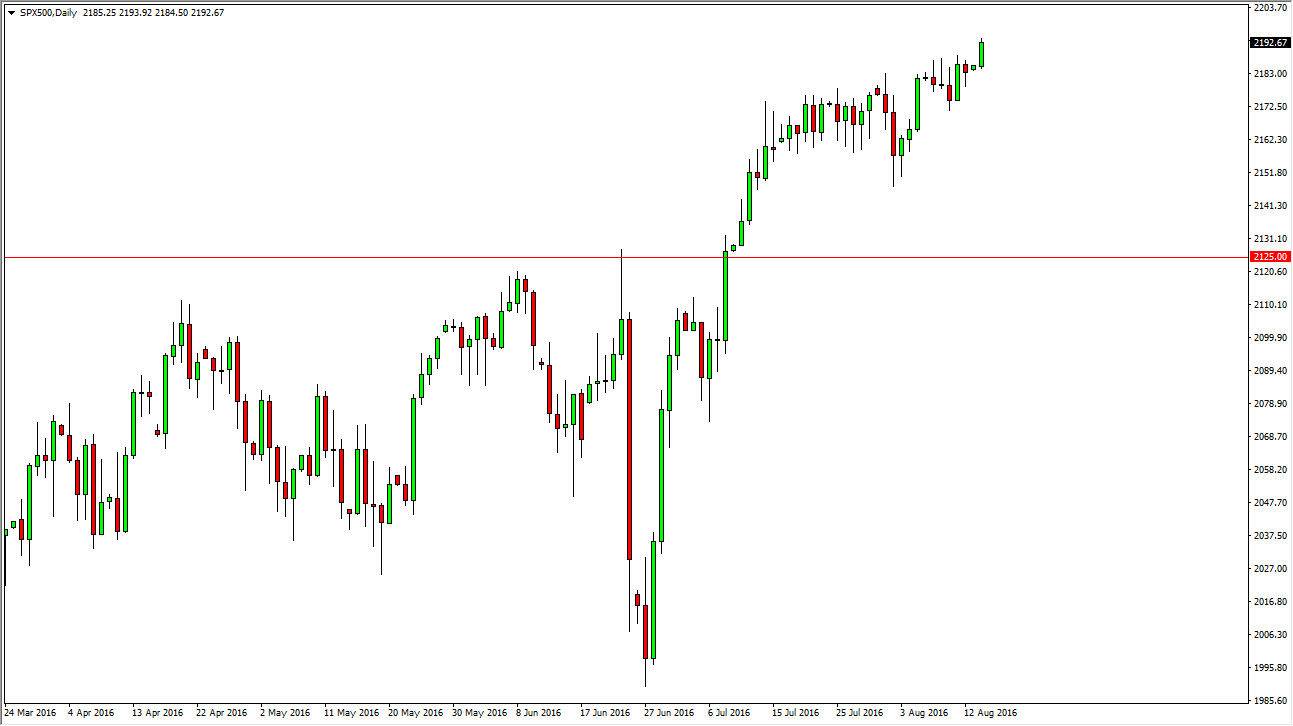

S&P 500

The S&P 500 rallied during the course of the session on Monday, as we continue to see buyers step into this marketplace. The 2200 level of course is a large round number that will attract interest by traders around the world. I believe that as we pullback we should find plenty of buyers below, as we have seen such a nice uptrend. I have no interest in selling this market, because quite frankly the US indices in general look very healthy, and of course will continue to attract money in a very low interest-rate global environment. On top of that, the US economy is considered to be one of the stronger economies out there, so it makes sense that the buyers continue to take advantage of value when it appears.

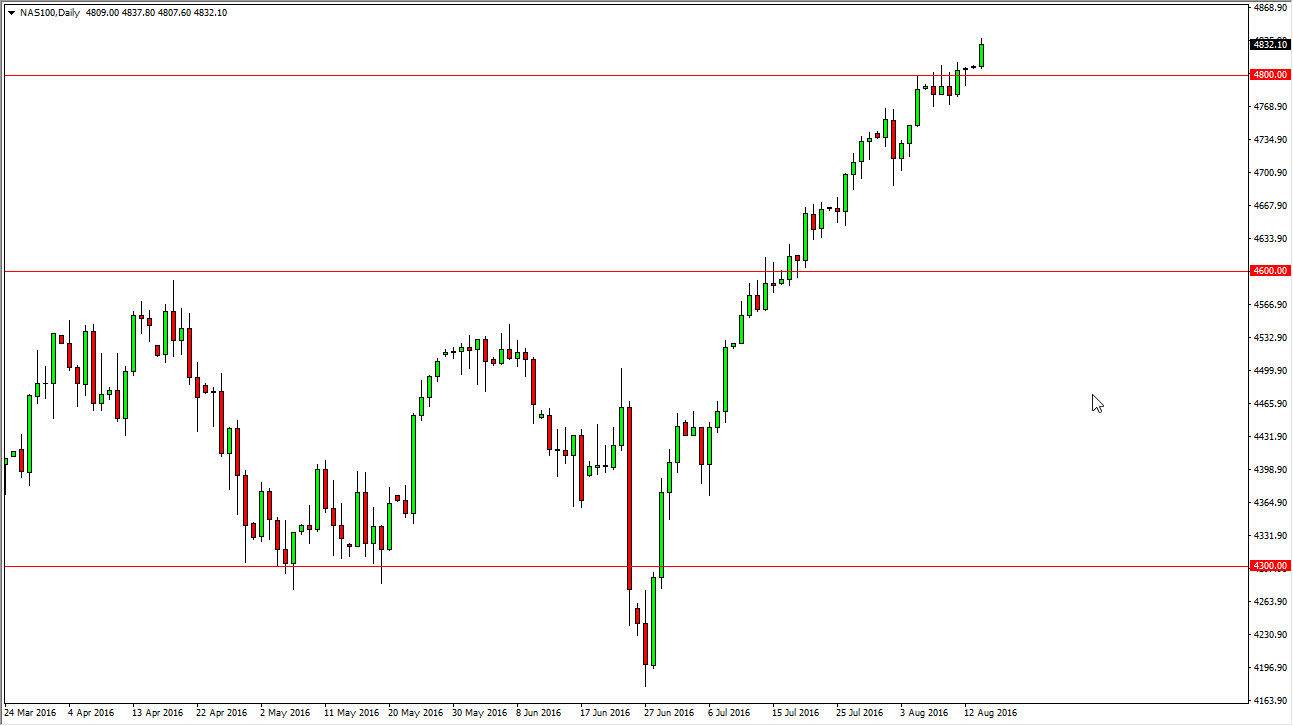

NASDAQ 100

The NASDAQ 100 broke out to the upside during the course of the day on Monday, as we are clear of the 4800 level. I believe that this market is eventually going to try to reach towards find thousand given enough time, but I think that there would also be plenty of pullbacks between here and there that we can pay attention to and use as “value” in this market as we should continue to go higher. I have no interest in selling, and I believe that there is a significant amount of support just below at the 4800 level, which could very well offer a bit of a “floor” in this market.

As long as interest rates are almost nothing, it makes sense that the NASDAQ 100 continues to go higher as it is almost impossible to find any type of rate of return without taking risk going forward. I believe that pullbacks will continue to be bought time and time again as the market certainly has been in a very nice and steady uptrend. I have no interest whatsoever in selling.