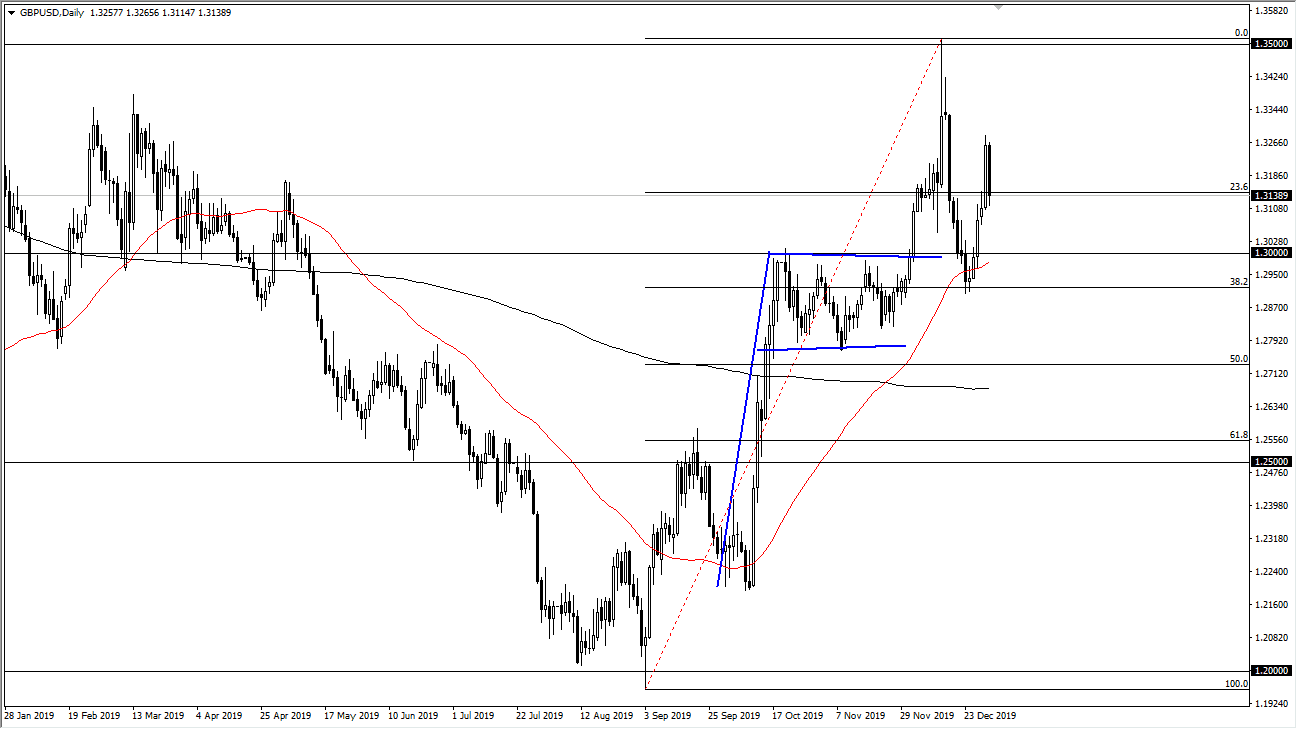

The British pound has pulled back significantly during the trading session on Thursday, reaching down below the 1.3150 level. At that point, the market is likely to look for buyers underneath, as we had previously formed a very bullish looking flag on the chart. Beyond that, we had pulled back to reach towards the 50 day EMA before bouncing significantly, and that of course is something to pay attention to. The 50 day EMA is currently hovering just below the 1.30 level, and that large, round, psychologically significant figure will attract a lot of attention.

To the upside, I think that the 1.35 level above is a significant barrier, but if we were to somehow break above there it’s likely that the market then goes looking to the 1.38 handle. The bullish flag that has been broken out to the upside measures for a move to the 1.38 handle. Towards the end of the bullish flag, the market had seen the 50 day EMA cross above the 200 day EMA, forming the “golden cross”, something that longer-term traders pay a lot of attention to. That being said, it’s very likely that plenty of buyers will come back into this market.

However, if the market was to break down to reach below the recent low, that could send the market down towards the 1.28 handle underneath. The 1.28 level being broken to the downside obviously would be a major turn of events, and could unwind this trade completely, and reaching down towards at least the 1.25 handle. Having said that, it’s very unlikely to happen anytime soon, and I think that we are much more likely to break out to the upside than down, but obviously this is a pair that is going to have a lot of variables out there that could come into play. Beyond that, the economic headlines in more importantly the political ones will cause quite a bit of trouble.

I believe that it is going to be very difficult and choppy, but I still favor the upside, but would do so slowly as the market is likely to be very noisy in cause a lot of volatility from time to time. This is probably something you should be building up a core position, and not jumping in with both feet right away. With that being said, I’m looking for value and I suspect that most other traders are as well.