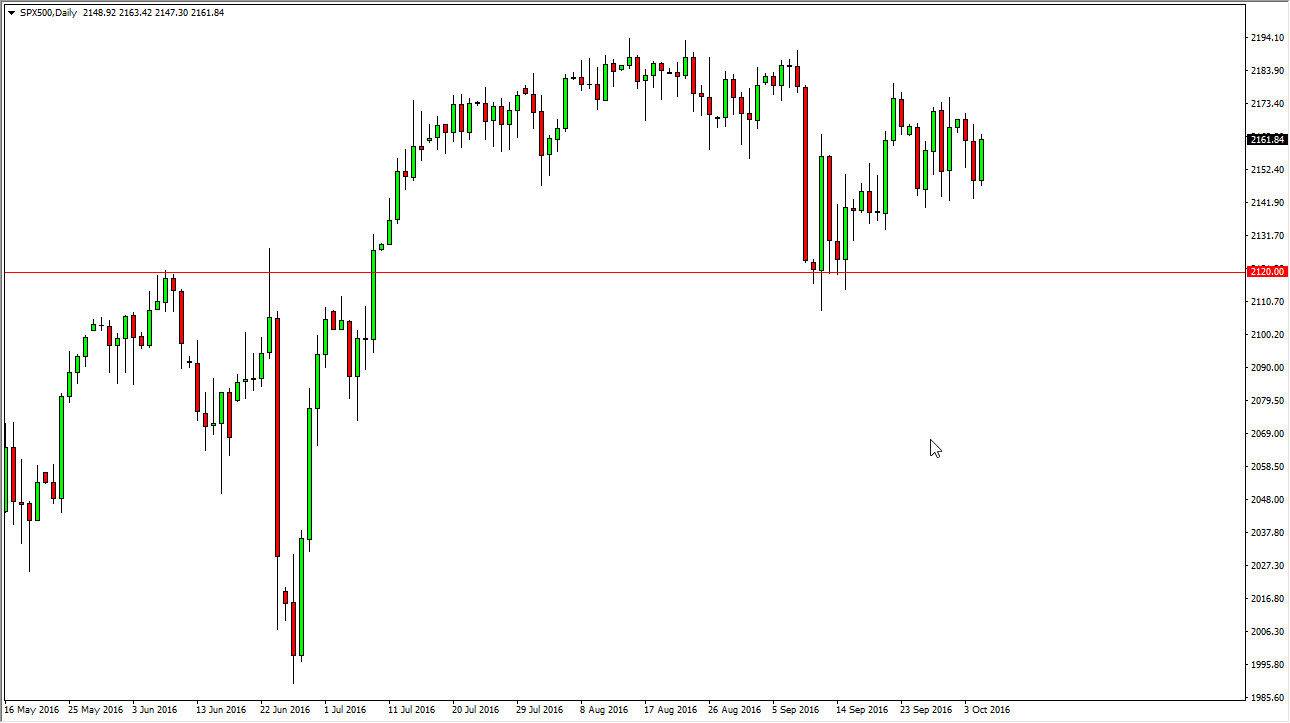

S&P 500

The S&P 500 rallied a bit during the course of the day on Wednesday, as we continue to bang around in this general vicinity. Larger picture, I think that we are trying to form some type of ascending triangle, or perhaps even a symmetrical triangle. I also think that part of the reason for the consolidation is that we are waiting for the jobs number on Friday. Ultimately, I think that we have a bit more of an upward bias longer-term, so pullbacks could offer buying opportunities. If we can break above the top of the ascending triangle, the market should then reach towards the highs yet again. Keep in mind that this is a low interest-rate environment, and that should continue to give a little bit of poignancy to this market.

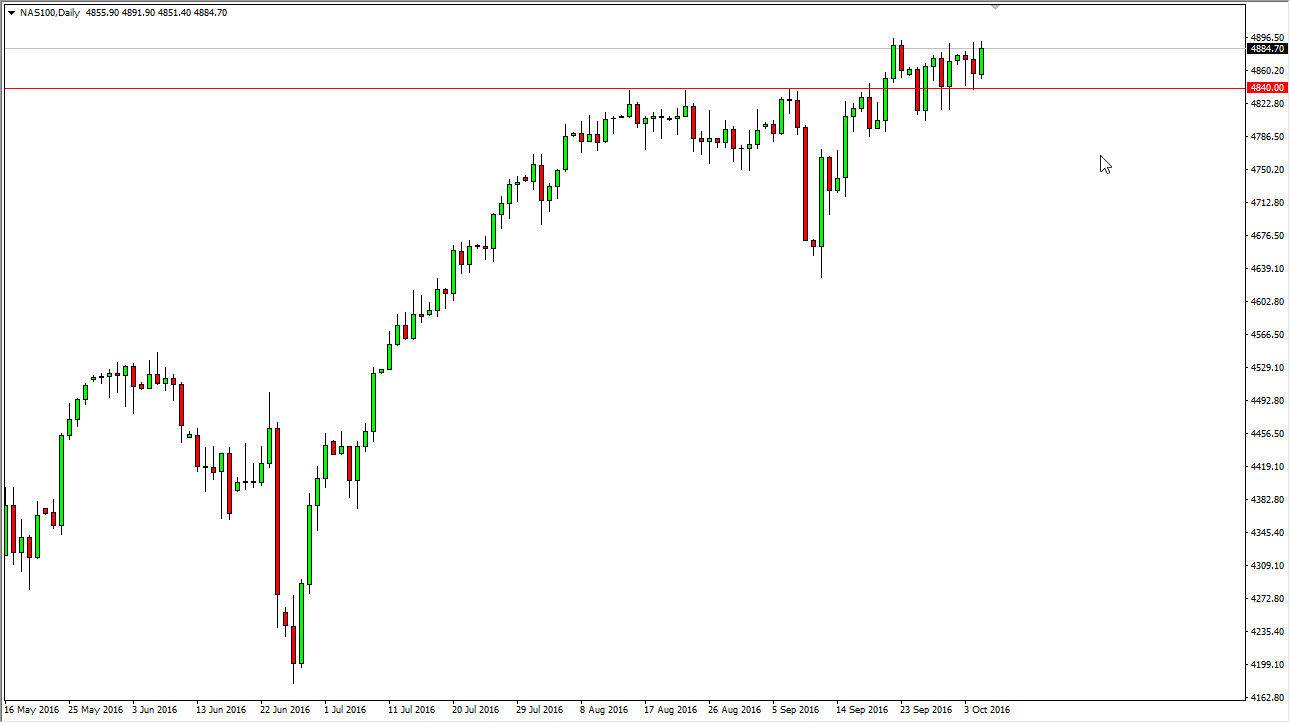

NASDAQ 100

The NASDAQ 100 broke higher during the day on Wednesday, using the 4840 level as support. Because of this, it makes a lot of sense that we will continue to go higher, and I do believe that it is only a matter of time before that happens. I think the pullbacks will continue to find buyers below, and therefore I am a “buy only” type of trader when it comes to the NASDAQ 100 now. Given enough time, I feel that the 5000 level will be targeted, but it will take a while to get there.

Pullbacks will be the way to go, as we can take short-term long positions off of shorter-term charts when we do fall. I have a hard time believing that we won’t reach the 5000 level, because a lot of larger traders will be simply hanging onto all of this bullishness that we have seen. Given enough time, I think we probably even break above the 5000 handle, but that’s not going to happen anytime soon. With this, I remain bullish when it comes to the NASDAQ 100.