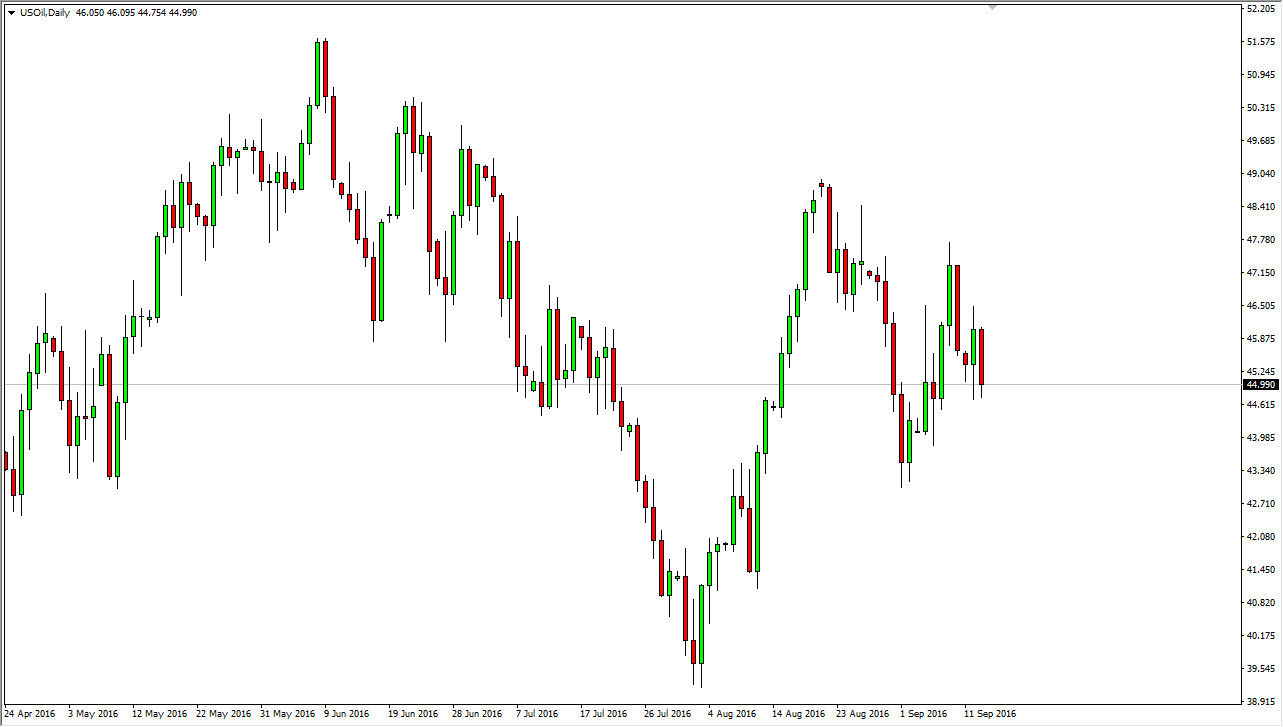

WTI Crude Oil

The WTI Crude Oil market fell a bit during the course of the day on Tuesday, as we continue to consolidate overall. I believe that this market will perhaps get some type of movement in the next 24 hours, as we get the inventory numbers coming out of United States. In the meantime, I will probably wait to see what that reaction will be in order to place my next trade, because I see quite a bit of noise just below, but I can say the same thing about the area just above. Ultimately, this is a market that continues offer quite a bit of volatility so therefore we are going to need to see some type of impulsive candle in order to get involved.

Natural Gas

The natural gas markets initially tried to rally but then turn right back around to form a shooting star. The shooting star of course is very negative, and there is an area above the $2.90 level that extends all the way to the $3.00 level, which of course has a significant amount of psychological importance. With this being the case, I feel that it’s only a matter of time before the sellers get involved again and push this market lower. This is a market that continues to show quite a bit of negativity above, and I believe that the area is all the way to at least $3, but quite frankly it’s likely that if we break above there that would be a massive change in the overall momentum. At this point time though, I believe that a break down below the bottom of the shooting star would be a nice selling opportunity, as the market should continue to reach back down towards the bottom of the consolidation area that we have been in recently. Ultimately, this is a market that seems a bit overextended.