S&P 500

The S&P 500 took off to the upside during the course of the session on Friday in reaction to the stronger than anticipated jobs number. This should continue to be a bullish market in my estimation, because we have been so bullish previously, and now that we have a stronger jobs number, it makes sense that people will be willing to go long of this market. On top of that, now that we have made a fresh, new high at one point during the day, it shows that we are starting to break through a significant amount of resistance. I believe now that the 2100 level below should be a supportive level, and as a result I believe it is essentially the “floor.” I have no interest in selling, and I believe also that we are starting to reach into a “buy-and-hold” type of market.

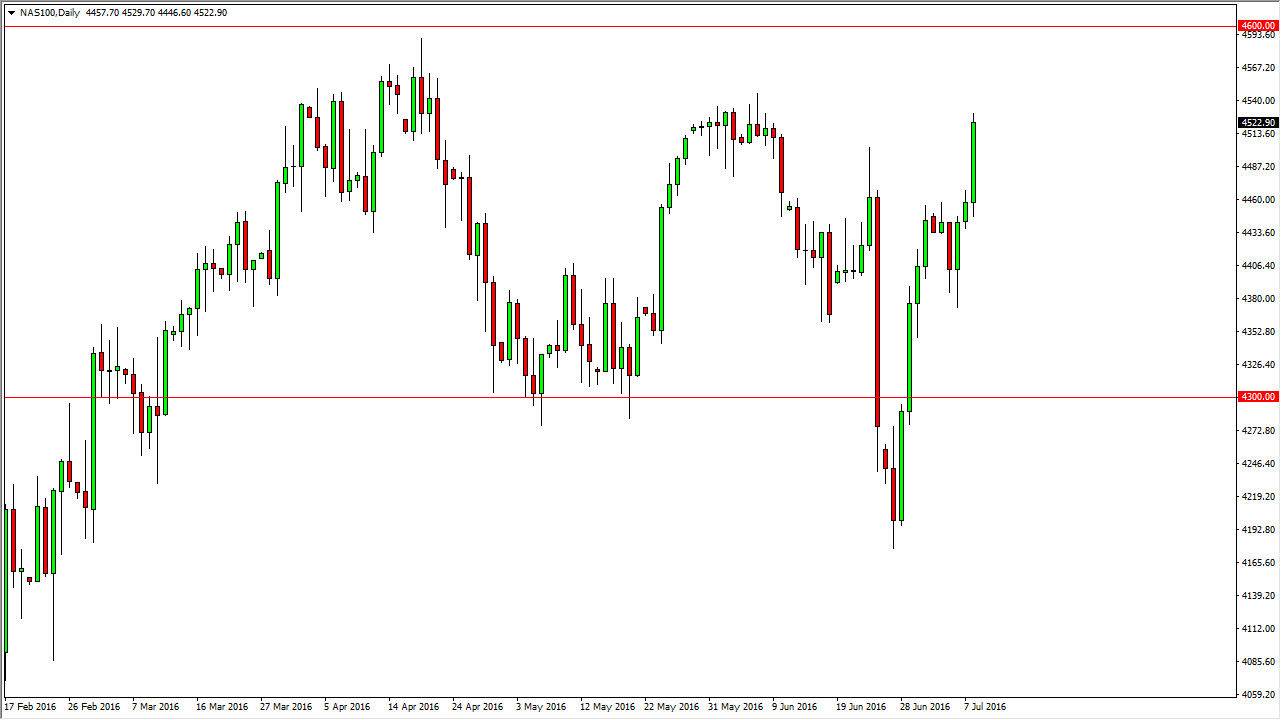

NASDAQ 100

The NASDAQ 100 and took off to the upside as well, and in fact made a “higher high” finally, and as a result it looks like the NASDAQ 100 should continue to go even higher as we closed so close to the top of the range for the day. The NASDAQ 100 has been lagging the S&P 500 and the Dow Jones 30 lately, so it now looks as if we are starting to play “catch-up.”

The 4600 level above is my target now, but I do recognize we may pull back a little bit in order to build up momentum. With this, I believe that it’s only a matter of time before the market find buyers every time we pullback, and I believe that the NASDAQ 100 will simply follow the rest of the indices in America. If we break above the 4600 level, I believe that the market becomes more of a “buy-and-hold” type of situation. The 4400 level below should be massively supportive in my estimation.