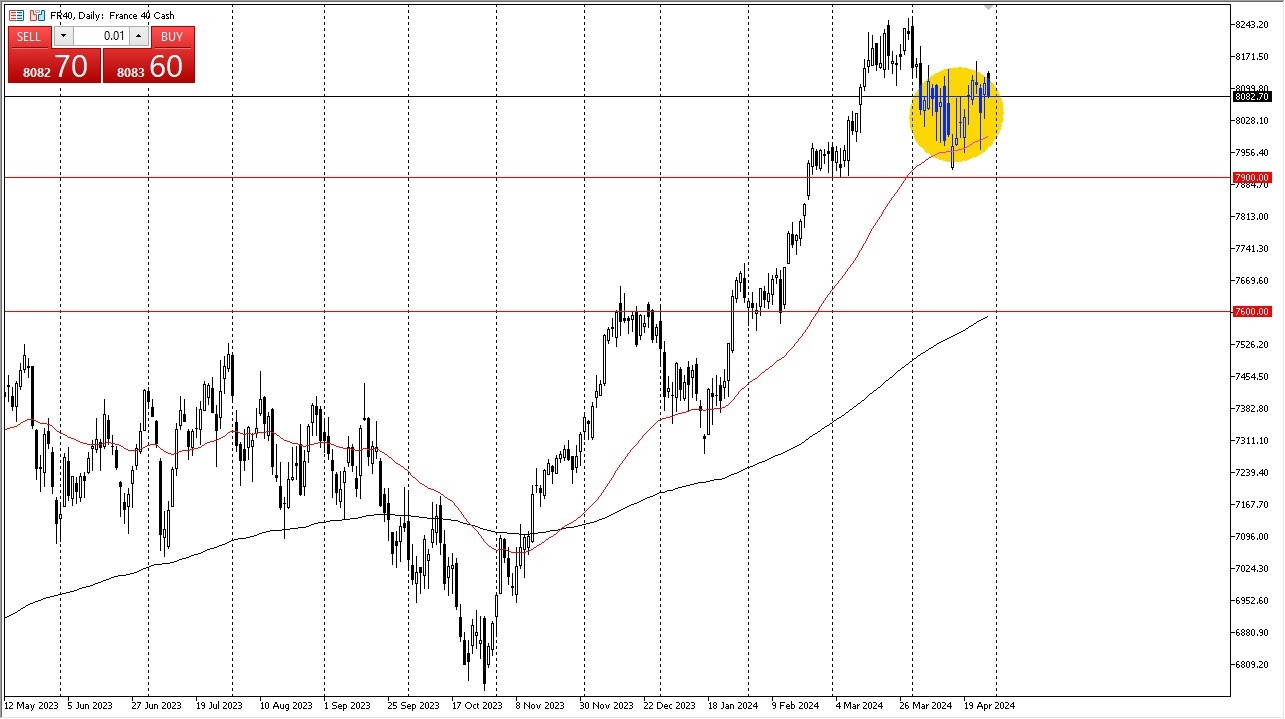

- The Parisian CAC pulled back just a bit during the trading session on Monday, after initially gapping higher to kick off the trading week.

- This probably won’t come as a huge surprise, due to the fact that the €8100 level has been important multiple times.

- At this point though, does look like we are trying to build up enough pressure to finally take off to the upside, so it is deftly worth paying attention to what’s going on here.

The pullback at this point opens up the possibility of value hunting, and I do think that’s what we are about to see. Ultimately, the 50-Day EMA sits near the €8000 level, so I think at this point not only do we have market memory offering support there, but it’s also quite telling that it is a large, round, psychologically significant figure, and because of this I think you get a situation where sooner or later buyers will step in.

European Central Bank

The European Central Bank is of course going to be a situation that people would be watching very closely, as it looks like they might be cutting rates soon. If they do, that should help equities in the European Union, unless of course they are doing it in some type of panic. Furthermore, it’s probably worth noting that the euro is historically cheap, so the idea of European exports being attracted to other people around the world makes quite a bit since.

Remember, the CAC is full of luxury brands, so that is something to pay attention to as well. One of the things Joyce have to ask yourself when trading the CAC is “How are the wealthy doing worldwide?” As long as they are doing fine, these luxury brands will almost certainly attract a certain amount of attention. In the meantime, it looks like we are simply consolidating in an area that sits above significant support that could extend all the way down to the €7900 level. In general, this is a very bullish market, and I think given enough time we will eventually break to the upside but right now we are more or less in a “holding pattern.”

Not sure which broker to choose? We've made a list of the best forex brokers for you.