EUR/USD

The euro had a fairly volatile session against the US dollar during the Thursday trading hours, but as you can see the 1.10 level offered enough support to keep the market barely above it. This is the bottom of a larger consolidation area, which extends all the way to the 1.12 level. In other words, we continue to bounce around the same area but I do feel that the downward pressure is starting to pick up a little bit. After all, we broke down below the bottom of the hammer from the Wednesday session at one point during the day. I think that eventually we will break down but it won’t be an easy trade to take immediately. After all, we should have quite a bit of noise overall, and with that being the case I feel that this market will be noisy, but negative as the European Union still house quite a few questions and I think that the US dollar gets a bit of a safety bid. With this, I’m looking to sell short-term rallies for short-term trades.

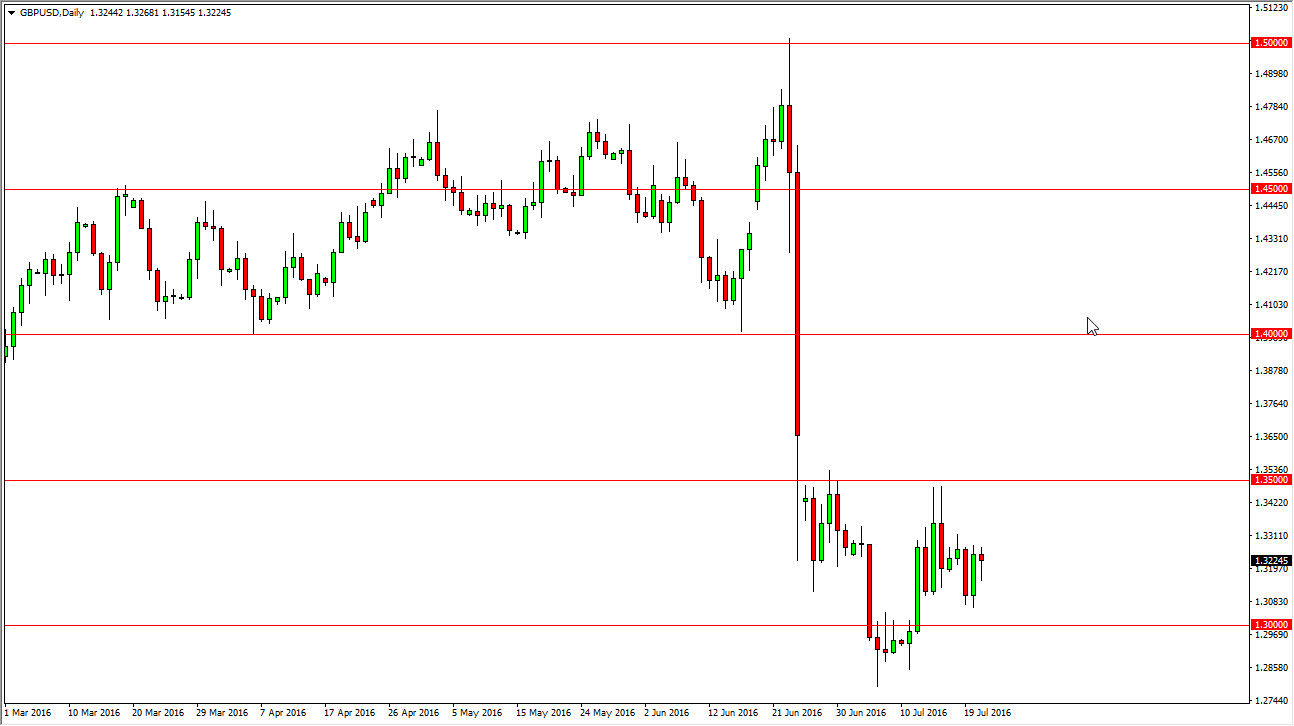

GBP/USD

The GBP/USD pair fell initially during the course of the day, turning back around to form a hammer. Ultimately, this market looks as if it is trying to go higher but I recognize that the 1.35 level above is massively resistive, and that resistance extends all the way to the 1.3650 region which was where the gap formed. Ultimately, this is a market that should sooner or later see quite a bit of exhaustion. With this, the market will eventually offer a selling opportunity as far as I can see, especially considering that the British pound is getting beat up worldwide due to the vote to leave the European Union. I believe that the US dollar and its safety features will continue to favor the downside in this market. I recognize that we can go downward forever, so this bounce is very likely going to eventually offer selling opportunities.