By: DailyForex.com

WTI Crude Oil

The WTI Crude Oil market initially fell during the course of the session on Thursday, forming a relatively neutral looking candle. In fact, I could even go as far as to say that it is a bit of a hammer where we had seen quite a bit of support, so a bounce could be coming. Quite frankly, I believe that there is a massive amount of resistance above, and sooner or later exhaustion will come back into this marketplace and I would be a seller of it. On the other hand, we could break down below the bottom of the range for the session on Thursday, and if we do I would be a seller at that point as the market should then reach down towards the $40 level below there.

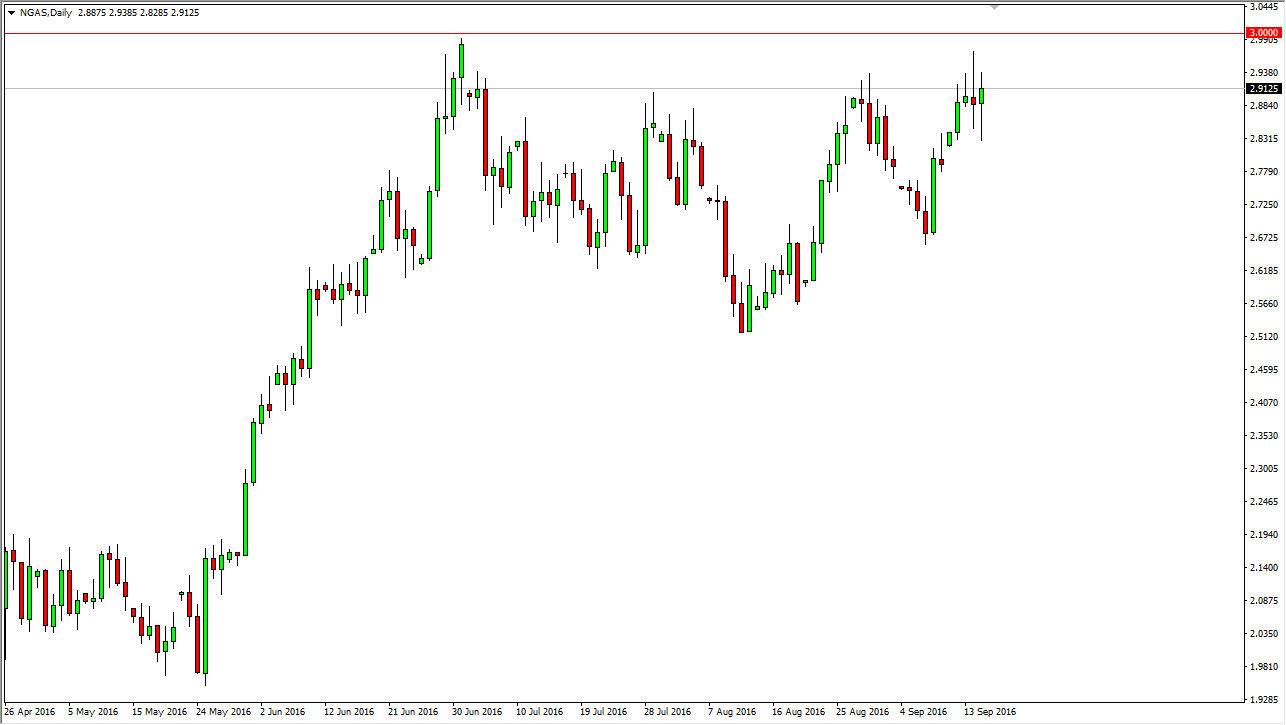

Natural Gas

The natural gas markets fell initially during the course of the session on Thursday, but found enough buyers near the $2.83 level to turn things around and form a nice-looking hammer. This is preceded by a shooting star though, so having said that this is a market that I think is going to continue to bounce around in this general vicinity, and I believe that the $3 level above will continue to be a massive barrier that is going to be very difficult to overcome. If we did, that would be a very strong signal to start buying now.

A break down below the bottom of the hammer of course would be a selling opportunity, but I think there is enough bullish pressure underneath the keep the market afloat. In other words, I think we’re going to see a lot of volatility and short-term choppiness in this market. If you are a short-term trader, the natural gas markets might be a great place to be, but if you are willing to hang on to trade for longer than a very short-term, it’s going to be difficult to trade this market.