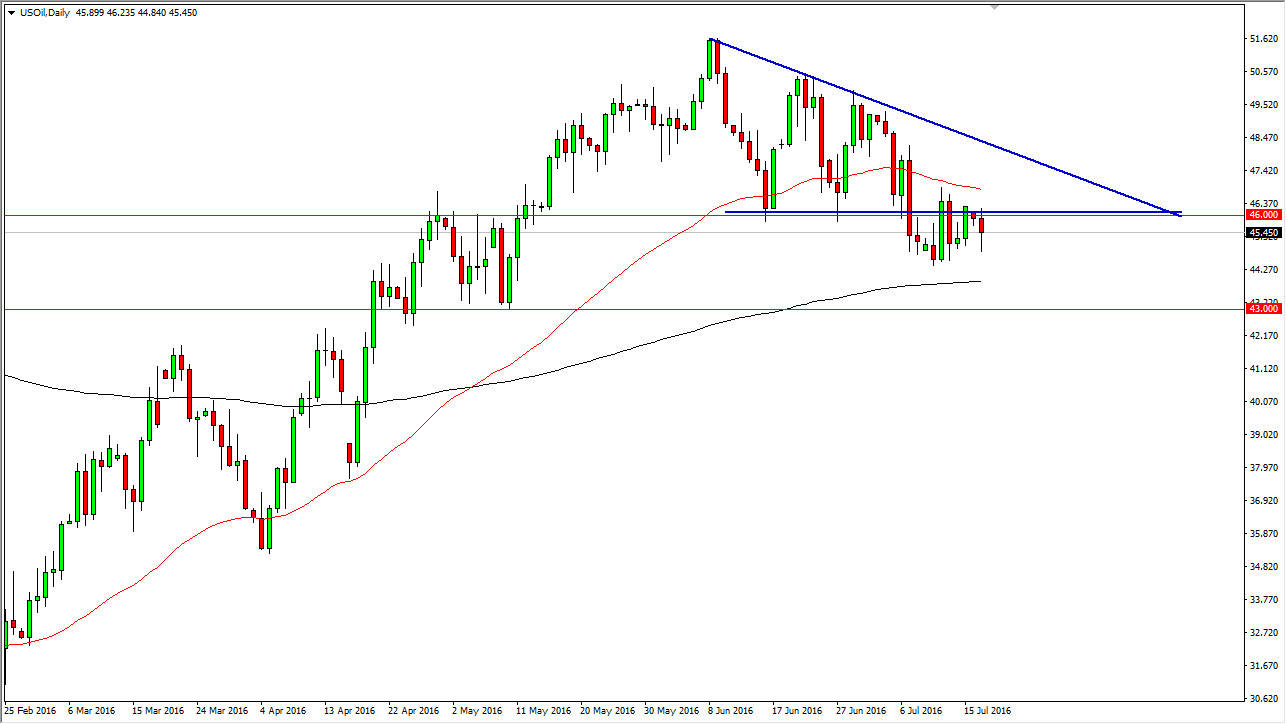

WTI Crude Oil

The WTI Crude Oil markets fell slightly during the course of the day on Monday, as we continue to respect the bottom of the previous descending triangle. The 50 day exponential moving average above continues to offer dynamic resistance as well, but at the same time there is a certain amount of support at the 200 day exponential moving average. I believe that we are still going to reach down towards the $43 level, but it isn’t necessarily going to be some type of meltdown. I believe that short-term rallies the show signs of exhaustion or selling opportunities, just as a break down below the $45 level would be. I have no interest in buying this market at the moment, as it looks like we are to simply going to roll over.

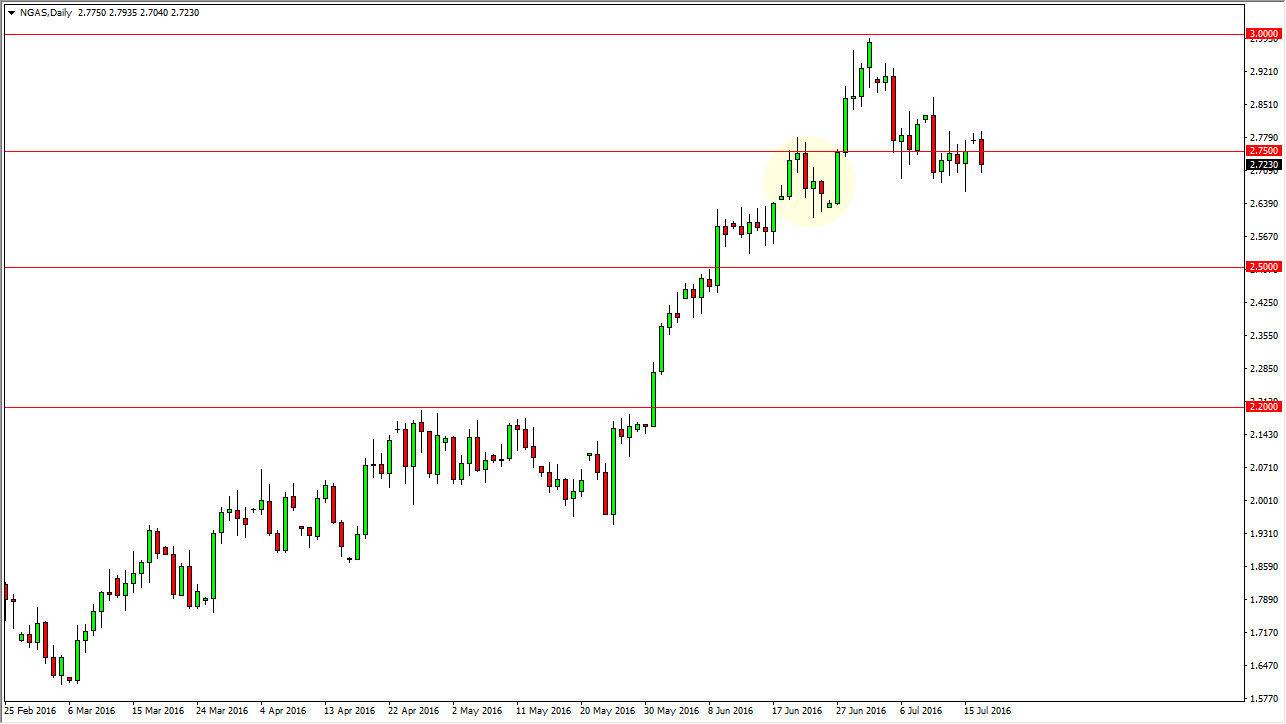

Natural Gas

The natural gas markets fell during the course of the day on Monday, testing support that we’ve seen at the $2.70 level. This market of course has quite a bit of noise in this general vicinity, so therefore I feel that we will probably trying to test that area yet again, and with that we should continue to see selling. However, this very well could lead to buying in the short-term as well. I believe that we are simply going to bounce around in this general vicinity as we try to figure out where to go next. This is a longer-term uptrend anyways, but the $3 level above is massively resistive.

After all, it may take a bit of momentum building in order to break above there, so the recent volatility makes a lot of sense. After all, we will need to attract quite a bit of buying pressure in order to go higher. If we get some type of break down below the $2.50 level, then it would be a selling opportunity from a longer-term perspective. Until then though, I expect we get a lot of noise back and forth with a slightly upward bias.