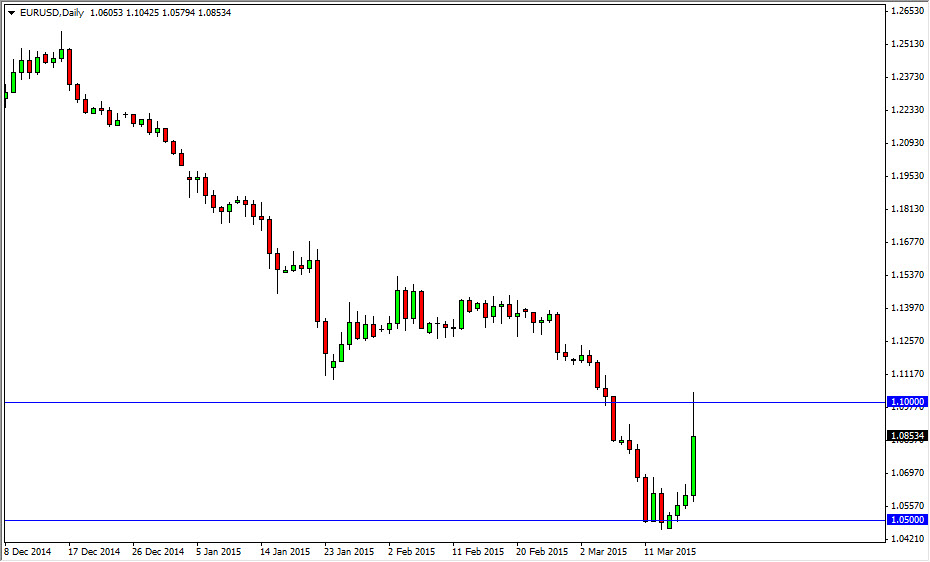

The EUR/USD pair broke much higher during the course of the session on Wednesday, as the market slammed into the 1.10 level. This was basically because the Federal Reserve suggested that perhaps interest rates will remain extraordinarily low longer than anticipated in the United States. Because of this, perhaps the US dollar isn’t going to go much higher in general, because the Euro has been so beaten up that perhaps a rally is in order.

However, let us not forget that the European Union continues to struggle overall though, and even though we’ve seen so much strength during the session on Wednesday, the truth of the matter is that the downtrend is still very much in effect. Ultimately, this 1.10 level should be an area that sellers could come back into play. After all, we did pullback towards the end of the day so we will have to wait to see whether or not we can break out.

Selling rallies still

I still look at this market is one that you can sell rallies on, simply because there’s so much in the way of bearish pressure. Yes, we took off during the session on Wednesday, but ultimately there is still quite a bit of resistance just above to the 1.15 level. Ultimately, this market needs to break above at least the 1.15 level for me to consider buying as I believe that this market continues to show significant downward pressure.

The candle of course is very bullish though for the Wednesday session, so it does look like there is a chance to break out. Because of this, I am actually sitting on the sidelines in the meantime as I have to wait to see what happens next. I believe that the volatility could continue for another 24 hours or so, forcing me to wait for a daily close in order to make a trading decision. Quite frankly, I have absolutely no interest in risking money in a market that could take it away from me fairly quickly. Sometimes, you need to step aside.