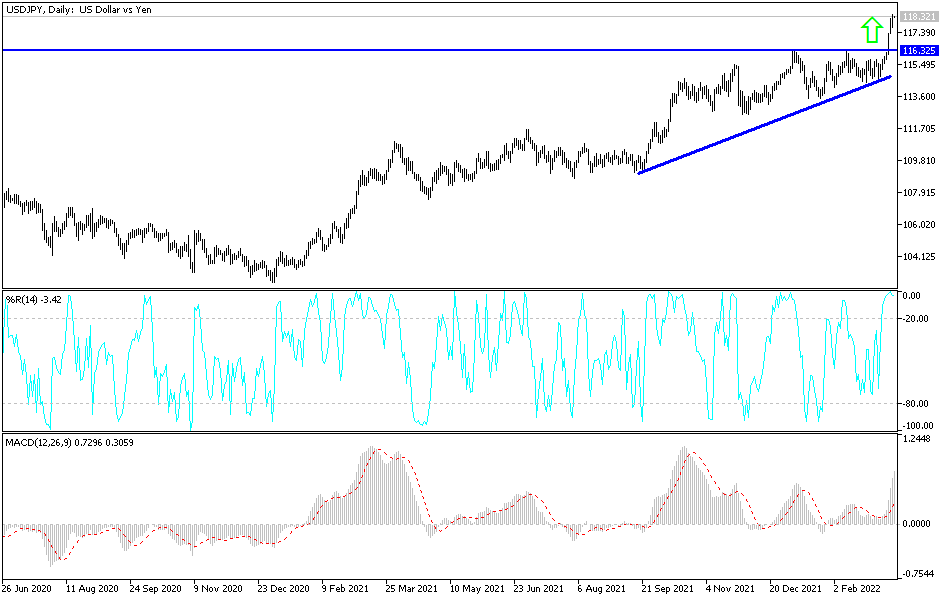

A crucial moment for the gains of the US dollar pairs today, as the US Central Bank will announce a widely expected decision, which is to raise US interest rates for the first time in 2018. Based on those expectations, the price of the US dollar against the Japanese yen currency pair (USD/JPY) moved amid strong upward momentum. It reached the level of the resistance 118.45, the highest for the currency pair in five years. Yesterday it was exposed to limited profit-taking operations, reaching the level of 117.70, then it returned in the same path to the level of 118.30 at the time of writing the analysis.

Ahead of the Bank's decisions, US producer prices rose 10% last month compared to the previous year - another sign that inflationary pressures remain severe across the US economy. The Labor Department said the Producer Price Index - which tracks inflation before it hits consumers - rose 0.8% from January. The increases were in line with economists' expectations. Wholesale energy prices are up 33.8% over the past year and food prices are up 13.7%. The report did not include price changes after February 15 and missed the sudden rise in energy prices when Russia invaded Ukraine nine days later.

Excluding volatile food and energy prices, wholesale inflation rose 0.2% from January and 8.4% from February 2021.

Last week, the US government reported that rising gas, food, and housing costs pushed consumer prices up 7.9% in February from the previous year - the biggest rise since 1982. Inflation, which has been dormant for four decades, resurfaced last year with the United States has rebounded unexpectedly quickly from the short and devastating coronavirus recession of 2020. Surprised by caution, companies scrambled to find supplies and staff to meet an unexpected surge in orders from customers flocked with government relief checks. Factories, ports, and shipping yards came under pressure. Accordingly, shipments were delayed, and prices began to rise.

To combat price hikes, the Fed is expected to raise interest rates several times this year, starting this week with a quarter-point rise in the benchmark short-term rate.

On the other hand, affecting the market sentiment. A senior Ukrainian negotiator said talks with Russia would continue on Wednesday. Mykhailo Podolak, an adviser to Ukrainian President Volodymyr Zelensky, who spoke to Russian negotiators via video link on Monday and Tuesday, described the talks as "extremely difficult and sticky".

He added that "there are fundamental contradictions," but added that "there is certainly room for compromise." The video link talks this week follow three rounds of negotiations in Belarus that failed to make any tangible progress. Russian and Ukrainian negotiators expressed cautious optimism but did not elaborate on any details of the talks.

According to the technical analysis of the pair: It must be taken into consideration that any indications from the US Federal Reserve regarding the expectations of raising US interest rates in the remainder of 2022 may give traders the opportunity to activate selling operations to take profits after the gains of the US dollar pair against the Japanese yen. The latter, which moved the technical indicators towards overbought levels. Breaking the current upside trend depends on moving towards the 116.00 support, and on the upside, the next psychological resistance will be 120.00. This is in case the US Central Bank confirms that it will be more aggressive to raise interest rates, which is unlikely for the markets so far.