal Reserve's future plans and now people believe that the central bank will start rising interest rate sooner than what they thought just a month ago. Friday's data from the Commodity Futures Trading Commission (CFTC) show that speculative investors on the Chicago Mercantile Exchange reduced their net-long position in gold to 117317 contracts, from 136814 a week earlier.

As usual in the first week of the month, plenty of economic data is scheduled for the week ahead, including trade balance, Chicago PMI, ISM manufacturing and services activity surveys, ADP non-farm payrolls and government's jobs report. Market players will also pay close attention to Chinese economic figures which will come out on Tuesday.

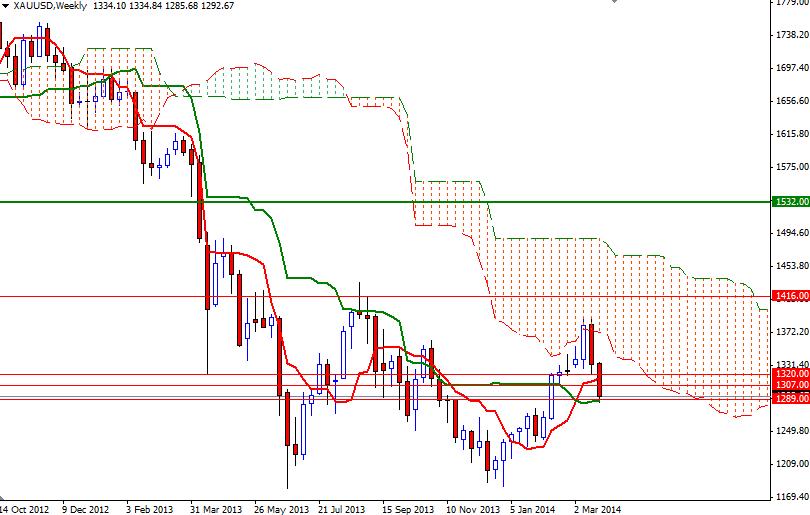

From a purely technical point of view, I think the Ichimoku clouds (on the daily chart) just below the current prices will play a significant role. If the pair finds some support and pulls itself out of the bears' grip, it is likely that we will see the market testing the first resistance level at 1300.

The bulls will need to break through the 1307 resistance level before challenging the bears in the 1316 -1320 zone where the bottom of the Ichimoku cloud currently sits on the 4-hour time frame. However, if the American dollar gets a boost from the upcoming fundamentals and prices drop below 1286, we will probably see a bearish continuation and test the critical 1268 level which caused prices to pause or reverse several times in the past. A close below that would open the doors to 1256/2.