As expected earlier any gains of the GBP will be a selling opportunity, because the British economic sectors are producing unstable results and always affecting negatively, in addition to the renewed fears of a hard BREXIT.

The GBP/USD settled below support at 1.3000, despite the positive retail sales data from the UK, which was stronger than expected, as the market focused more on the BREXIT fears and the unlikely movement from Bank of England to tighten its monetary policies with further more than expected drop in the British Inflation Data. The pair retreated to the support level at 1.2933 before settling around 1.2970 in the start of Friday’s trading. At the same time, the political worries inside Britain is weakening P.M. May in gaining more support to face the difficult negotiations. Therefore, any gains for the pair are going to be an easy target for the bears at any time if the investors felt the hardness of these negotiations. The expectations of near policy tightness and raising interest rates by BoE, especially after the hawkish statements from the bank’s members, headed by the governor Carny himself, still stands and supports the pound’s gains.

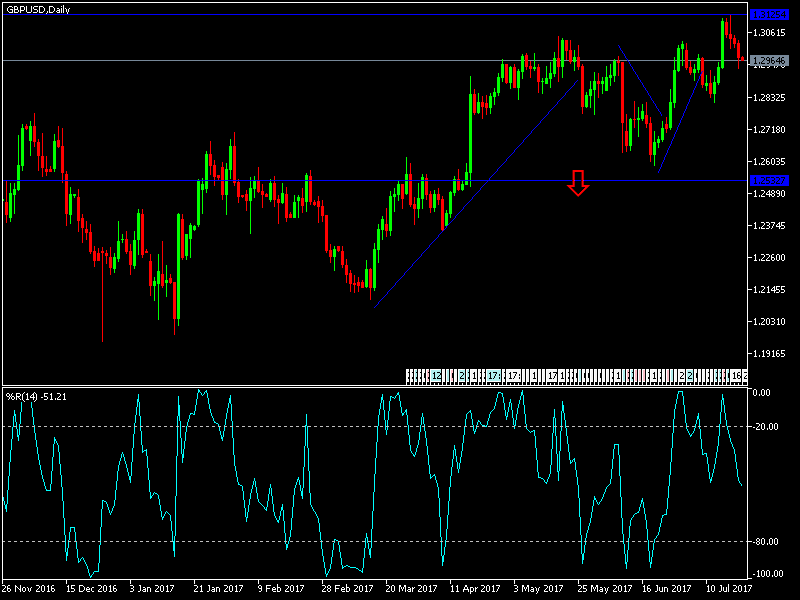

Technically: the GBP/USD will be in relatively volatile ranges on the short and medium run, in light of the Federal Reserve abandoning more hawkish tone. And between increases of statements from BoE regarding more or less hawkish stance, and anything related to the BREXIT negotiations. Investors are seeing a better chance to sell this pair around 1.3100 and above, with nearest targets being 1.2950 and 1.2800, and the latter means a breakthrough of the current upward move of this pair.

On the economic data front: The focus today is going to be on the market reactions toward the latest British economic data and the Fed’s monetary policy expectations, that is with an empty economic agenda of any American or British data.