- The month of July has been a bit negative for the West Texas Intermediate Crude Oil market, as we dropped toward the $75 level at the very end of the month.

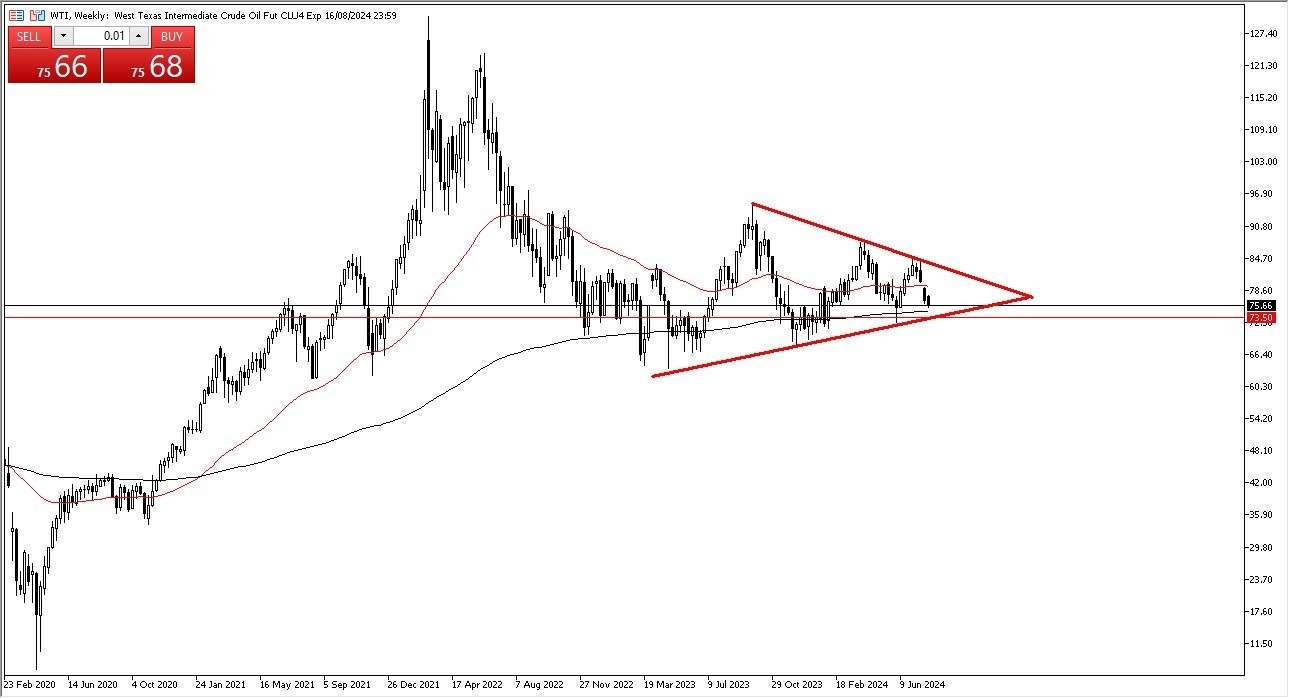

- Ultimately, when you look at the longer-term charts, you can see that we are in a massive symmetrical triangle, and therefore I think a lot of people will be looking at this through the prism of whether or not it is going to continue to respect the boundaries of the symmetrical triangle.

Ultimately, you need to keep in mind that the crude oil market is highly sensitive to the global growth prospects around the world, and it certainly looks as if we could see a bit of an economic slowdown. If we do, then it means that demand for crude oil will almost certainly drop. On the other side of the equation, you have to keep in mind that there are plenty of geopolitical concerns out there when it comes to crude oil, and a potential conflict in the Middle East. As long as there’s tension in the Middle East, it does open up the possibility of a bit of a “fear trade” coming back into the WTI market.

Top Forex Brokers

Consolidation Overall

I believe at this point in time we are in the midst of consolidating, and I think that may end up being the picture in general. I believe that the $73.50 level will continue to be supported, just as the $85 level above could be resistant. If we can break above or below one of these levels, then it kicks off a bigger move but right now I think a lot of traders are out there trying to figure out exactly what’s going on. Quite frankly, after the pandemic, it’s obvious to me and most of the people out there that there is something wrong with the US economy, and it seems like we are in a situation where traders continue to see economic announcements undulate back and forth as far as strength is concerned. With this, we will continue to see choppy trading, and indecisive markets.

Ready to trade monthly forecast? Here are the best Oil trading brokers to choose from.