The EUR/USD exchange rate was relatively better last week, but it may struggle to avoid being the weakest performer this time in crystallizing risks to energy supplies and economies in Europe, and added headwinds from new coronavirus restrictions in China.

Beginning of this week's trading:

- The EUR/USD pair moved in a narrow range.

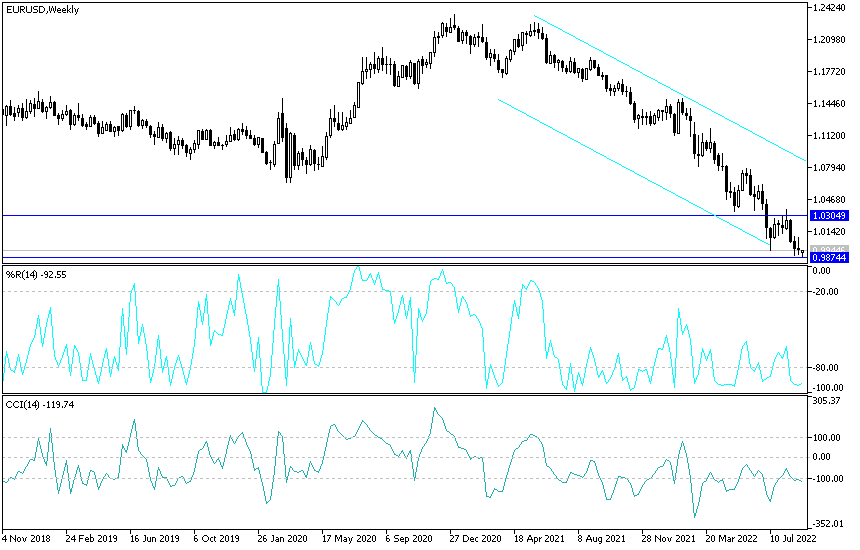

- This is amid the continuation of the downtrend between the support level of 0.9877, the lowest in 20 years, and the level of 0.9944.

- Before that, the European single currency rose broadly last week when a new rise in eurozone inflation prompted economists to expect a record increase in interest rates for the European Central Bank next Thursday, and after European Commission officials said they would consider measures to reduce energy costs.

The euro came under pressure ahead of the weekend, with more short-term losses seen early on Monday after Russiam's Gazprom said its Nord Stream pipeline would remain closed indefinitely and thus no longer deliver natural gas to Germany.

German gas storage tanks were reported to have been full at target levels before the pipeline suspension was announced last week, a potential dampener for energy prices and may be the reason behind limiting EUR/USD losses on Monday. Economists' expectations of the European Central Bank's interest rate decision on Thursday have been raised in favor of a record 0.75% increase in all three key interest rates, and implied market measures of investor expectations point to a high probability of such a move. However, it remains to be seen if there is board support for this type of measure, while any vote in favor of another 0.5% increase could leave the EURUSD rate at risk of a deeper reversal this week.

Valentin Marinov, FX Analyst at Credit Agricole says, “The growing risk of a severe recession in the eurozone will continue to cloud the euro outlook. We also expect the European Central Bank to raise interest rates by 75 basis points on Thursday in part as a way to support the euro.” “This appears to be already expected by price markets, however, while there remains a lot of uncertainty about the bank’s final policy rate.” European Central. This could mean that the best the ECB can hope for is for the euro to stabilize at historically low levels,” he said.

Important US Economic Data Due

The European Central Bank raised interest rates for the first time in a decade in July and warned of the possibility of further increases, while some Governing Council members have since called for a more aggressive pace of monetary policy normalization. While European energy issues and European Central Bank policy are likely to be the dominant drivers of the EUR/USD rate this week, there is also a batch of important US economic data due and a slew of comments from Fed policy makers preparing to speak publicly.

Most of all, Federal Reserve Chairman Jerome Powell will participate in a moderate discussion at the Cato Institute's annual monetary conference on Thursday, though three others will also attend public participations before that including Vice President Lyle Brainard. In addition, the market may be looking to see if Tuesday's release of the Institute of Supply Management's (ISM) Services Purchasing Managers' Index for August confirms the message of previous S&P Global PMI surveys, which indicated that both industries slid deeper into recession last month.

Forecast of the euro against the dollar today:

The proximity of the EUR/USD currency pair around and below the parity price still supports the bears’ stronger control of the general trend. It warns of the possibility of a downward move towards stronger levels of support, especially if concern about the energy future in the eurozone increases or the European Central Bank’s decisions this week come without market aspirations. Currently, the closest support levels for the currency pair are 0.9890 and 0.9800, respectively.

On the other hand, according to the performance on the daily chart, there will be no first reversal of the current trend without moving towards the 1.0200 resistance level.

Ready to trade our Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.