Traders should check the price of WTI Crude Oil they are being quoted as the commodity opens for trading early on Monday, this because closing prices on Friday were reported differently by various sources.

- CFD traders of WTI Crude Oil should pay strict attention to the market as it opens early on Monday, particularly if they have a working order that was not closed on Friday.

- The close for WTI Crude Oil via various CFD platforms is being reported with different values on a handful of brokerage platforms.

- This is due to the volatile close in the cash market which seems to show it ended around 76.610 USD.

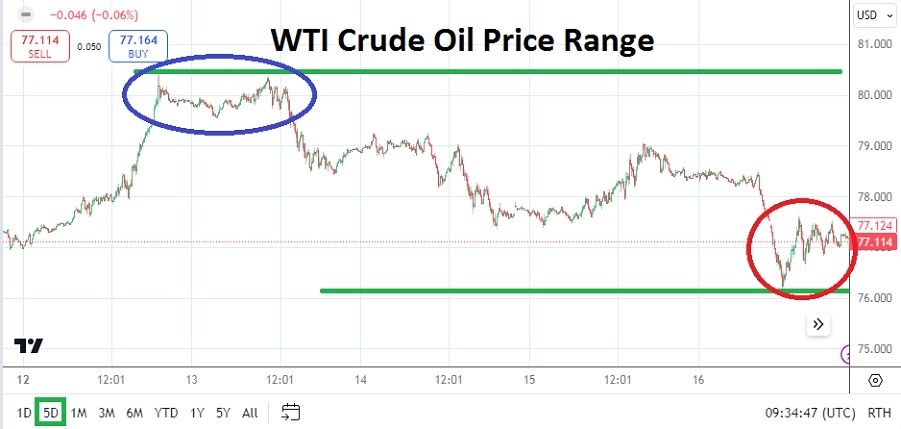

However, because there was strong selling as Friday concluded it appears that technical charts and prices via some CFD brokerages are not 100% correlated. This could be simply due to bid and ask ratios differing. Traders should expect some early market volatility early on Monday as the mud clears and prices become calmer again which will certainly happen quickly. The high for WTI Crude Oil occurred last Monday when the commodity briefly went above 80.000 USD.

Top Forex Brokers

Nervous Behavior Followed by Calm and Sudden Drops

The high early in last week likely occurred because some speculative large players had braced for a potential escalation between Iran and Israel around the 12th of August. The day was a religious holiday for observant Jews and some speculators likely had read rumors that Iran may be tempted to attack on that particular day. After the tensions calmed WTI Crude Oil began to lower and price dropped below the 78.500 ratio on Tuesday.

On Wednesday another slight rise in the WTI Crude Oil market happened, but this time the price only challenged the 79.300 vicinity and then the value of the commodity began to see stronger selling develop. Depending on which narrative you chose to believe, which includes higher inventory in the U.S of Crude Oil, renewed hope for a political deal in the Middle East, or technical pressures, the price of WTI Crude Oil certainly dropped. It does appear the report of a possible deal between Israel and Hamas may have sparked the swift selling of WTI Crude Oil as Friday concluded.

Price Velocity and Sudden Lows in WTI Crude Oil

WTI Crude Oil was trading near the 78.400 ratio on Friday when news started to filter into the market about a possible ceasefire deal being discussed with optimism being expressed by some sides (not by others). The commodity seems to have touched a low of nearly 76.120 and the market provided rather choppy fast conditions as it closed going into the weekend.

- While it is important to note that large energy traders have plenty of experience and are not likely to react to sensational developing news, retail speculators should monitor reports from the Middle East early this week.

- It may sound odd to suggest the Democratic National Convention in Chicago may affect the price of WTI Crude Oil this week, but it actually may provide comfort or pain depending on the delivery regarding rhetoric about the Middle East.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 73.500 to 80.400

Crude Oil has traded below the 80.000 mark since the 19th of July for the most part. Yes, the price did climb above the level early last week. But it should be remembered on August the 5th, only two weeks ago the price of the commodity was closer to 72.000 USD.

That lower value may be too wishful for optimistic bears selling WTI Crude Oil, but pursuit of lower values and the 76.000 to 75.000 ratios do not seem unreasonable, if things on the ‘big screen’ can remain calm early this week. Traders need to remain conservative in Crude Oil and wager carefully. Politics will certainly blow hard this week and behavioral sentiment could react to storms caused by those speaking the loudest.

Ready to trade our weekly forecast? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.