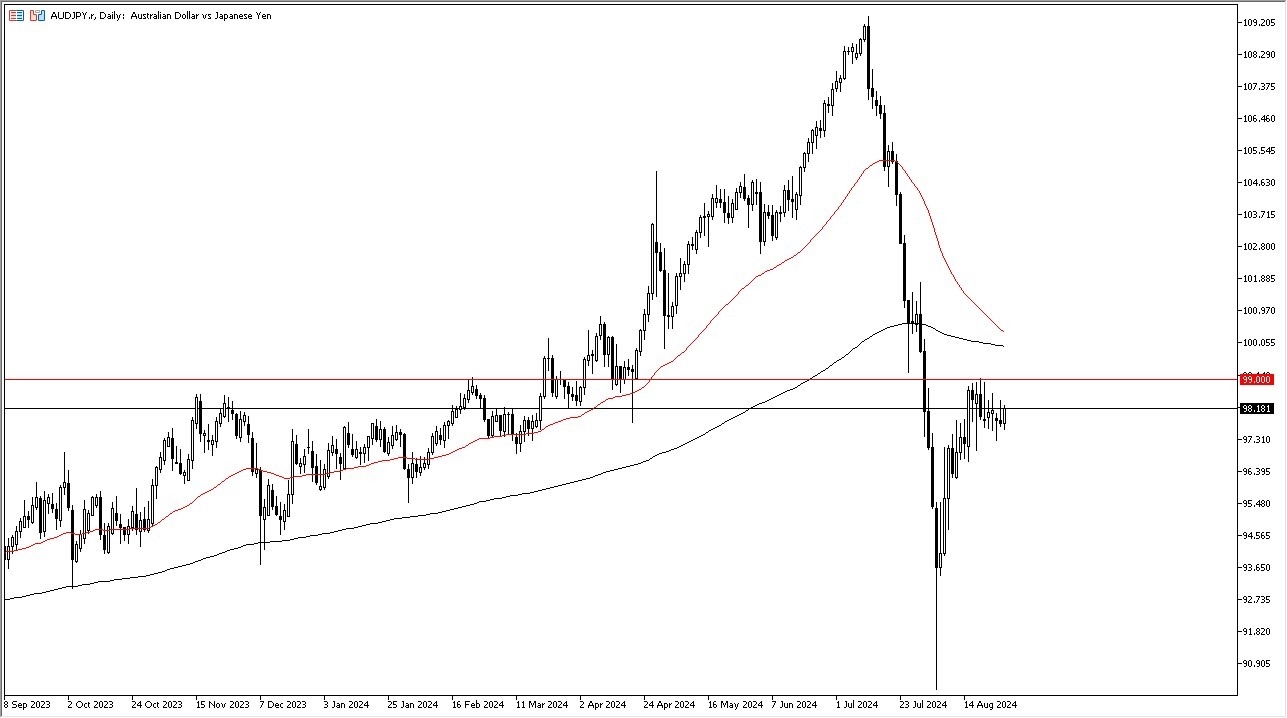

Potential Signal:

- I would be a buyer of the AUD/JPY pair, going long above the ¥99 level, with a stop loss at the ¥97.50 level below.

- I’d be aiming for the ¥100.75 level above.

- The first thing I see is that it looks like we are trying to form some type of bottoming pattern, and we have an obvious resistance barrier just above that we can pay close attention to.

- After all, the ¥99 level has been a very obvious area of noise, and therefore I think if we can break above it, we could see a bigger move at this point in time.

Top Forex Brokers

The Australian dollar of course is highly sensitive to commodities and Asian growth, while the Japanese yen is more or less being influenced by the idea of whether or not the carry trade is disappearing. I don’t think it will over the longer term, although recently we have seen a lot of damage done to it as the Bank of Japan decided to raise rates. At the end of the day, the Japanese are stuck with their monetary policy because quite frankly, if they raise rates too far, it would destroy the Japanese economy which has an extreme amount of debt attached to it.

Ultimately, this is a market that I think that the traders out there are trying to dip their toes into, but quite frankly, we got a situation where there is a lot of fear, due to the fact that central banks got involved. If we can break above the ¥99 level, then I think we got a real shot at the market trying to reach toward the ¥101 level, and then perhaps even higher than that.

Swap

Keep in mind you get paid at the end of every day to hold this pair, and sooner or later people are going to start focusing on that again. Even though the Japanese have tightened monetary policy somewhat, the reality is that the interest rate differential is still wide enough to drive a bus through. As long as that’s the case, it makes a certain amount of sense to own this pair, although I wouldn’t do so with the massive position into it, at least not until the rally is confirmed.

Ready to trade our Forex daily analysis and predictions? Here are the best trading platform for beginners to choose from.