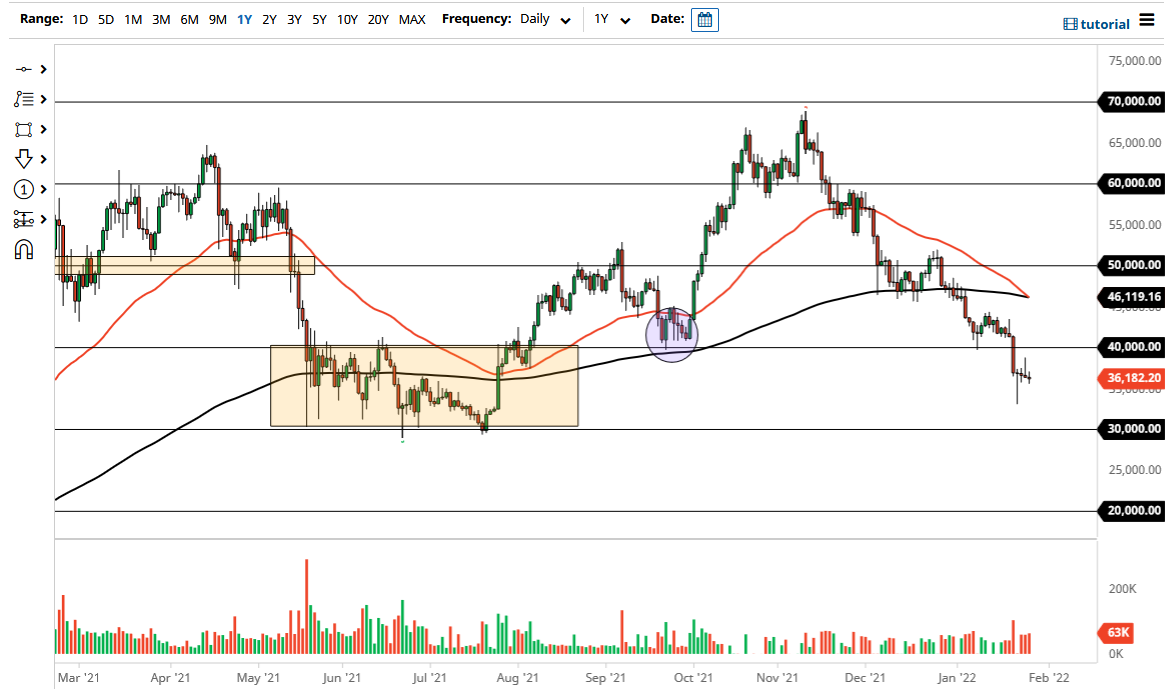

Bitcoin went back and forth during the course of the trading session on Thursday as we continue to see a lot of noisy behavior. The last four days have been nothing but chop, and therefore you could say that we are at least trying to set up the consolidation in order to build up a little bit of a basing pattern.

That being said whether or not we can hang on to the $35,000 level, the market would more than likely be focusing on that. If we can hold onto it for a significant amount of time, the market will then more than likely go looking towards the $40,000 level above, an area that was significant support previously. Because of this, I think it only is a matter of time before sellers would come back into that area. However, if we were to take off to the upside and break out above the $42,000 level, then you could see a little bit of momentum come back into the picture.

To the downside, if we can take out the bottom of the hammer from the Monday session, then it is likely we could go looking towards the $30,000 level underneath. The $30,000 level underneath will continue to be important, and if that were to give way, this market would fall apart. I do not think that happens, and I do think that there should be a certain amount of buying pressure. If we break down below the $30,000 level, it is likely that the market will go into what is known as “crypto winter” when the markets will simply grind sideways in go nowhere for a long period of time. If that is going to be the case, people will be out there accumulating massive amounts of Bitcoin for the next bullish run. I think that we will almost ultimately see buyers jumping back into this market, but I do not know if we are there quite yet.

Looking at the 50 day EMA crossing below the 200 day EMA, it is theoretically a “death cross” signal that a lot of people could be looking at but quite frankly I do not think it is very likely to be a signal that you can follow, simply because it warms far too late to be of any real use but certainly will be a talking point.