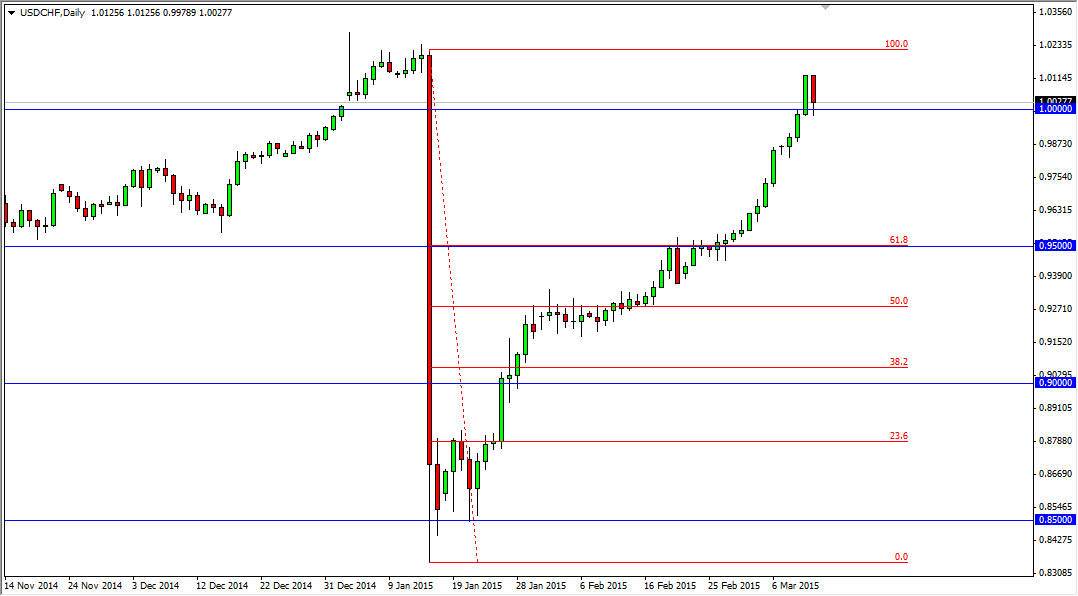

The USD/CHF pair fell during the session on Thursday, testing the parity level for support. We did in fact find it there, which of course is what you would anticipate based upon basic technical analysis. The fact that we found support there in the market bounced slightly suggests to me that we are in fact heading to the 1.02 level, which of course was the start of the meltdown in this pair that was precipitated buying the Swiss National Bank of abandoning its currency peg against the Euro at 1.20 several weeks ago. With that, we will have essentially done the “round-trip”, and now I feel that once we get above there we can continue to go even higher. After all, the US dollar is the favored currency around the world, and while the Swiss franc is considered to be a safety currency, the Swiss have a huge problem.

Bad neighbors

The Swiss have a huge problem in the sense that they send 85% of their exports into the European Union. Because of that, you have to think that it’s starting to hurt the economy in Switzerland as the main customer is broke and is certainly struggling. On top of that, in a deflationary setting, European customers will look for cheaper and cheaper prices - which is a problem for Swiss exporters. That of course works against the value of the Swiss franc simply because the economy is probably going to sputter.

Any pullback at this point in time for me is a buying opportunity. Even if parity gives way, I think the 0.95 level will be the floor as well. I don’t have a scenario in which I sell this pair anymore, as we have certainly just broken out to the upside and smashed all but the last vestiges of resistance in this market. With that being said, I buy and buy again, looking for dips as potential value regarding the US dollar.