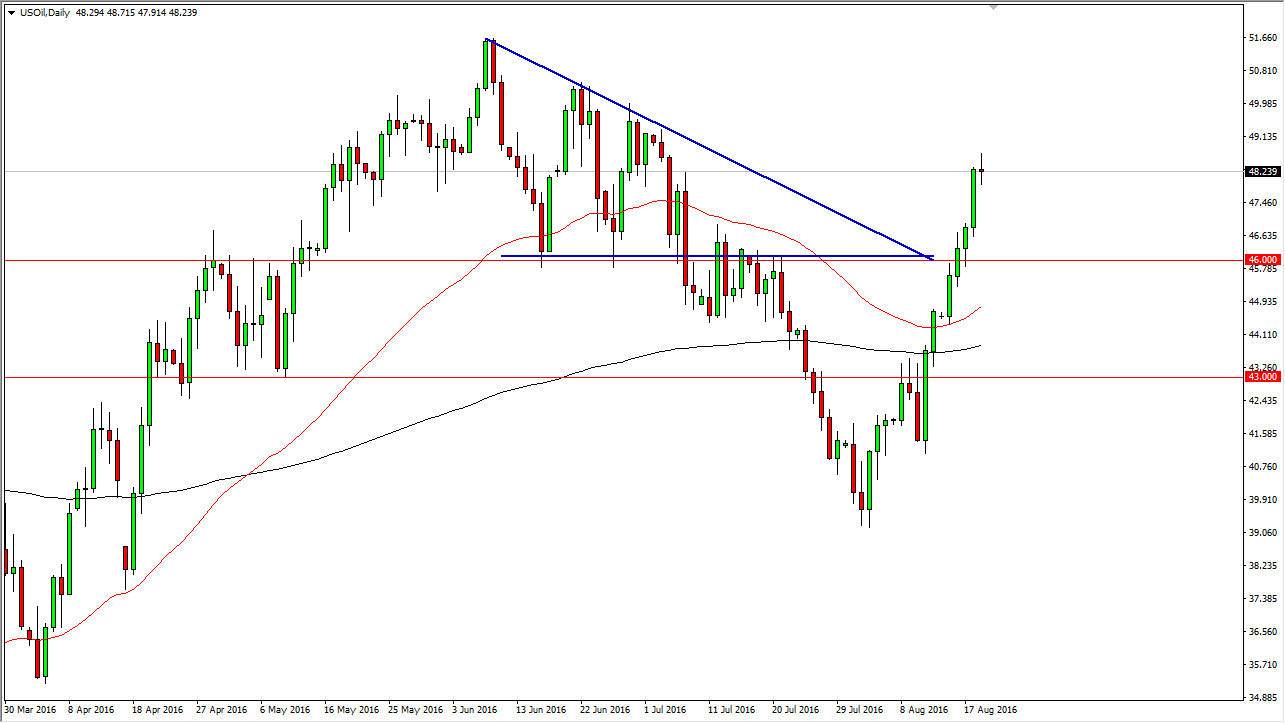

WTI Crude Oil

The WTI Crude Oil market went back and forth during the course of the day on Friday, ultimately forming a fairly neutral candle. That being the case, I think we are starting to run out of momentum at the moment, but given enough time I think that the buyers will return eventually. With this being the case, I’m simply going to let this market pullback and try to find support that we can take advantage of. I believe that the $46 level below is supportive, and should continue to offer a bit of a “floor” in this market. I have no interest in selling at this point even though I fully anticipate that the market is going to drop. At this point, there simply far too much in the way of bullish pressure to step in front of it.

Natural Gas

Natural gas markets fell during the course of the day on Friday, as we continue to see bearishness in this market. I believe that we are going to reach towards the $2.50 level, and there we will determine whether or not we can continue the longer-term move lower. At this point, I believe that it is probably easier to sell this market on short-term rallies that show signs of exhaustion than anything else. After all, the temperatures are starting to cool down a little bit in the northeastern part of the United States, so less natural gas is being used for air-conditioning. With that being the case, I feel that the markets will continue to offer a bit of negativity, but we have seen such a bullish move higher over the last several months that it is going to be a fight going lower. I continue to sell short-term rallies that show signs of exhaustion. I have no interest in buying this market, I see far too much in the way of resistance above.