Gold logged a second straight weekly loss on Friday as the dollar gained strength after the Federal Reserve increased interest rates and announced it would begin shrinking its holdings of bonds and securities this year. The Federal Reserve also signaled that it was still on track for one more hike in 2017. The more hawkish-than-expected tone of the policy statement provided a lift to the greenback back but a series of disappointing economic data fueled expectations that policy makers would remain cautious.

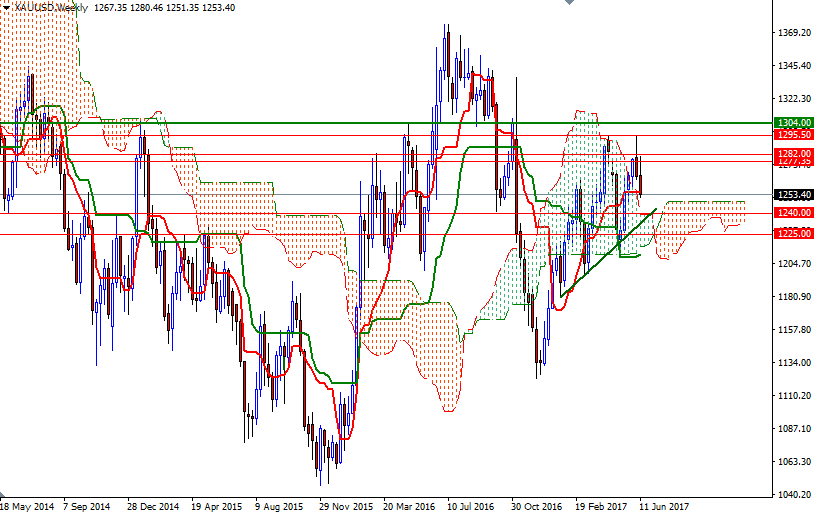

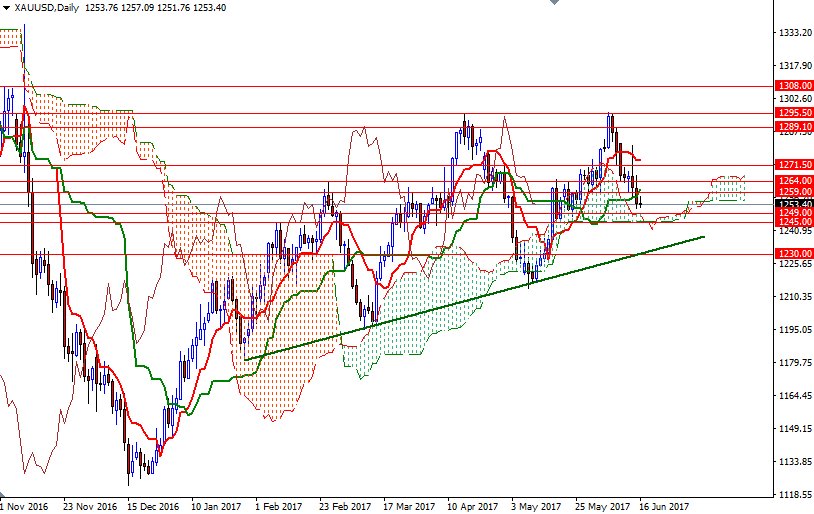

The latest data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 190274 contracts, from 204465 a week earlier. XAU/USD is above the weekly and daily Ichimoku clouds. In addition to that, the Tenkan-Sen (nine-period moving average, red line) and the Kijun-Sen (twenty six-period moving average, green line) are positively aligned, indicating that the bulls have the medium-term technical advantage. The short-term charts, on the other hand, are still bearish, with the market trading below the Ichimoku clouds on the H4 and the H1 time frames. The Chikou-span (closing price plotted 26 periods behind, brown line) also reside below the clouds on both charts.

With these in mind, I think prices will tend to drop further (possibly reach the bullish trend-line on the daily chart) before encountering more serious support. Down below, we have the daily cloud occupying the area between the 1249 and the 1245 levels. If the market drops through 1245, then the 1240/39 area where the top of the weekly cloud sits will be the next stop. The bears will need to demolish this support to make an assault on the critical 1230 level. A daily close 1230 would open up the risk of a move to the 1218/6 zone. To the upside, there are hurdles such as 1260/59 and 1266/4. If the market can climb and hold above 1266, prices may proceed to 1271.50-1269, the bottom of the 4-hourly cloud. Breaking up above the 1271.50 level would signal an extension towards the 1282-1277.50 zone. This is the key resistance for the bulls to capture so that they can challenge the bears on the 1289.10 battlefield.