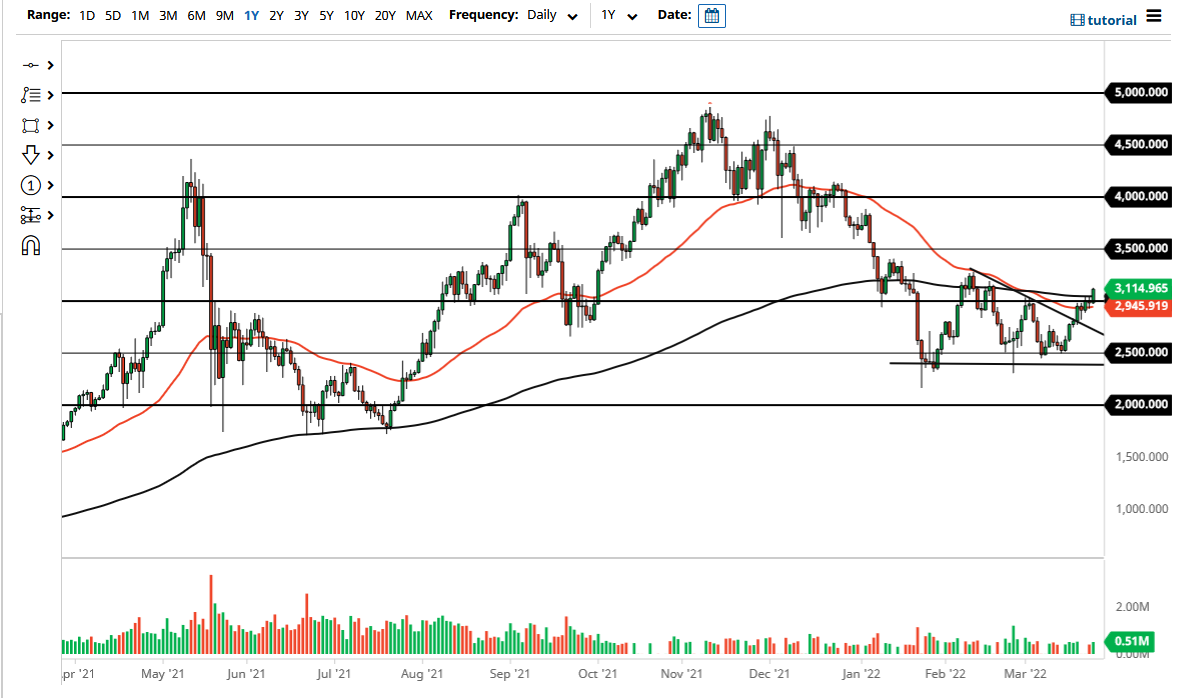

Ethereum has finally done it, it has broken above the crucial 200 Day EMA. We are now well above the $3000 level as well, and now it looks like we are ready to swing higher. This has been a rather choppy move, but Thursday was much more decisive than the previous three days ahead of it. Because of this, it is likely that we will continue to see buyers jumping into this market on dips now.

Furthermore, the 50 Day EMA is starting to curl a little bit higher, so it does suggest that perhaps we will get a little bit of a “golden cross” forming, which could open up the possibility of some traders looking at that as a signal. The size of the candle is bigger than the previous several months, so that of course is a good sign as well. Ultimately, I think this is a market that will eventually go looking towards the $3250 level, possibly even the $3500 level.

Bitcoin has looked rather well over the last couple of days also, which tends to lead Ethereum going higher. When they both go higher, that is a good sign for crypto in general. Looking at this chart, I could see a path to much higher levels, but obviously, we need to see more momentum. Having said that, I think it is coming as we are starting to see more and more interest in this market.

“Ethereum 2.0” has had a few advances over the last couple of weeks, which of course has helped as well. From a fundamental standpoint, Ethereum continues to be the building block of most blockchain applications, and therefore it will lead the way for all of the other coins underneath it. At this point, I look at this as a massive “W pattern” that can also be used to protect a final target closer to the $4000 area.

I do believe it is only a matter of time before we go higher, but you need to build your position up slowly, as the volatility will probably be rather drastic at times. Having said that, it appears that the worst is finally behind us when it comes to Ethereum. Altcoins should pick up rather shortly as well, but it may take a little bit of time for those that follow right along.