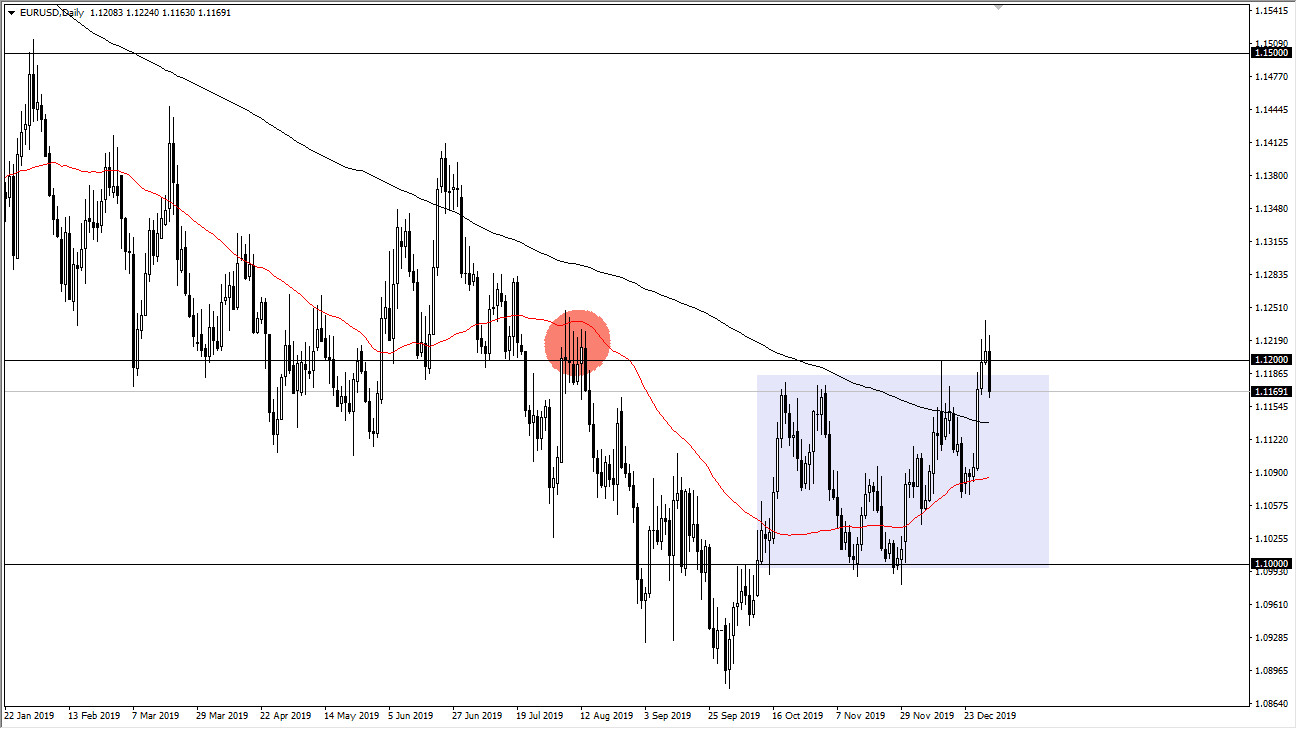

The Euro has initially tried to rally during the trading session on Thursday but then broke down below the 1.12 handle. So, the question now is whether or not this was a real move, or has it just simply a bit of profit-taking as we had gotten a bit overstretched? At this point it’s a bit difficult to make that distinction because it is just after New Year’s Day, and that of course means that the liquidity is going to be a bit suspect. With that in mind, I can present a couple of different scenarios here and therefore it makes the market very difficult to trade.

One of the main features of the Euro is the fact that against the US dollar, it is visited by high-frequency trading and therefore it tends to be extraordinarily choppy. Retail traders get sucked into this pair due to the fact that it has a low spread, which unless you are scalping the market really makes no difference. That being said, the low spread is exactly why you see so many computers trading this pair now.

We had recently broken above the 1.12 handle, and then ended up forming a shooting star at the 1.12 handle. That of course is a negative sign but, on the way, up we have seen the market slice through the 200 day EMA like it wasn’t even there, and it has formed a couple of “higher lows. We also had formed a “higher high”, so all of that is bullish in theory. Having said that, we did fail at the 1.12 handle so that is bearish and therefore we have a bit of a conundrum going forward.

You can make an argument for a potential trend change, and I am certainly open to that. It doesn’t mean that I think it should happen, but we think should happen and what is reality is quite often a different argument. If we can break above the top of the shooting star from the previous session, then I think the market is very likely to go looking towards the 1.14 handle given enough time. However, if we break down below the explosive candlestick from last Friday, then the market is likely to go down towards the 1.10 level underneath. I would probably stay out of this pair for another couple of sessions, because we are obviously getting ready to make some type of move.