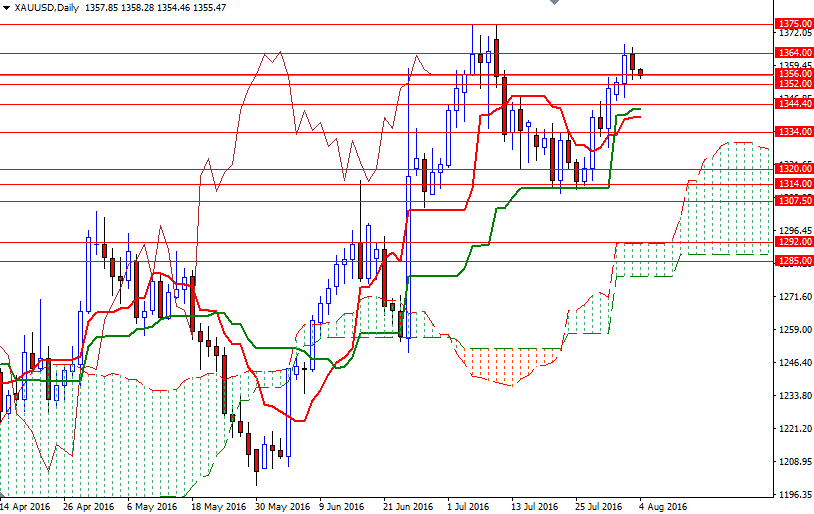

Gold prices rose for the first time in four sessions and settled at $1357.97 per ounce as a rebound in the dollar and gains in stocks dented investors' appetite for the precious metal. The failure to sustain prices above the $1364 level also weighed on the market. In economic news, the ADP Research Institute reported that US private payrolls grew by 179K in July beating the forecast of 171K. Gold prices edged down in Asian trade, testing the support at around the $1356 level at the moment.

Despite the positive medium-term outlook, short-term charts show signs of exhaustion - the XAU/USD pair trading below the Ichimoku clouds on the 1-hour and 30-minute charts and Tenkan-sen (nine-period moving average, red line) and the Kijun-sen (twenty six-period moving average, green line) are negatively aligned. If the bulls fail to defend this camp, then the 1352 level will be the next stop. A break down below 1352 could increase the downward pressure and pave the way for a test of the 1347.50-1344 area where the 4-hourly Kijun-sen sits. Closing below 1344 would suggest that the XAU/USD pair might continue to retreat towards the 4-hourly cloud.

To the upside the first challenge will be waiting the bulls at the aforementioned resistance around the 1364 level. If XAU/USD pass through this barrier and climbs above Tuesday's high, then expect a push up towards the 1371-1368.50 zone. Once above that, the market will be aiming for the key resistance at 1375. Since this level prevented prices from going higher last month, only a close above this barrier could provide the bulls the extra fuel they need to challenge 1383.