The 110.00 psychological peak remains a crucial target for bull to continue the USD/JPY's recent upward correction. The pair moved to the resistance level of 109.70 at the beginning of trading this week and stabilized around 109.38 at the beginning of trading today. The fate of the dollar hinges on the reaction to the release of US jobs numbers by the end of the week. These numbers may cause the Federal Reserve to begin thinking about tightening its current monetary policy. Currency markets are investing heavily in central bank policy making, with those currencies belonging to central banks looking to provide bonus time for their first rate hike.

Despite the strong start of the US dollar this week, one of the major investment banks warns of expecting a strong bullish trend. In this regard, said Eric Martinez, an analyst at Barclays Bank: "Despite the continued outpacing of growth in the United States, we see some balancing factors of the overt strength of the US dollar as demand for the vaccine is losing its pace in the United States and catching up with it in the rest of the world."

Corona vaccination was one of the main principles for the superior performance of the US economy during 2021.

Barclays Bank is citing last week's vaccination statistics in the US that showed a slowdown in newly administered doses, with an average 7-day drop from 3.4 million in mid-April to 2.7 million at the end of the month. The bank’s analysts argue that this does not appear to be caused by supply constraints, but by slowing demand. And they argue that while vaccine reluctance could prolong the timetable for a full economic recovery, it should also reduce concerns about the potential overheating of the US economy, while implicitly it means more room for catch-up than the rest of the world as vaccines sped up elsewhere.

The US Commerce Department reported that the trade deficit, the gap between what America buys from abroad and what it sells to other countries, was 5.6% larger than February's $70.5 billion gap. US imports increased 6.3% to $274.5 billion, while exports increased 6.6% to $200 billion. The United States imports so much more than it exports that the import rise, in dollar terms, was even greater.

The politically sensitive trade deficit with China rose 11.6% to $27.7 billion, which was, as usual, the largest deficit of any single country.

During the first three months of this year, the US trade deficit reached $212.8 billion, an increase of 64.2% over the deficit during the same period last month, and at a time when the US economy was mainly closed due to the coronavirus pandemic. The United States recorded a deficit in the whole of 2020 amounting to $681 billion, which is the largest annual gap since 2008 as the virus disrupted global trade.

The US economy is recovering much faster than the rest of the world, and this is evident in the trade numbers as the gap widens. Americans are starting to spend again, while US exporters are facing a slowdown in external demand in countries that are recovering more slowly. Commenting on the figures, Oren Clashen, chief US economist, said: “The strong growth of the United States compared to its trading partners will lead to the growth of the trade deficit in 2021. Domestic demand will maintain import attractiveness, thanks to improved health conditions, reopening and historic fiscal expansion."

During his four years in office, Trump pursued a strict trade strategy that used punitive tariffs on other countries' products as a way to eliminate America's trade deficit with the rest of the world and restore millions of lost manufacturing jobs.

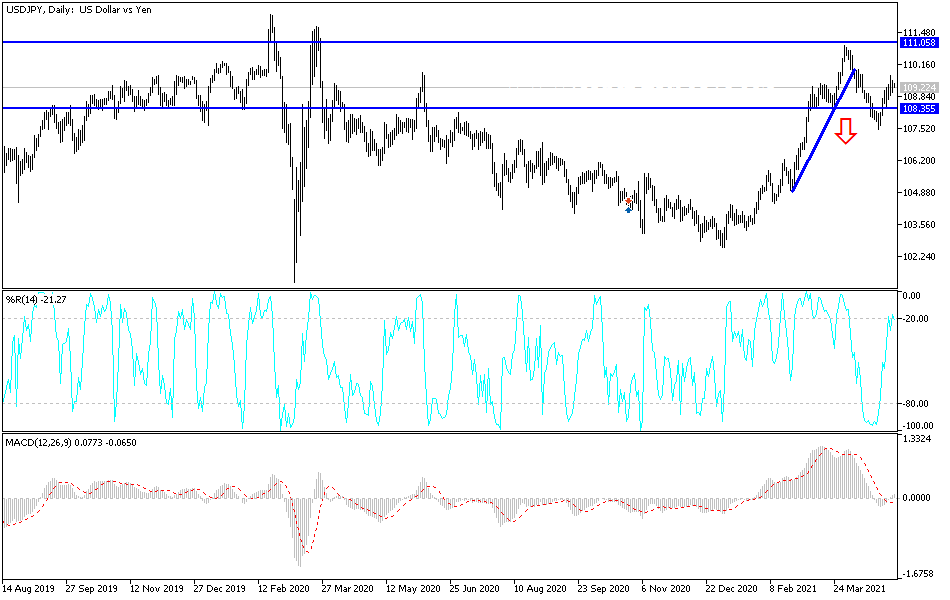

Technical analysis of the pair:

The bullish momentum of the USD/JPY remains in place, and the bulls will gain control over the performance by breaching the psychological resistance of 110.00, which may increase buying and push the currency pair towards higher peaks. Bulls' control of performance will evaporate if bears move the currency pair below the support level of 108.35, depending on the performance on the daily chart. I still prefer to buy the currency pair from every downside.

The currency pair will be affected by the extent of investor appetite for risk or not, as well as US session data, where the first issue of US jobs numbers will be announced, as well as the ADP survey to measure the change in non-agricultural jobs and the ISM Services PMI reading.