Potential signal:

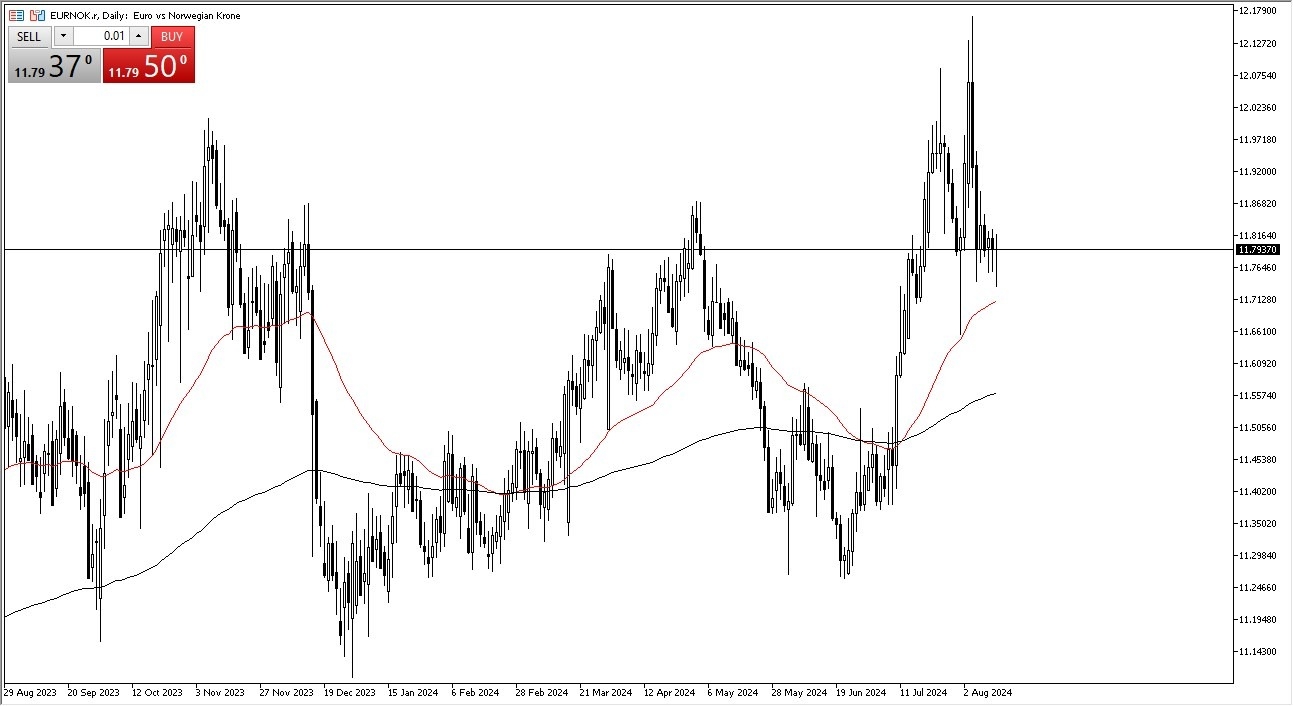

- If we can break above the 11.84 level, I’m a buyer and would have a stop loss at the 11.75 level.

- To the upside, I would have a target of 12 NOK.

- I have been paying close attention to the EUR/NOK pair, because we are at such an obvious level from a technical analysis standpoint, so therefore I think we could be setting up a nice technical trade.

- The market did initially fallen during the early part of the session, only to turn around and attempt to recapture the 11.80 NOK level.

Top Forex Brokers

Keep in mind that the euro of course is considered to be a major currency while the Norwegian krone is considered to be a minor one. While it’s not necessarily an emerging market, Norway gets pegged into the idea of whether or not oil is doing well. The euro and the other hand, although not necessarily a safety currency, is one of the biggest currencies in the world, and therefore in and of itself offers a little bit of safety. In other words, if this market takes off to the upside, it’s very likely that we see some type of situation where the traders out there will look at what’s going on around the world, and then trade this pair accordingly based upon risk appetite more than anything else.

Nice Pull Back

We’ve had a nice pullback in this currency pair, reaching down toward the 50-Day EMA, only to turn around and form a hammer for the third day in a row. This of course is a very bullish sign, and therefore I think it’s probably only a matter of time before the market does bounce from here. That doesn’t necessarily mean that we are going to shoot straight up in the air, just that it’s likely that we will find a certain amount of support that will continue to keep this market alive.

If we were to break down below the 50-Day EMA, then it’s possible that the market could break down to the 11.60 level, but that obviously is something that hasn’t been able to occur despite the fact that we have seen so much volatility in general. Quite frankly, if we start to see people out there focus on the fact that the global economy might be struggling, that probably helps this market reach toward the 12 NOK level again over the longer term. This is a backdoor way of playing the risk spectrum.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.