Natural gas markets continue to look very sluggish, and quite frankly probably will continue to offer selling opportunities every time it bounces. The natural gas markets are oversupplied, and we don’t have anywhere near enough demand during the month of September - which is the upfront month that we are trading right now. In general, there are only a couple of months that natural gas will be bullish, and we aren’t quite there yet.

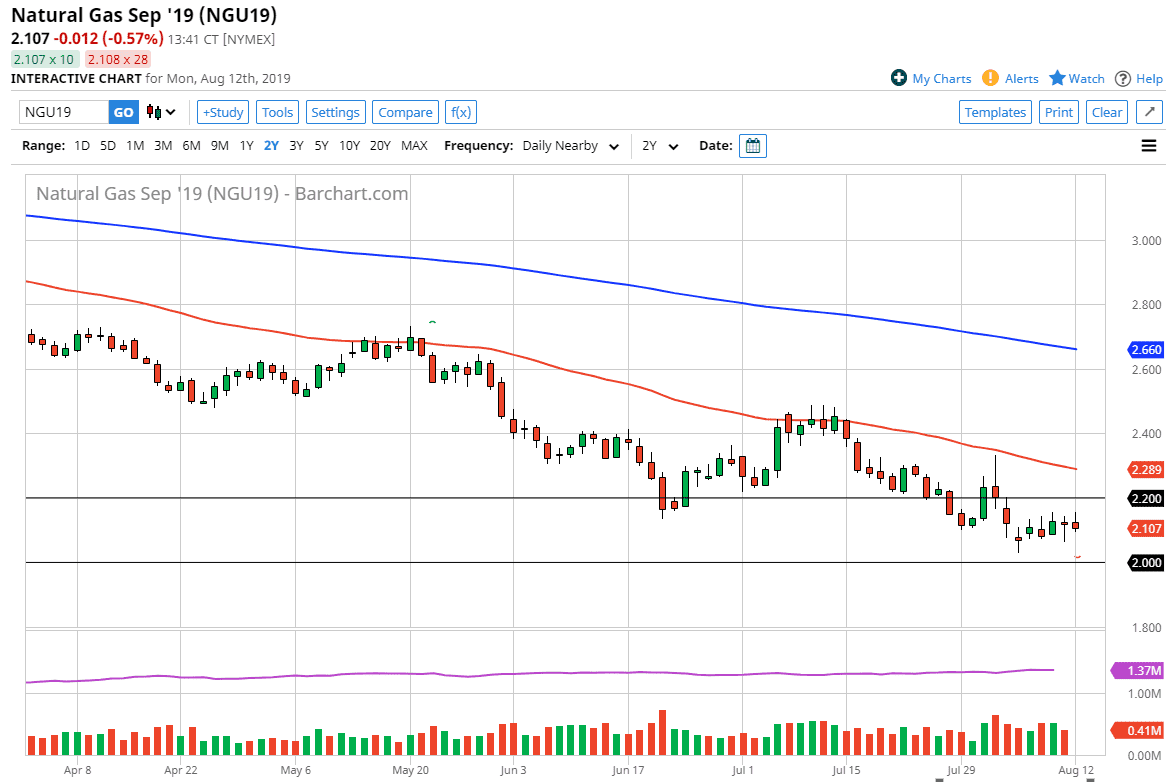

I currently see the $2.20 level as a major barrier that will be difficult to overcome, but if we can break above there then we will probably go looking towards the 50 day EMA which is pictured in red. I think that will attract a lot of downward pressure as we have seen a lot of selling at that moving average more than once. The alternate scenario is that we simply drop from here and go looking towards the $2.00 level, an area that will of course offer a lot of psychological support. I don’t think we can break through there right away though, and I think that if we do get a break down below there, then it could be a major flush lower and send this market looking towards $1.75 level next.

All of that being said, I think it’s more likely that we will continue to see short-term rallies that are faded, as it will take a lot to have people shorting the market at the $2.00 level. Although this pair has been in a downtrend for some time, the reality is that we are getting a bit stretched at this point, and it’s only a matter time before we start trading winter month contracts, which of course will feature quite a bit more demand as the United States and Europe will be looking to heat homes during those months. This means that there is a cyclical trade-in natural gas, but we are not there yet and it’s very likely that the next move higher will probably be sold into it as well.

If we do break out to the upside and above the 50 day EMA, then it’s possible that we could go looking towards the $2.50 level, which is a psychologically important figure. If we were to break above there, that could change a lot of things but we look to be a long way away from something like that.