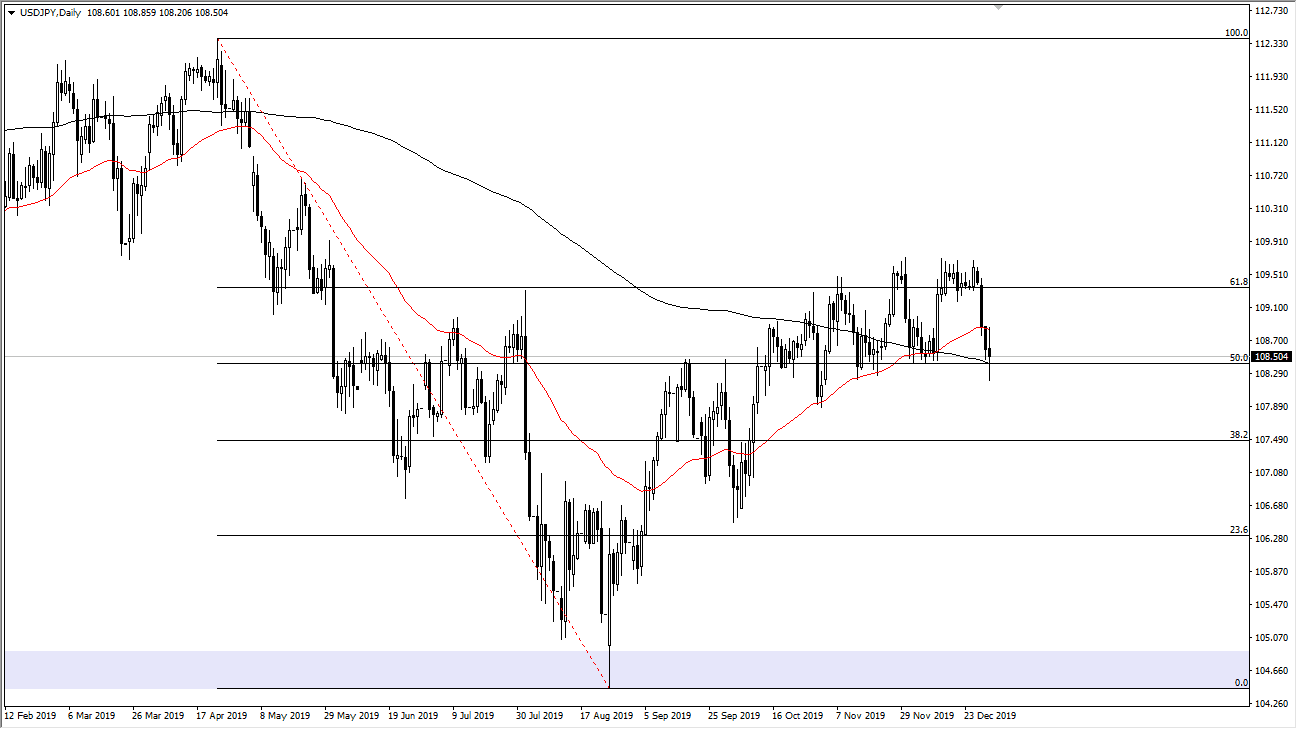

The US dollar has been all over the place against the Japanese yen during trading on Thursday, dipping below the 200 day EMA at one point. However, it has shown some resiliency as the 200 day EMA underneath is offering plenty of support. That being said, it looks as if we continue to trade between the ¥108 level and the ¥110 level. As we are at the bottom of this range, I believe that we will probably try to rally. After all of the volatility for the session and it looks as if we are ready to go sideways, and therefore we probably have more likelihood of going higher than lower.

Keep in mind that this pair is extraordinarily sensitive to risk appetite, so that comes into play as well. I don’t think that the market is likely to get too shaken up, because most of the risk appetite causing factors include the Brexit and the US/China trade situation. At this point it looks as if both of those are at least moving forward, so that should help. That being said, the US dollar itself is a little bit more sluggish than some other currencies, so although I anticipate that we will probably bounce from here, I also recognize that we are more than likely going to see this pair underperform others such as the AUD/JPY, or even the NZD/JPY pairs.

The market has been very comfortable in this area, and I think that will continue to be the case. However, if we were to break down below the ¥108 level, then the market is likely to go down towards the ¥106.50 level. If we can break above the ¥110 level, something that I don’t see happening during the session on Friday, then the market is likely to reach towards the ¥111 level, followed by the ¥112.50 level. All things being equal, in a consolidation area like this after a move higher, it typically means that continuation is likely. Having said that, that doesn’t necessarily mean that has to happen on your timeline. Because of this, being patient is the only thing that will keep you sane, and in the meantime you have to think that the market will simply do what it has done for a while, therefore I would anticipate that bouncing back and forth will probably continue to be the main feature here.