WTI Crude Oil

The WTI Crude Oil market fell significantly during the course of the session on Wednesday, as the Crude Oil Inventories number came out much more bearish than anticipated, as demand seems to be slipping a bit. Because of this, the market broke down below the $46 level, and then eventually the $45 level. Ultimately, the market looks like it’s going to reach down to the $43 level. Any rally at this point in time on a short-term chart is likely to be prone to exhaustion, and at that point in time we should see sellers jumping into the market as the bearish trend should continue. This will be especially true once the volume comes back into the market and therefore I think that the sellers will return given enough time. Pay attention to the jobs number though, because the Friday session could be very influential as well.

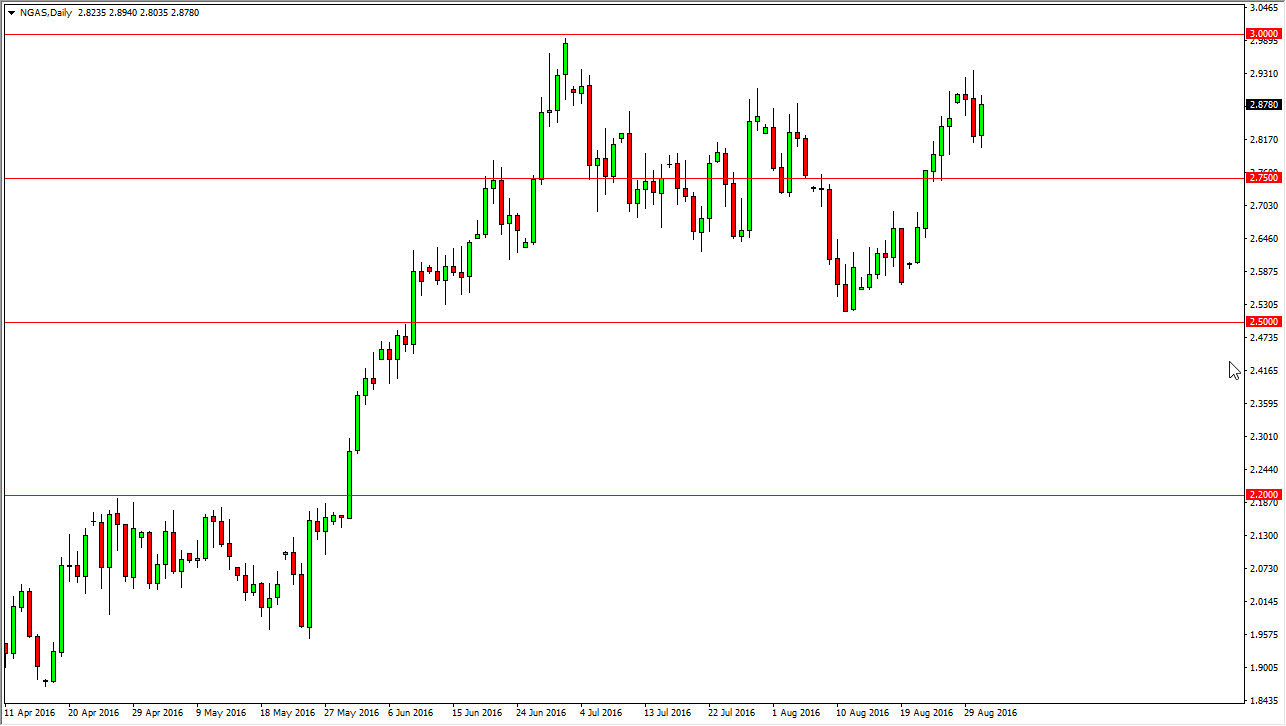

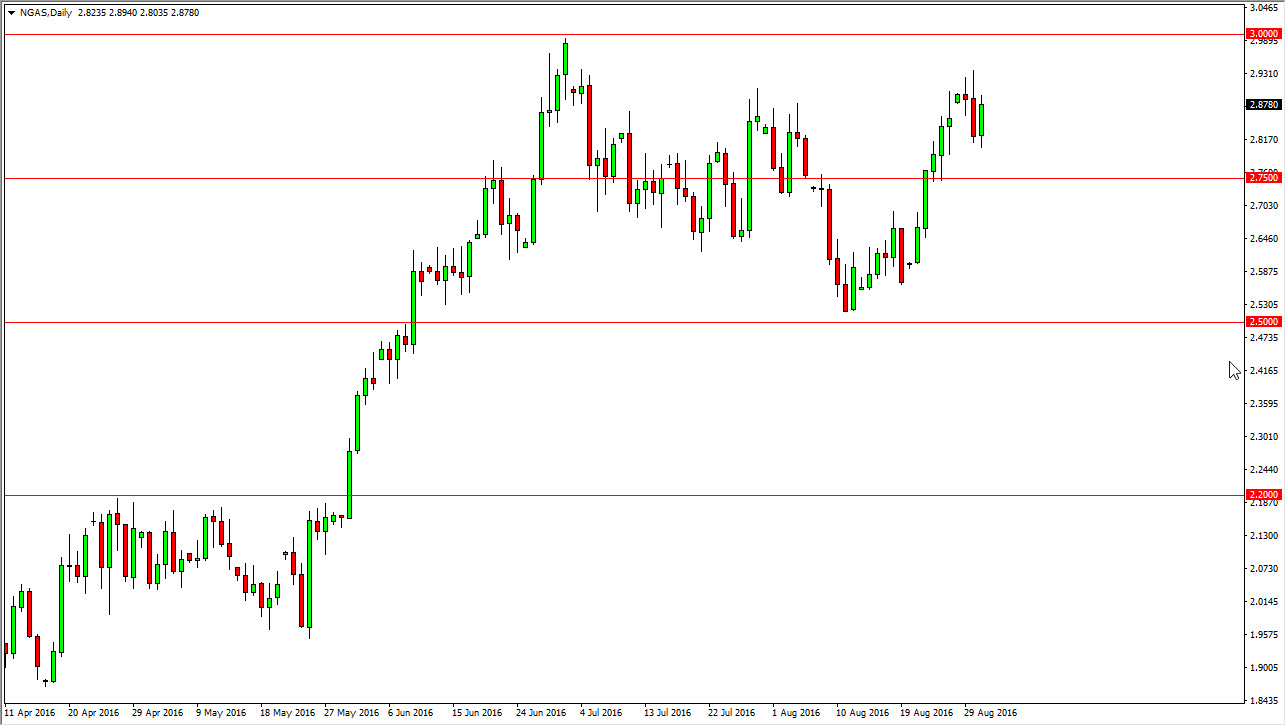

Natural Gas

The natural gas markets bounced significantly during the course of the session on Wednesday, as we continue to grind back and forth. Quite frankly, this is a market that looks like it is ready to consolidate and trying to test the resistance barrier that starts from the $2.90 level, and extends all the way to the $3.00 level. With that being the case, I think that sooner or later we will find an exhaustive candle that we can sell, but at this point it’s not quite ready to do so yet. I think given enough time we will get the candle that’s needed. This is also likely to be a market that will have to wait for the nonfarm numbers coming out on Friday to get a little bit more momentum, but at this point in time I think it’s probably best to simply sit on the sidelines and wait to see what happens next.