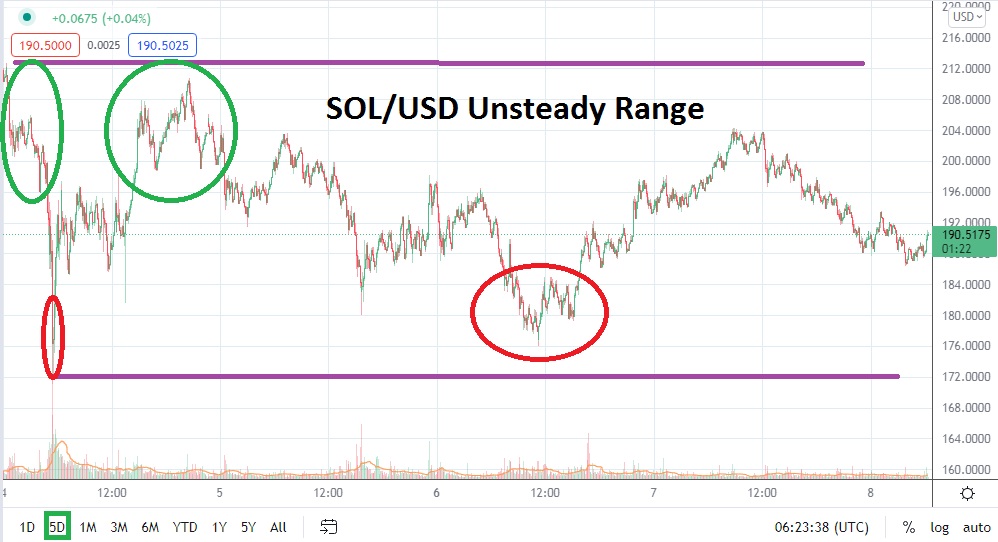

Having recovered some of its lost value following the flash crash SOL/USD suffered this past weekend when the digital asset fell to nearly 171.000 momentarily, Solana as of this writing is around the 190.200 level. Fast trading conditions need to be anticipated by speculators within SOL/USD as the broad cryptocurrency market continues to show signs of nervous trading. A short-term high of nearly 204.000 was achieved in yesterday’s trading.

However, after hitting Tuesday’s high, which essentially matched the high made on Sunday following the flash crash on Saturday, SOL/USD has faced headwinds again. Solana has correlated with the broad cryptocurrency market the past month and, after reaching an all-time record price of nearly 260.000 on the 6th of November, SOL/USD has incrementally lost value while experiencing a rather choppy price realm. However, the technical trend has certainly proven bearish.

The rather unsteady price range is now near rather important support and resistance which could prove to be significant regarding behavioral sentiment. SOL/USD may have to topple the 200.000 resistance level and sustain trading over this juncture for a solid duration – at least a few days – to warm the hearts of bullish traders who are cautious and want to pursue momentum-based trading positions.

Importantly, too, is the current technical support level of 186.000 which is clearly within sight of the current SOL/USD price. If this support realm proves to be vulnerable it could set off a wave of nervous selling among some Solana speculators who may believe the values seen during the flash crash this past weekend was potentially an ominous sign of developments to come.

While the broad cryptocurrency market has recovered from the spikes caused by widespread selling late Friday and through Saturday, the values of cryptocurrencies remains largely below their values being traded on the 4th of December, and this includes SOL/USD.

Speculators should practice some caution within SOL/USD short term; if a trader wants to aim for potentially quick hitting trades by using nearby support and resistance levels this may prove the correct wager. Traders should use strict entry orders to safeguard their price fills in the current market. Bearish speculators who believe the current support level below may be a legitimate target near term may be making a worthwhile bet on SOL/USD.

Solana Short-Term Outlook

Current Resistance: 197.300

Current Support: 185.800

High Target: 219.900

Low Target: 169.400