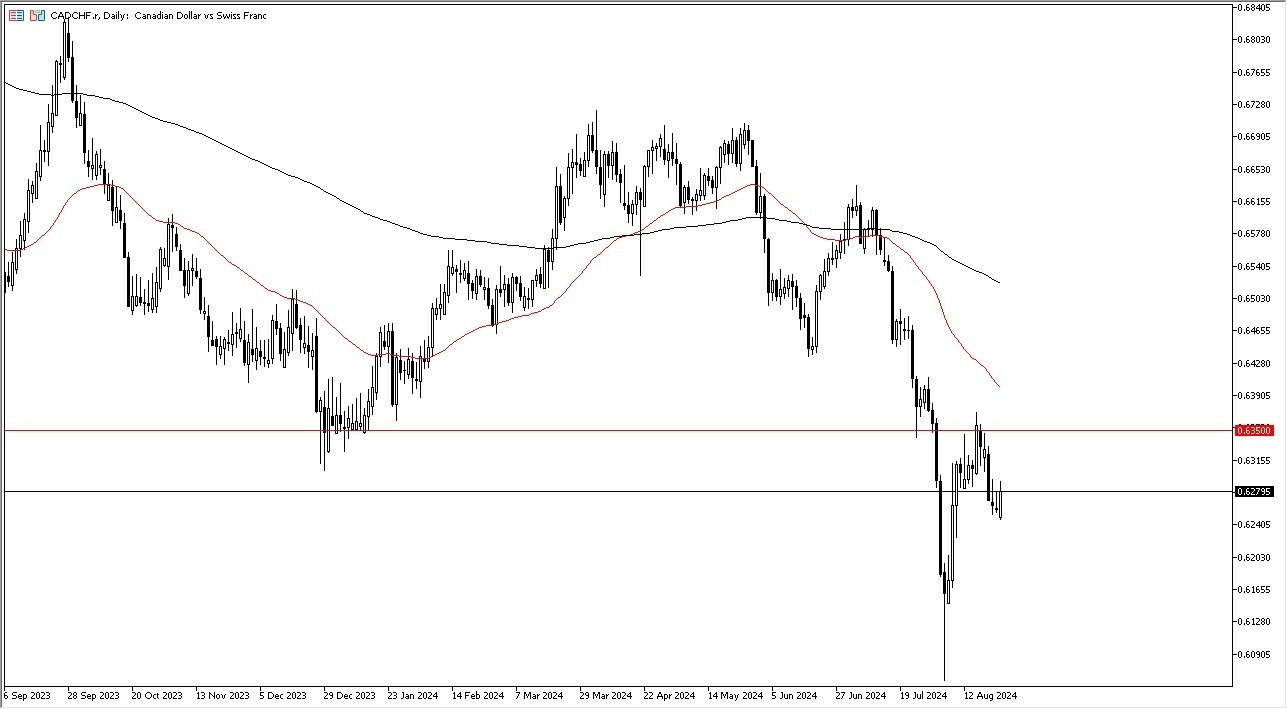

- The first thing I see is that we have broken higher in the early hours of Friday in the CAD/CHF pair.

- Ultimately, this is a market that has a lot to do with risk appetite, so we will have to pay close attention to it.

- After all, the Swiss franc is considered to be a “safety currency”, while the Canadian dollar is a commodity backed currency.

Crude Oil

Keep in mind that crude oil is a major influence on the Canadian dollar, and we have seen the crude oil markets rally quite significantly. By doing so, that has put some demand in the markets for the Canadian dollar, and I think it makes a lot of sense that we would continue to see traders look at this through the prism of whether or not crude oil is going to pick up. After all, central banks around the world like they are getting ready to cut rates so it could drive up demand.

Top Forex Brokers

While the Bank of Canada has cut rates a couple of times, there is still an interest rate differential between these 2 economies, and it does make a certain amount of sense that people would shy away from Switzerland due to the interest rate differential. That being said, I also recognize that at the first signs of trouble, this market can turn around rather rapidly as people run toward Switzerland for safety. The markets of course are very erratic right now, and I quite frankly think that a lot of traders out there need their hands held. It’s been ridiculous trading for some time, and this pair won’t be insulated from the schoolgirl type of panic that we have seen.

If we can break above the 0.6350 level, then it’s likely that we will fight the 50-Day EMA, which of course is a significant technical indicator that a lot of people pay attention to. If we can break above that, then the market really could take off to the upside. Underneath, I see the 0.61 level as a major support level in this pair.

Ready to trade Forex daily analysis and predictions? Here are the best Oil trading brokers to choose from.