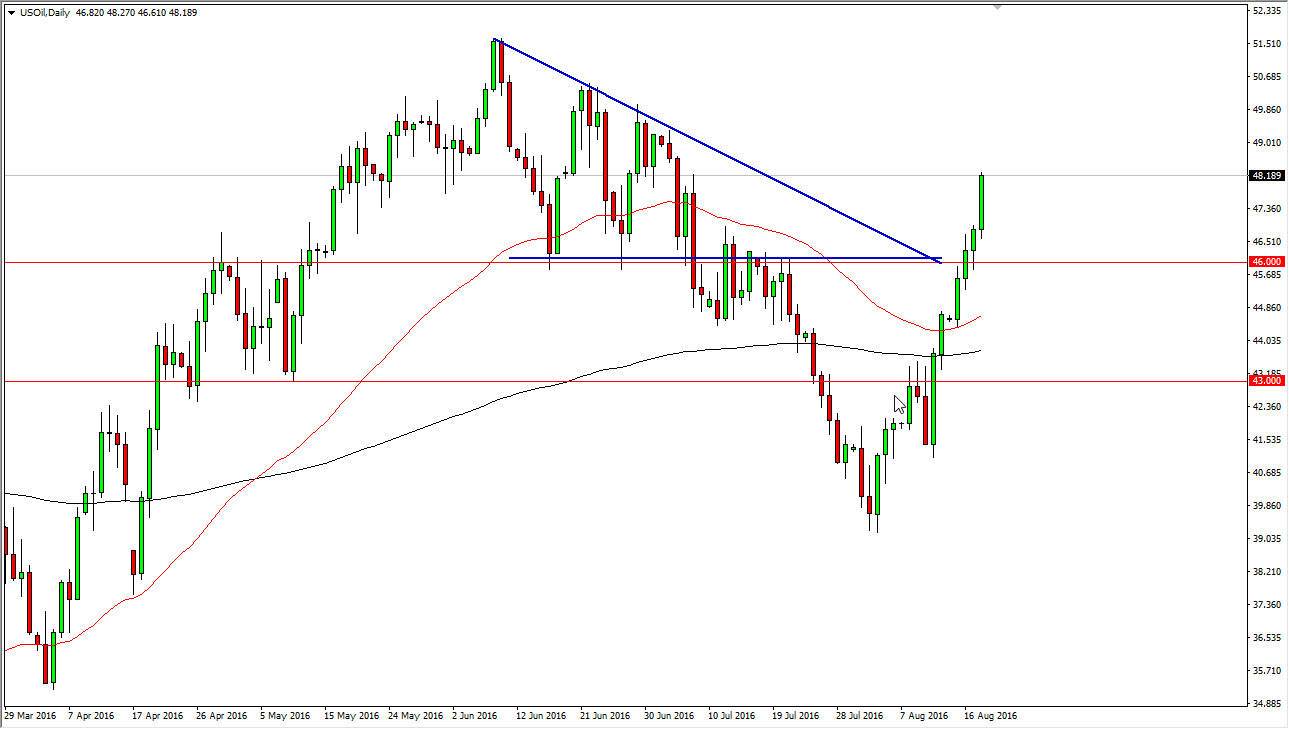

WTI Crude Oil

The WTI Crude Oil market broke higher during the course of the day on Thursday, as we continue to see quite a bit of bullish pressure. In fact, we broke above the $48 level and that of course is a large, round, psychologically significant handle. We have clearly don’t quite a bit of pressure to the upside in this market and I feel that we are going to reach towards the $50 level now. The $46 level below should be somewhat supportive, at least in the meantime. However, I do have questions about the longer-term viability of this rally, because it is held upon the idea of less drilling and 2017, but quite frankly I don’t necessarily think we are going to have the demand to make this move stick. In the short-term though, we should go higher.

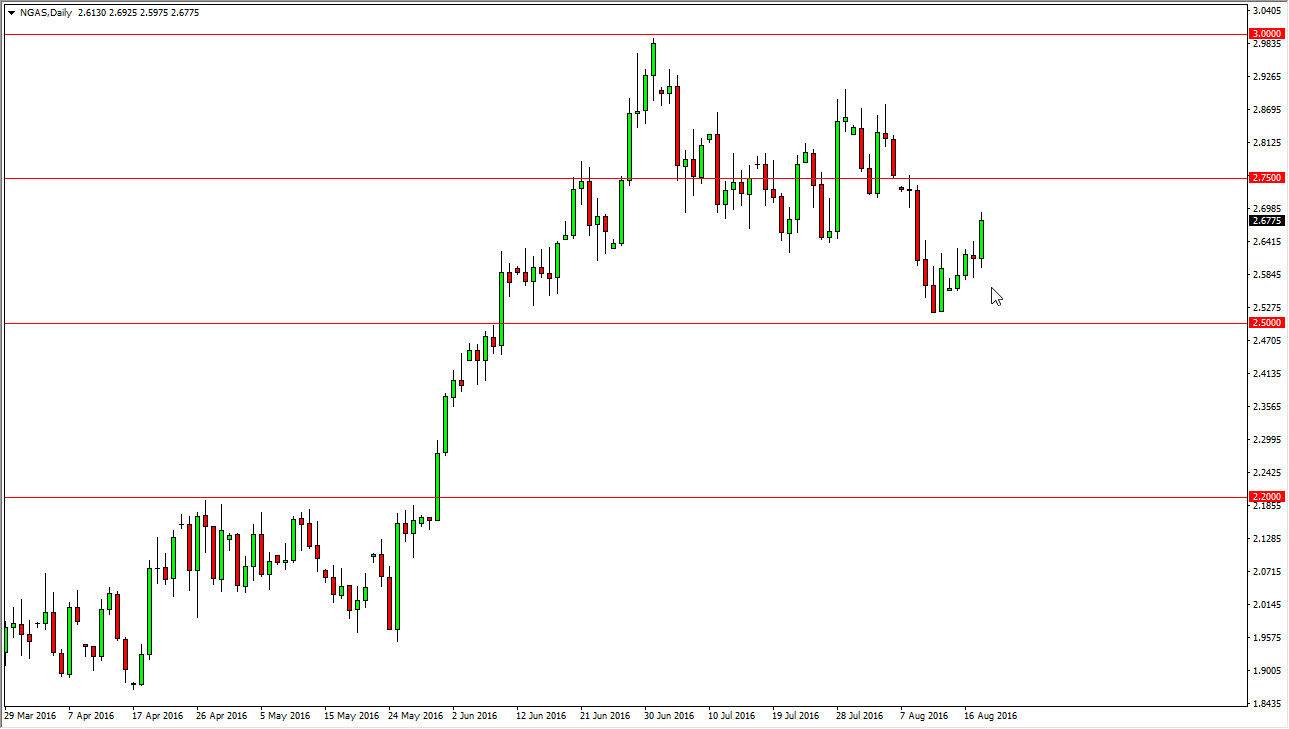

Natural Gas

Natural gas markets rose during the course of the session on Thursday as well, breaking above the $2.60 level. The $2.70 level above is a little bit psychologically significant, but the thing that I’m paying the most attention to is the fact that we have so much in the way of noise above. Any type of exhaustive candle in that general vicinity should be an opportunity to start selling again, and at this point time I don’t do silly want to buy this market, because it is going into the meat of the consolidation area that is based around the $2.75 level that we had formed recently.

With this, I think it’s going to be easier to sell exhaustive candle once it appears, but until then I simply cannot risk money into this market as it has been so volatile and of course has broken down recently. This of course is a positive sign so far, but there so much in the way of noise that I think it’s just going to be easier to trade other commodities this point in time.