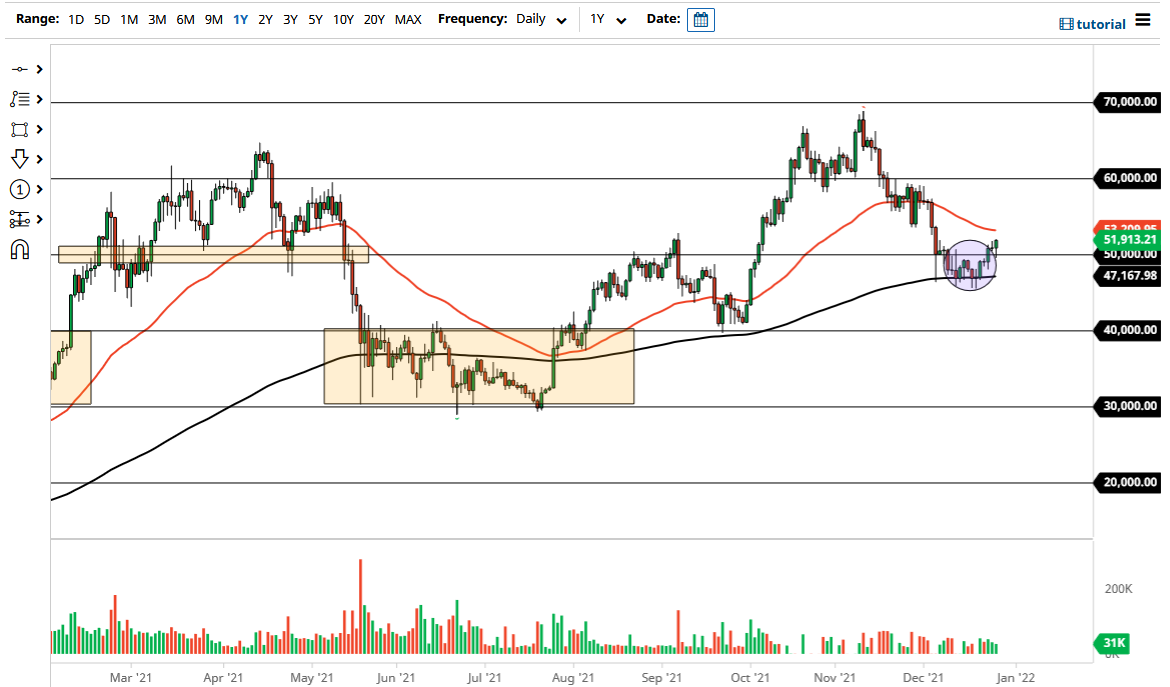

Bitcoin initially dipped lower on Monday to reach below the $50,000 level but turned around to show signs of life and break above the $51,000 level. This is an area that I have been paying attention to for quite some time, and I said that if we can get above here it is likely that we will see follow-through to the upside. At this point in time, the next target I think is going to be the 50 day EMA, currently sitting at the $53,305 level. Breaking above that then allows Bitcoin to continue going much higher, to go looking towards the $60,000 level, which is my target over the next several weeks.

I still believe at this point that pullbacks are going to continue to offer plenty of support, especially around the 200 day EMA which is technically very important. As long as we stay above there, we are technically in an uptrend and I am going to continue to play this market through that prism. I am going to add little bits and pieces along the way, building up a much bigger position for next year. I fully anticipate that the move next year is going to be much bigger.

The market breaking down below the 200 day EMA is not something I expect to see, but if it did, I anticipate that we will go looking towards the $40,000 level next. At that point, the market would have to save itself or things could get rather ugly rather quickly. That being said, though, the most likely of outcomes is going to be that every time we dip a little bit, buyers will come in and pick up just a bit more. Yes, things might get a little bit tense between now and New Year’s Day, but overall this is a market that continues to go higher from what I can see. I will not sell this market, but I do not necessarily want to jump in with both feet, because this time year can be a bit erratic; so jump in with a ton of money when you can scale in and get a bit of a better price in general. Given enough time, I do not see any reason why we will reach all-time highs yet again.