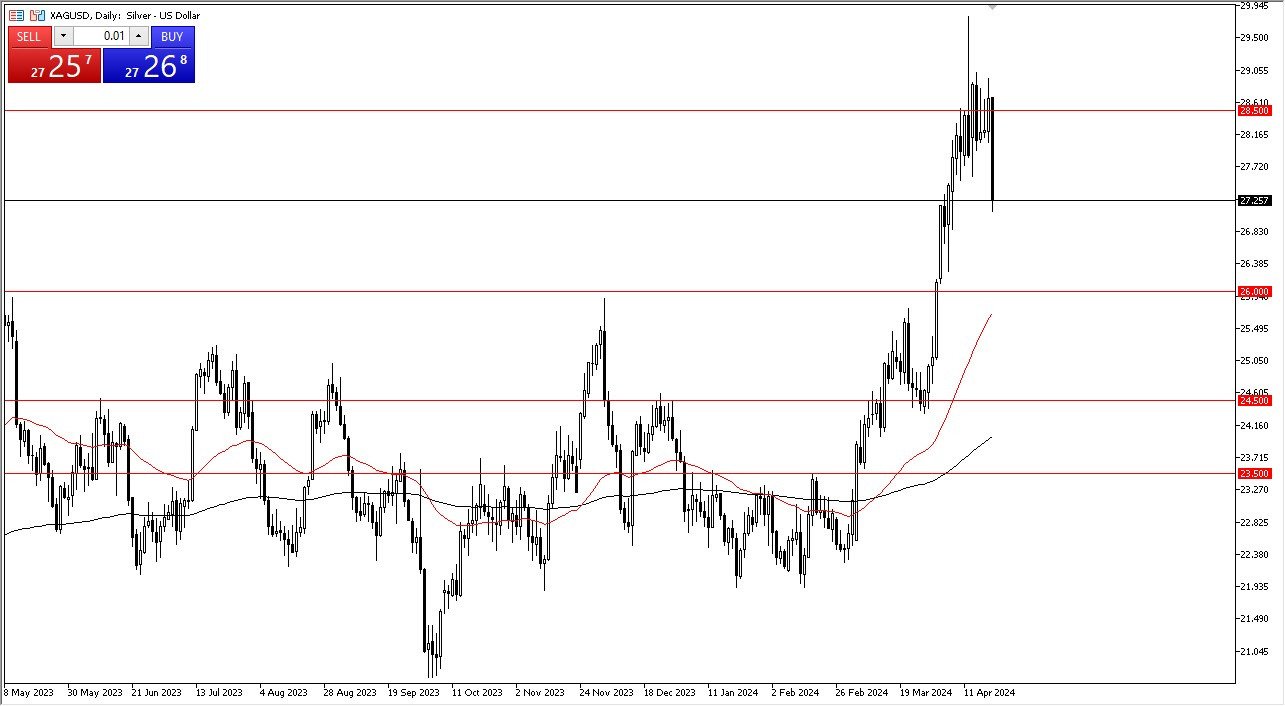

- Silver markets have plunged drastically to kick off the week, as we have finally seen the lack of momentum take apart this market.

- After all, silver has a long history of seeing a lot of noise above the $28.50 level, extending to the $30 level, which has been like a brick wall and only been breached twice in the last 60 years.

The size of the candlestick does suggest that there’s probably further selling coming, but that doesn’t necessarily mean that it’s safe to short this market. After all, silver is extraordinarily volatile, and you can get hurt trading this market if you are not careful. Underneath, I see the $26 level as potential support and of course we have the 50-Day EMA sitting in that same general vicinity as well, so a lot of this could come down to that very level. This is an area that previously had been rather significant as far as resistance is concerned, so I do think you have a situation where the market remains cognizant of this potential floor.

Silver Highly Manipulated

Keep in mind this is the paper silver market, and it doesn’t pay attention to things like supply and demand. It is known that the market has been highly manipulated for some time, and J.P. Morgan itself has been find millions of dollars for doing just that. The bank has made billions of dollars, so they are perfectly comfortable paying this fee as the price of doing business. This is why groups like “Wall Street Silver” get crushed year after year. They will occasionally get a short squeeze like we’ve just seen, but eventually the paper market takes over, and people start shorting the futures contract.

At this point, it looks very much like $20.50 could be a bit of a ceiling in this market, so short-term rallies show signs of exhaustion are probably going to end up being selling opportunities. The size of the candlestick does suggest that we have further to go to the downside, but I am a bit cautious about shorting silver. However, if gold starts to fall even further, silver will get absolutely obliterated, as it is a much thinner market, and of course it is less favored by traders in general.

Ready to trade our daily Forex forecast? Here’s a list of some of the Top Silver Trading Brokers to choose from.