Despite Friday’s decline, the XAU/USD pair posted first weekly gain in two weeks as the market formed a temporary floor just above the 1240 level. U.S. data released last week were not as strong as hoped but were more or less in line with market expectations. The pair traded as low as 1245.74 after a report released by the Labor Department showed that the U.S. economy added 217K jobs in September, but recovered some of the losses afterwards.

Large financial institutions and speculators are divided on whether gold is cheap enough to increase investment as signs of an improving U.S. economy continue to play a crucial role on the market sentiment. Friday's data from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold (for the second consecutive week) to 59151 contracts, from 73391 a week earlier.

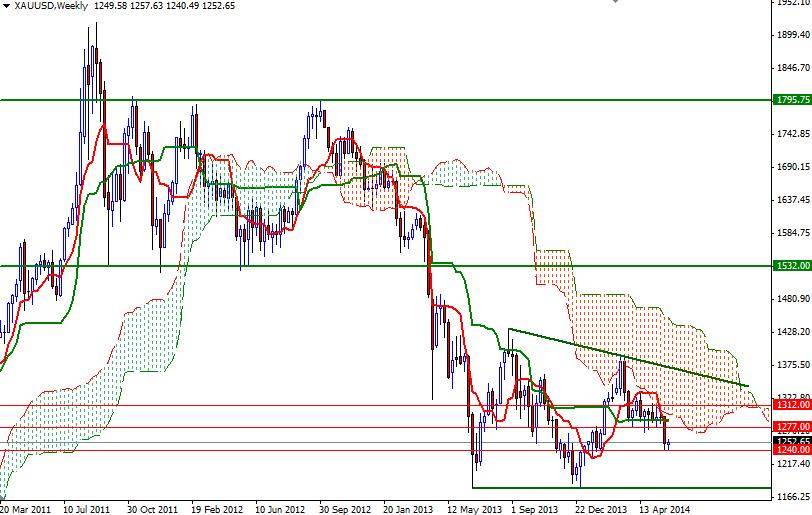

Although I think there is still some room to the upside in the short term, the broader directional bias remains weighted to the downside. Technically speaking, trading below the Ichimoku clouds on the weekly and daily charts suggest that there is more strength and volume behind the bears. Until the outlook changes, any rally in gold will be an invitation to sell at higher prices. If the bears take the rains and drag prices back below the 1240 level, the next levels to pay attention will be 1235 and 1227. The bulls will need to climb and hold the market above the 1256/60 resistance area, if they intend to charge. In that case, expect to see resistance at 1268 and 1277.