By: Ben Myers

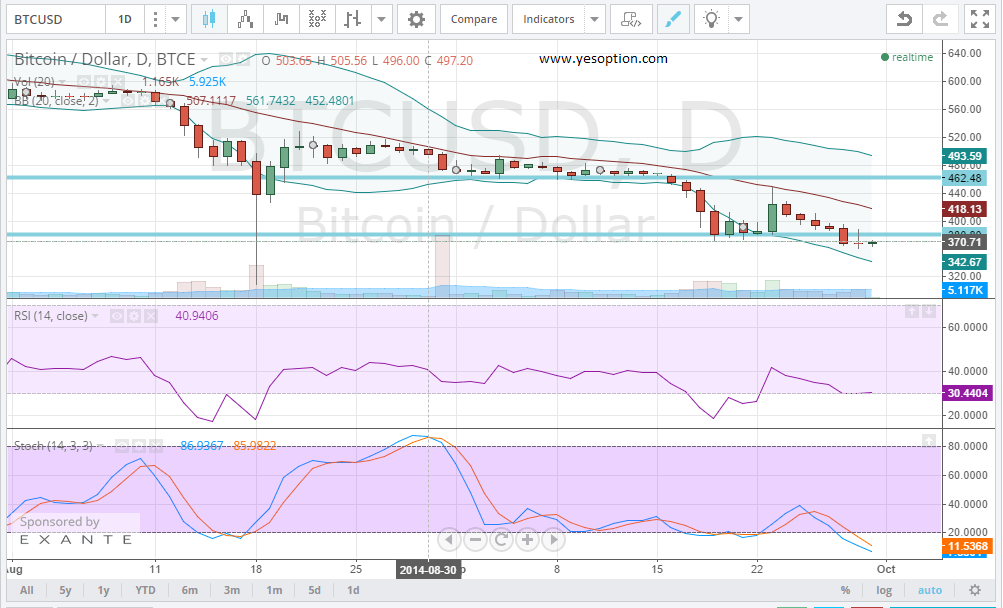

BTC/USD continued to remain in a strong downtrend in yesterday’s trading session. The digital currency post breaking below the all-important support zone at $380 has been unable to climb above the mentioned level. The BTC/USD continues to remain below important daily moving averages. The resistance for the BTC/USD remains near the $380 level and the support now shifts down to levels of $342 on the downside.

The stochastic oscillators for the digital currency have given a fresh sell signal and also have formed a lower high which is a divergence signal. The relative strength index has shown some signs strength but only a close above the aforementioned resistance zone at $380 would provide any confidence to the traders and investors.

Boston based Circle Internet Services has opened its invite only Bitcoin financial service to everyone. This is being seen as a huge positive for the digital currency in the near term. The development means that anyone in the US can now link their bank accounts with the Bitcoin services provided by Circle and start using the Digital currency.

There are no charges for fund transfers between accounts. This step is being seen as a massive game changer by the industry, and also the first step towards incorporating the BTC/USD into mainstream usage. In other not so exciting news, a pub in Dublin which had started accepting Bitcoin as a form of payment from patrons has stopped using the currency citing the legality involved with regards to the use of Bitcoin ATMs’. The Central Bank in Ireland said that it does not recognise Bitcoin as a legal form of currency.

Actionable Insight:

Long BTC/USD above $380 with a stop loss below $360 for a short term target at $400

Short BTC/USD at current levels for short term target at $340 with stop loss of $379