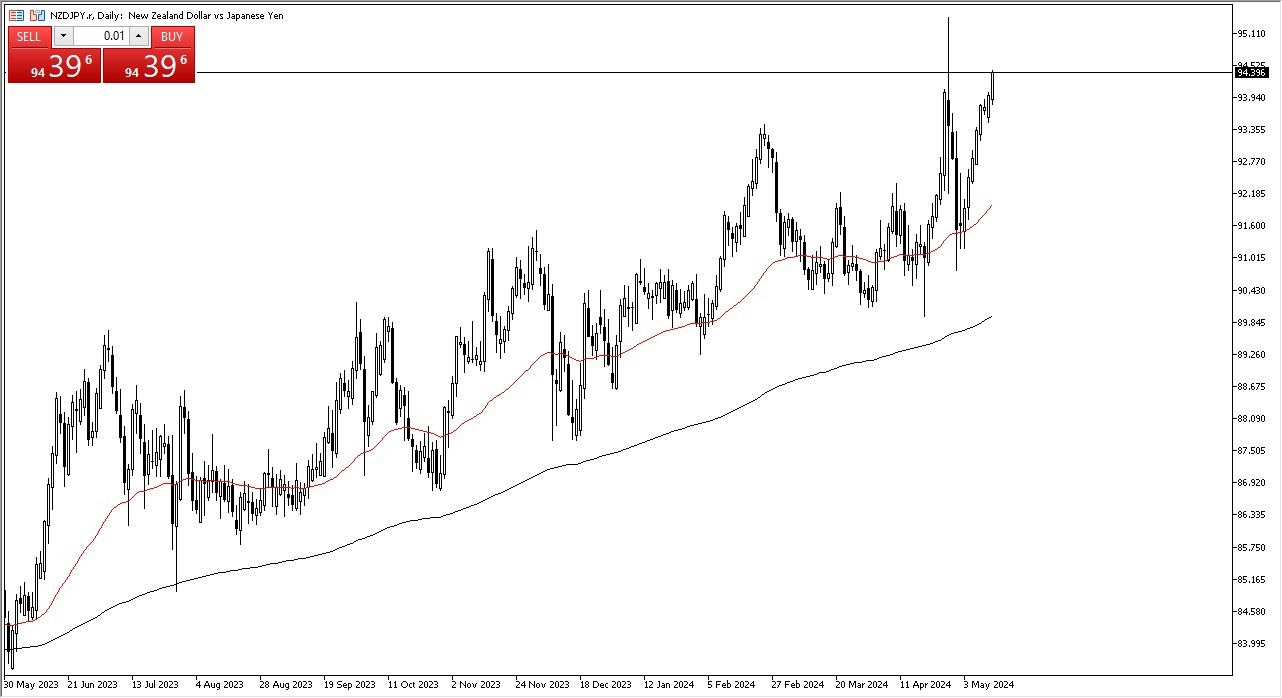

- The New Zealand dollar has rallied rather significantly during the course of the trading session on Tuesday, as we continue to see the interest rate differential be a major driver of where Japanese yen denominated pairs and up.

- All things being equal, this is a market that I think will continue to see a lot of upward pressure, but we are also getting a little bit stretched at this point, and therefore I think you get a situation where you simply cannot short this market regardless of what happens next.

Underneath, the ¥93 level is an area that I think a lot of people will be paying attention to, but I also recognize that we could drop much further than that and still see plenty of upward pressure overall. The size of the candlestick also tells us that there are plenty of buyers in this market, and it suggests that we will eventually go looking to the recent highs near the ¥95.50 level.

Top Forex Brokers

Buying On the Dips

I think this continues to be a situation where you are simply buying this market every time it drops. Furthermore, you can also see that the interest rate differential make sure that you get paid at the end of every day, and therefore I think it makes sense that a lot of institutional traders will be involved in this pair taken advantage of that added bonus. Quite frankly, if you wish to buy the Japanese yen, you have to pay for the privilege of doing so via the swap, and therefore you have to be very cautious with the idea of doing so.

Even if you told me that this pair was going to fall tomorrow, I have no interest whatsoever in trying to get short. I believe that looking for some type of pullback in a bounce is the best way to trade this market, or if you can trade with a small enough position, just simply buying it at current levels is acceptable, recognizing that there is going to be a lot of volatility at times.

Not sure which broker to choose? We've made a list of the best forex brokers for you.