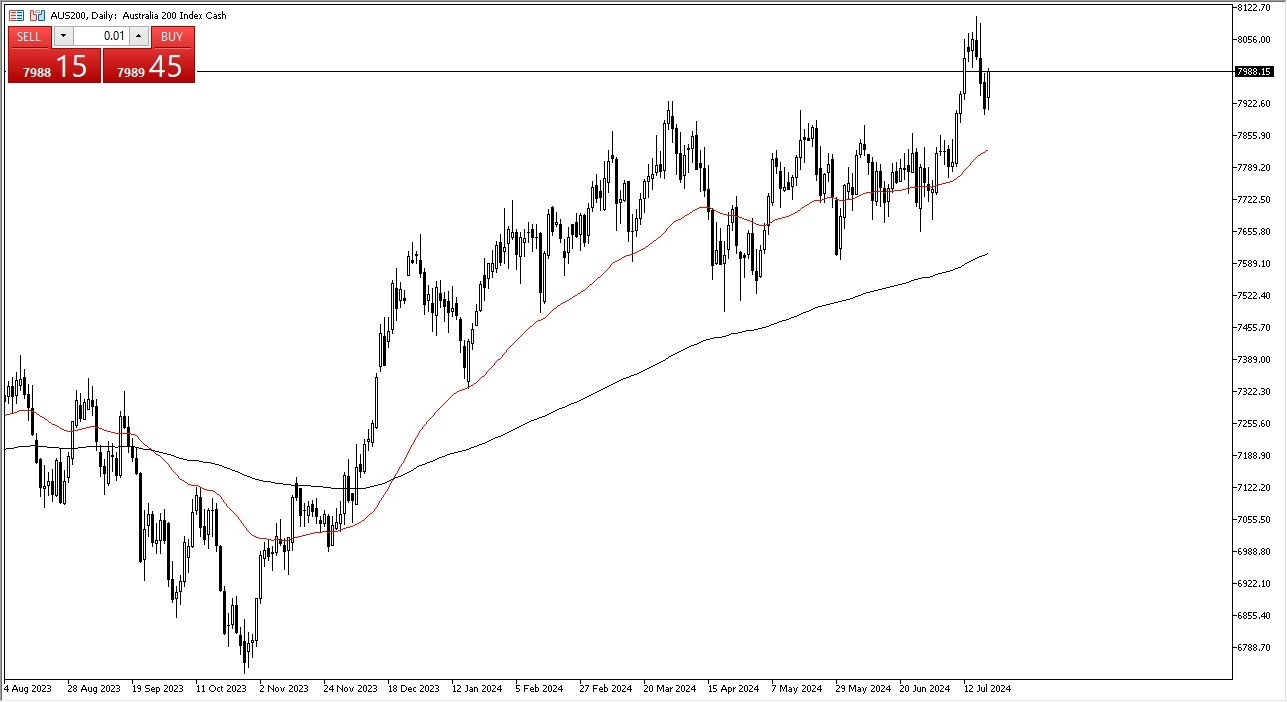

- It’s easy to see that the buyers have truly taken over at this point.

- That being said, this is also a market that tends to be very noisy and influenced by external pressures.

- With this, I think you have to understand that you need to look at the entire macroeconomic picture of the globe to understand how Australian equities may perform.

- After all, Australia is thought of as a commodity producer first, and an Asian financial hub after that.

Monday Shows Potential Continuation

While I don’t necessarily think you should go “all in” into any particular index at this point, the reality is that this one has been very strong, has pulled back to a major resistance level, and has since bounced from that region. Furthermore, we will have to pay close attention to commodities as it has a major influence on the Australian economy and a lot of the major corporations such as BHP, Rio Tinto, Fortesque, etc. these are all massive multinational corporations to have a major outsized influence on the ASX 200.

Top Forex Brokers

I believe that the AU$7900 level continues to be one level that is worth paying close attention to, due to the fact that it is not only a large, round, psychologically significant figure, but it is also an area that was the top of a major ascending triangle. This of course would bring in quite a bit of “market memory”, and therefore it’s not a huge surprise to see that we have bounced from there.

On the upside, the AU$8100 level is an area that has been significant resistance, so it’s not a huge surprise if we end up seeing this market struggle to get above there. If we can break above that level, then the Australian equity markets should continue to rally quite nicely, and therefore I think it’s a place that is most certainly should be paying attention to. Underneath, the 50-Day EMA is near that crucial AU$7900 level, so I think that’s also worth observing.

Ready to trade our daily Forex forecast? Here’s some of the top forex online trading Australia to check out.