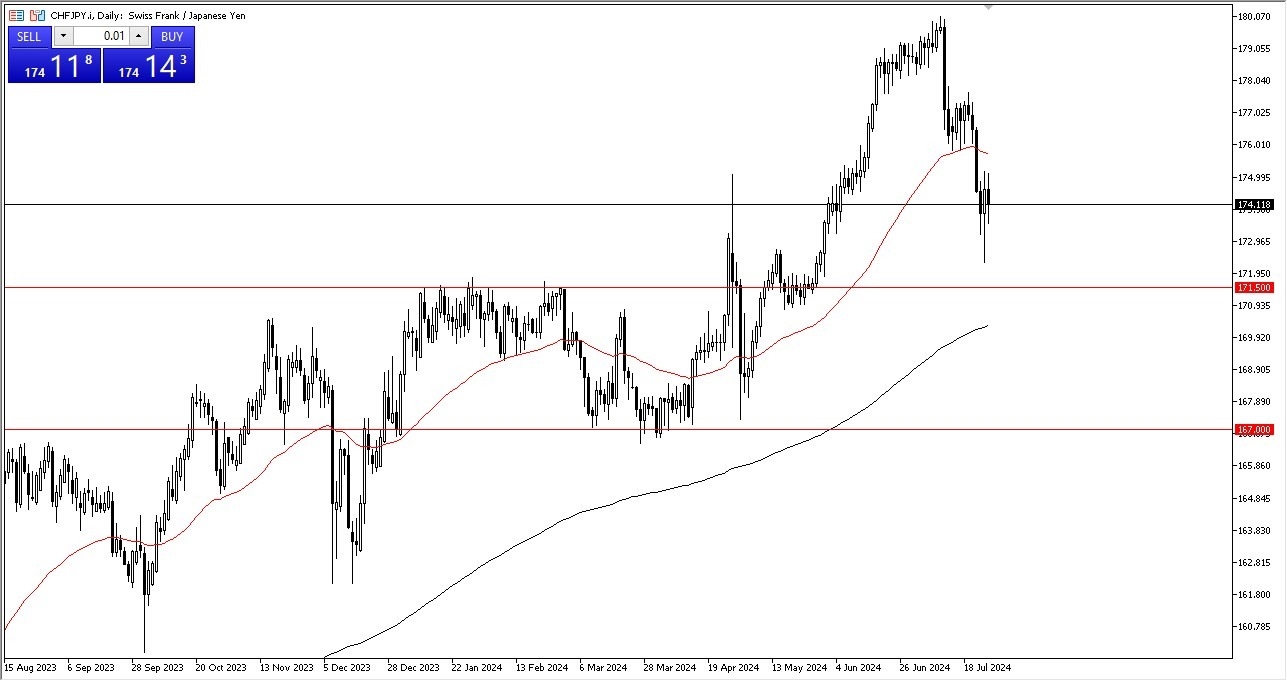

Potential signal:

- On a move above the 175 level, I am a buyer.

- I would have a stop loss at the 173 level, with the 179 level being a target. Or….I will be buying other yen-related pairs such as NZD/JPY, GBP/JPY, and USD/JPY.

The Swiss franc has pulled back just a little bit at the end of the day against the Japanese yen but really at this point in time you have a market that looks like it's trying to stabilize. The reason I pay so much attention to this pair is that it can give you an idea as to which funding currency you want to short. As things stand right now, you are looking for the weaker of the two currencies and then buy currencies against that. After all, the interest rates in both of these currencies are anemic at best.

Top Forex Brokers

The Swiss Franc does look like it is trying to stabilize, and the 174 yen level seems to be an area of interest. If we can turn around and rally and break above the 175 yen level on a daily chart, then for my analysis, I typically use this as a signal to maybe buy the dollar yen or the pound yen or maybe even the Australian dollar against the yen. It's not that I won't buy this CHF/JPY pair and I have multiple times in the past, but I recognize that the interest rate differential is not big enough to make the swap payments crucial as well. All things being equal, it looks to me like although the Swiss franc is weak, it's not as weak as the Japanese yen and that's the main takeaway from this chart right now.

If we were to break down below the 171.50 yen level, then perhaps you start to look at the Swiss franc as being weaker. But as things stand right now, after the massive yen strength that we have had recently, it looks like we are just hanging about here, and therefore it looks to me like the market is trying to convince itself to turn around and start rallying. Because of this, I will continue to watch this pair on a daily basis.

Ready to trade our free Forex signals? Get our top Forex brokers list we recommend here.