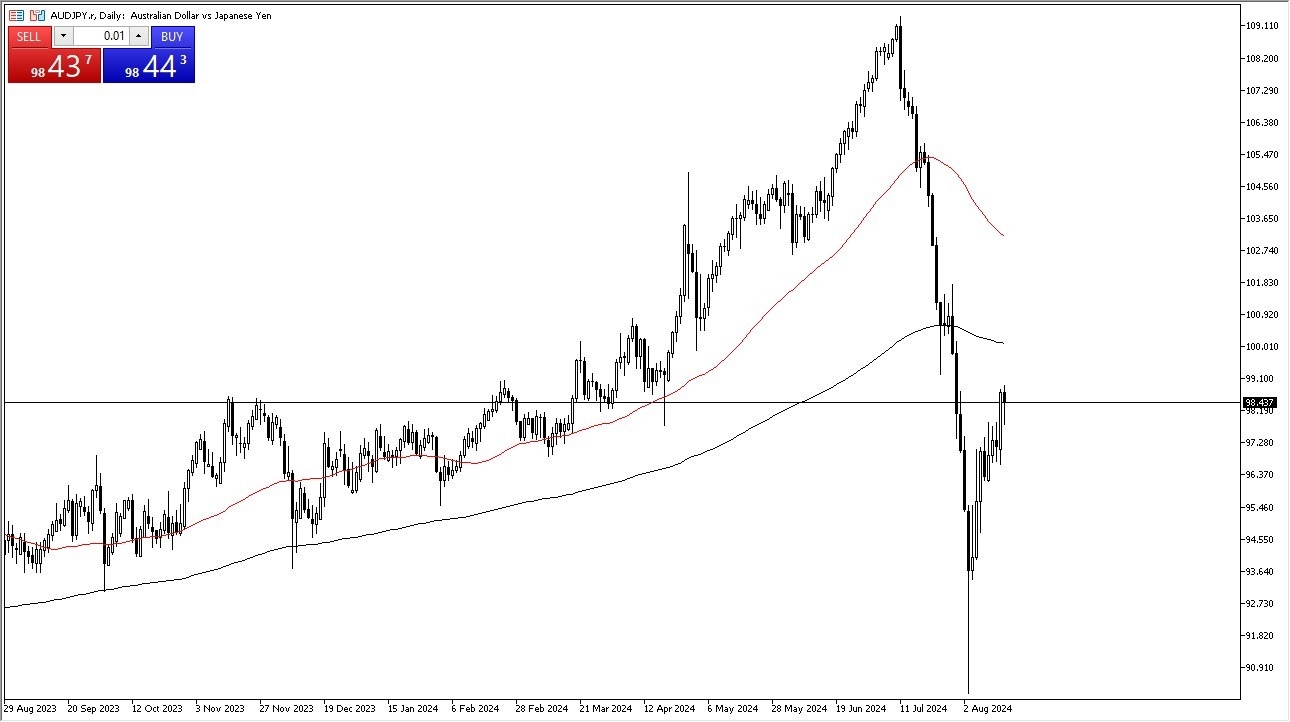

- During the trading session on Friday, we have seen the Australian dollar pullback have been against the Japanese yen to reach towards the 98 yen level before bouncing later in the day.

- This was something that we had seen in several yen related pairs.

- And at this point, I think what we've got is a situation where perhaps people are trying to return to the carry trade.

- That happens, we could see a huge value proposition playing out in real time when it comes to this currency pair, and everything else JPY-related.

The Bounce Matters

The fact that we sold off so hard in the early hours, but then turned around to show signs of life, tells me that there's probably some fight left in the carry trade. Keep in mind that you get paid to hang on to this AUD/JPY pair, and ultimately, I think that is going to be a big driver. Yes, I recognize that the carry trade has been damaged quite drastically, but at this point, it looks like we are at least trying to reach the 100 yen level above where the 200 day EMA currently resides.

Top Forex Brokers

If we can break above there, then it's likely that the market could go looking to the 103 yen level where the 50 day EMA is. On the other hand, if we turn around and drop down below the 96.50 yen level, then we could go looking to the 93.50 level. That’s an area that could be like a “trapdoor” when it comes to the market rapidly falling to lower levels.

That being said, it would probably come with a major risk-off attitude out there, and that of course is something to keep in the back of your mind. If we get more risk on behavior, and we have most certainly seen it over the last couple of days, it's likely that the ASE will continue to climb against the yen. Keep in mind that the Bank of Japan cannot tighten monetary policy too far, because quite frankly, they would wreck the Japanese economy.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.